With the price of literally everything rising, you might be looking for ways to increase your income. When I was paying off my mountain of debt I was looking for ways to make more money to pay off our $100K of consumer debt. So, I personally have done MANY of these 10 things to bring in more money. Here, I have compiled a list of 10 ways to increase your income.

1. Ask For A Raise

Asking for a raise can be nerve-wracking, but with the right approach and plan you can increase your odds of getting one! By asking for a raise at your current job, you will make more money, thus having more money to spend on things you need, pay down your debt, or build your savings. I have a podcast and I recorded an entire podcast episode on this very topic! You can find it on Financial Mission Podcast, or click here to listen, https://www.buzzsprout.com/2143456/14711379 There are ways to ensure you have good odds of getting a raise, so be sure to listen to the podcast for these steps.

2. Job Promotion

Seeking a job promotion is a sure way to increase your income. Be sure to do your homework ahead of time to figure out what you need to do to increase your chance of getting the promotion. Some upfront work will likely be needed. With a promotion likely comes increased responsibility and sometimes more stress, so be mindful of this.

3. Get A Second Job or Side Hustle

There are SO many different types of side hustles or part-time jobs you can take on to increase your income. Now, I don’t recommend hustling, grinding, and working yourself until you are completely and utterly exhausted for the long term. Picking up a second job or working a side hustle is for a season. Maybe you do this until your credit card debt is paid off, or your car loan is paid in full. I do not think you should make this the best option in order to survive long-term financially speaking.

Some examples of side hustles:

Pet, House, Babysitting

Window washing

Dog Walking

Uber Eats

Landscaping or lawn care

Cleaning houses or businesses

Tutor

Bartending

Virtual Assistant

Amazon Flex

Take online surveys

4. Turn Your Hobby Into A Business

I did this with my photography and it is a business that 11 years later I still have, although I only shoot part-time. What hobbies do you currently have and could you turn any of them into a business to bring in some additional income? Just a word of caution here, make sure you are making money at this and not spending all of your money on keeping the biz running.

I have always loved taking pictures as far back as I can remember, from using my Grandpa’s original Polaroid camera to the 2-pack disposable ones to my now fully manual monster of a camera. I LOVE photography! What started out as me wanting to take my own photos of my children turned into a full-blown (part-time) business. However, I realized that I needed to focus on budgeting and saving my photography income instead of spending it all on adorable little props! So, remember if you are turning your hobby into a business be mindful of your cash flow and business expenses. What can you get by with, what is a need, and what can you save up for?

5. Sell Stuff

This is one of my favorites! I still do this and I definitely did this A LOT when paying off our debt. I sold a little bit of everything, mostly items we no longer needed or used and even some items I didn’t necessarily want to sell but knew if I really missed the items I could buy them back when I was in a better financial situation in the future.

I sold clothes, shoes, kitchen gadgets, garage items, outdoor toys, gardening tools, and my Coach purse I had NEVER USED that was sitting in my closet for 5+ years! You name it, I most likely sold it. and ALL of the money I received from selling our items went straight into paying off our debt. I was able to pay off my car loan 3 years early and we paid off $100,000 of debt in less than 2 years.

The largest item we sold…our GORGEOUS 1-year-old destination camper! And guess what? I’ve never regretted it!

6. Freelance

Are you a great writer or editor? Could you write blog articles, and edit upcoming books? Could you tutor or are you artistic and could draw or paint and sell your art? Freelancing different things is a great way to make additional money on the side.

7. Work Overtime

After I realized I was drowning in debt and I wanted to make a change with how I was managing my money, I knew I needed to come up with a plan. At first, my plan didn’t include the snowball or avalanche debt payoff methods, it just consisted of paying of my debt as fast as possible. After I played farmer one spring and planted our farm crops, I went back to work as a nurse, after my 4-week furlough, and I worked a TON of overtime. It was during the peak of the COVID-19 pandemic, so I was able to pick up as many extra shifts as possible. Most of those extra shifts were paid at time and a half and some were even double time. So, I picked up all the extra hours I could, I swabbed a lot of noses looking for those pesky viruses and I put ALL of the extra money completely onto paying off our debt early. It was hard work, long days, and missed time with my family, however, it was 100% worth it.

If you have the option to work overtime, do it! This will increase your income and you will be able to meet your financial goals quicker. I would make it a goal of yours to get to a place financially where you don’t HAVE to work overtime to make ends meet. Sometimes I would work OT and apply that extra money towards an upcoming vacation or something else that we were paying for in cash by working OT it got us closer to that purchase quicker. I don’t recommend setting up your Financial Mission Plan, aka your budget, to NEED to work overtime in order for your numbers to work, chances are you will burn out. Trust me you don’t want this, I’ve done burnout and I promised myself to never put myself in a position where burnout would happen again.

After working hours upon hours in an N95 mask to prevent contracting Covid-19.

8. Find A Better Paying Job

I am going to tell you a hard truth, sometimes you need to just find a job that pays you more. I know this can be difficult and you might love your current job that doesn’t pay you enough to pay all your bills. There is a balance in finding a job where you like/love it and it pays you well. Many higher-paying jobs include more stress and responsibility, spoiler alert, so can lower-paying jobs. I want you to find a job where you feel fulfilled and you are paid well for your time and effort, however, there may be a season of life where you work a job you might not necessarily love in order to pay your bills or meet your financial goals. Once you are financially stable, independent, and free, you can then focus on finding a job or career where you feel fulfilled and passion filled.

9. Further Your Education

This might involve going back to school, college, or a university. It could also be that you take some courses, get a certification, do on-the-job training, read books, watch YouTube videos, listen to podcasts, read blogs, etc. Furthering your education doesn’t necessarily mean going back to school for a 4-year degree, but it could. I am a self-taught photographer. I researched and taught myself all about photography and then put that education into practice and got paid. I also taught myself, utilizing all sorts of free resources, all about personal finance. I also took a Financial Course Certification and have invested money in furthering my education in regard to finances and now I am teaching others how to manage their finances responsibly and I get paid for that.

Furthering your education, and investing in yourself can involve time, energy, and/or money. If you love to read, focus on books, blogs, and articles. If you love to listen, focus on podcasts or YouTube videos. I use a combination of these to further my education and I feel with every book I buy and read or course I take or podcast I listen to I am improving my income potential. I believe this for you too.

10. Open a High Yield Savings Account (HYSA)

By opening up a high-yield savings account you will be making a little bit of income on the money you are storing there. I recommend saving at least 3-6 months of expenses into your emergency fund, which I “house” or keep in a HYSA. I use Ally.com and I get a high interest rate on my money there than I do at my local bank or credit union. This high interest will add up over time and your money is still easy to get to when you need it.

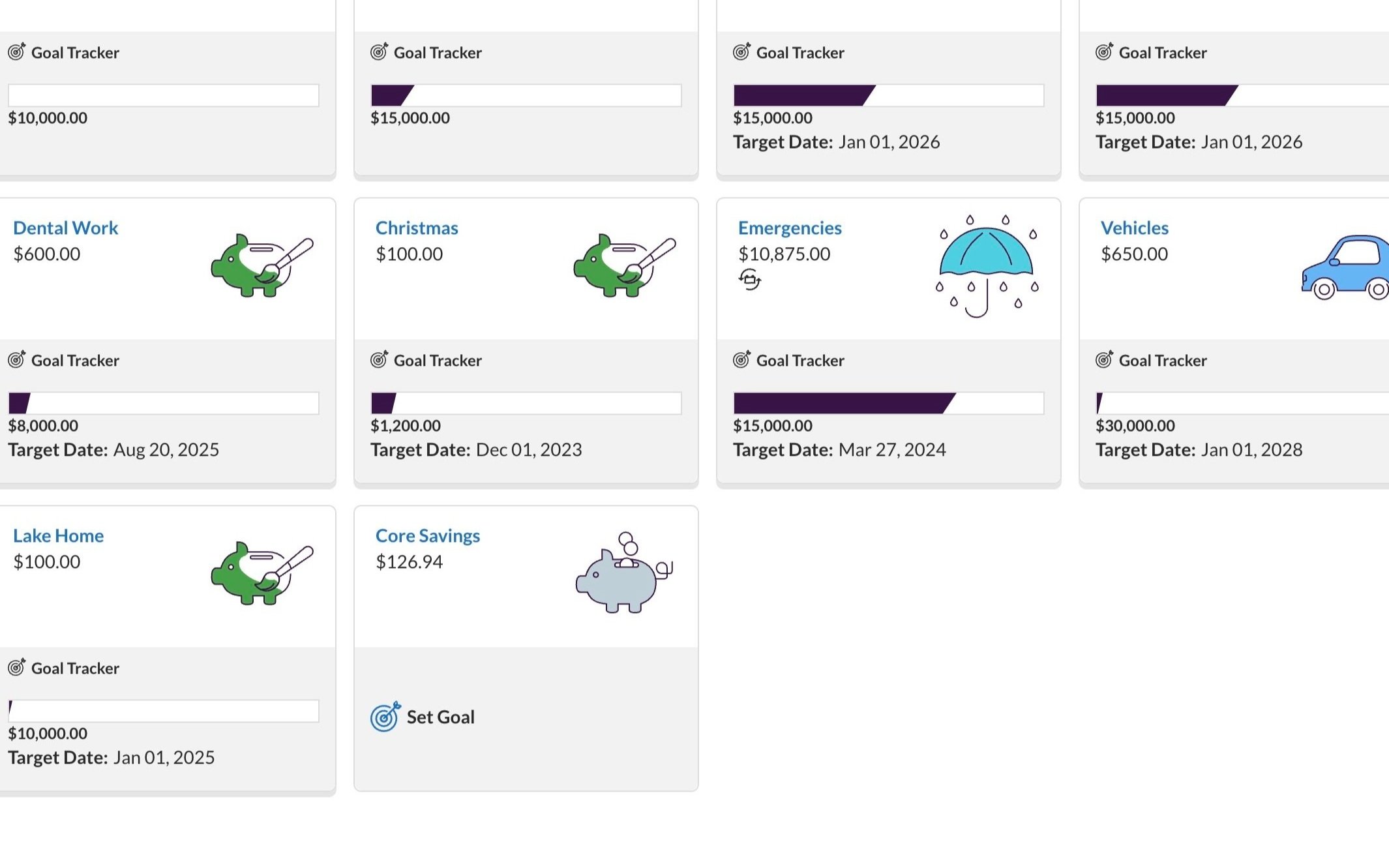

Examples of savings buckets I use at Ally.com

I also have some of my boy’s savings, our vacation money, our Christmas fund, and a few others in a HYSA, so I can take advantage of the high-interest rate. These online banks can give you a higher interest rate because their overhead expenses are lower than other banks because they don’t have the expenses of physical buildings and branches.

When picking out an online HYSA, make sure it is FDIC-insured and there aren’t any hidden fees. Then transfer your money and watch it grow!

So, there you have it, 10 ways to increase your income! Some of these you can implement right away, so you get to decide which steps you are going to take, starting today, to increase your income. You won’t regret making more money to achieve your financial goals quicker.

XOXO

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts