Living below your means is important more NOW than it ever has been. Prices keep going up and up making it harder to stay on budget and save your hard-earned money.

I am forever grateful that my husband and I paid off $100,000 of debt (in less than 2 years), in 2022. If I were to do it all over again I would in a heartbeat.

Living below your means doesn’t have to be super restrictive. If it is, you might need to change some factors in your life, like increasing your income.

We live in a society that values “things” and expensive things at that. The average price of a new vehicle is almost $50,000! That is insane and the advertisements we hear and see for “goods” are endless. No wonder we feel like we can’t keep up.

I swear my kids ask me for one hundred things to buy every single day. I get overwhelmed and frustrated by all the WANTS. I WANT things too, but when does it stop? When do we decide to just be happy with what we have? The thing is our brains are wired and “talked to” to constantly want more and more.

Living below your means may mean that you have to cut out some wants in your life. You will need to say NO to yourself and your family and that can be difficult. Saying no is like working out, we have to flex that muscle because some of us have never said no. We are not used to telling people no.

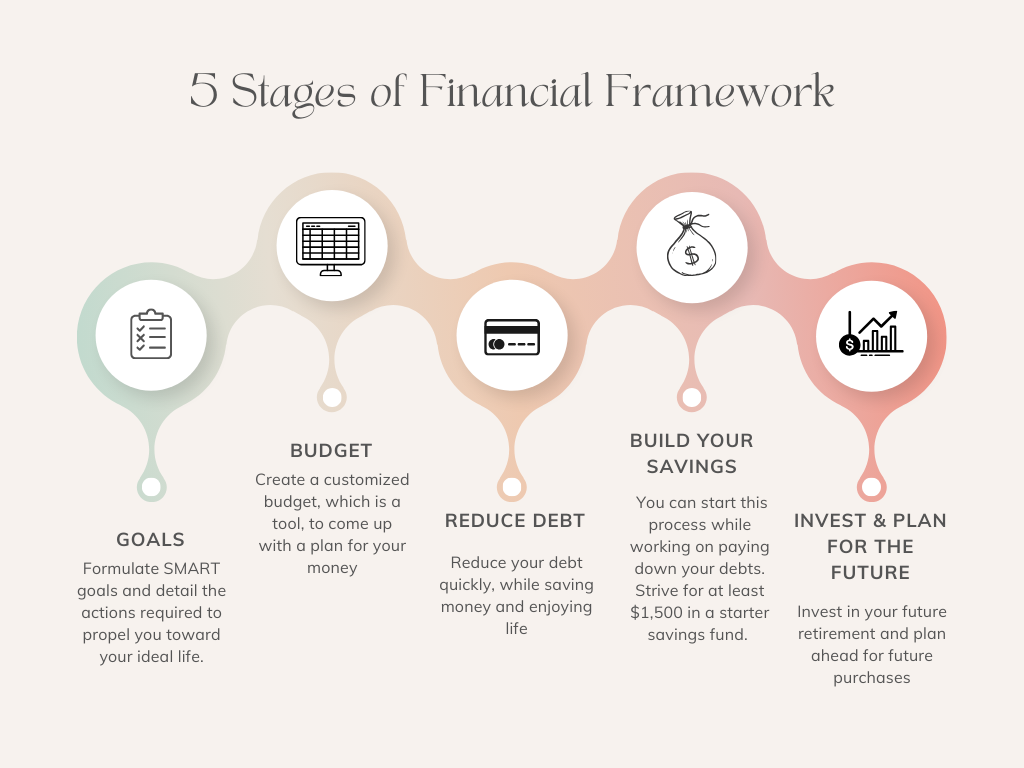

Now let me lay out the foundation for truly living below your means:

1. Know your spending habits

2. Create a customized budget to your needs and wants

3. Cut back (decrease) your spending

4. Make some life and money goals (SMART goals)

5. Save for emergencies (when not if)

6. Prioritize paying off debt

7. Save for the FUTURE (retirement and savings goals for the long-term)

8. Don’t allow lifestyle creep to knock you off your financial path

9. Try using cash and pay yourself first

10. Automate!!!

1. KNOW YOUR SPENDING HABITS

Tracking your spending and knowing where you are spending your money and how much money is so important. This will take some time but it is worth it. I use The EveryDollar app (the free version) to keep track of all my spending and bill payments. I am able to look at my money spending habits at any time and see what I am spending my money on. I can also see how much money I have spent in each category and how much money I have left for the month.

2. CREATE A CUSTOMIZED BUDGET

I don’t believe in a budget that is a one size fits all. All of us are in a unique situation and season of life. We each need our own customized budget and type of budgeting method. I talk in depth about budgeting methods in my Eliminating Debt-ditch debt for good online course. I will share the link here for you to check it out. https://jessica-s-site-d45b.thinkific.com/collections . You can also read more information on types of budgeting methods on my blog. I personally use a combination of budgeting methods when I plan my budget. I use the Pay Yourself First, Plan Ahead, and Zero-based budgeting methods.

3. CUT BACK YOUR SPENDING

Once you know your spending habits and what you are typically spending each month on each category, you can use that information to figure out how you can decrease or cut back your spending. The top categories you can cut back on your spending in are food (both groceries and dining out), insurance (shop around yearly to find the best rates), subscriptions (Netflix, Hulu, Disney +, etc), and cell phone plans. I personally have an expensive cell phone plan because my husband is often farming in locations with limited cell service and we feel it is best for our circumstances to pay more for a company with the best service. At least the best service we have found in the locations he works in.

4. MAKE LIFE AND MONEY GOALS

I am a firm believer in making goals to meet your future dreams and visions and doing the work to achieve those goals. When you make SMART goals, they tend to keep us motivated to work hard to reach them. SMART stands for Specific, Measurable, Achievable, Realistic, and Timely. Make sure each of your goals has a time frame attached to them. But, remember your goals can always be changed/improved/modified. I have two VERY different goals I want to share with you.

Goal #1: To save $1200 for Christmas 2023 by December 2023. I will put $100 per month into a Christmas savings account from January 2023-December 2023 and I will have $1200 in my Christmas savings bucket come December.

Goal #2: I want to save for a cabin/house on a lake.

Which of these two goals do you think I will accomplish? My hope is that I am able to accomplish both of them. I will accomplish my Christmas savings goal by December. I hope to eventually meet Goal number 2 but I better change that to a SMART goal if I am serious about meeting it. Most goals are related to money even if we don’t realize they are. Almost everything we do in life takes money or is involved with money in some way. I have a life goal to be able to work from anywhere. That will take time and money to accomplish even though the goal itself doesn’t have a number in it specifically.

5. SAVE FOR EMERGENCIES

Unfortunately, it is not a matter of “IF” an emergency will happen but “WHEN”. Emergencies happen all the time, some are medical/health related and some are not. We had 3 medical emergencies happen recently in just a matter of a month and a non-emergency happen a few weeks later. My husband was in the ER, our middle son, Bryson broke his arm, and then Bryson was in the ER again, with severe abdominal pains. My car also had to have thousands of dollars’ worth of repairs done to it. I can honestly say, I was so very grateful and thankful for our emergency savings fund. It was sad to see our money disappear, but so happy it wasn’t going onto our credit card. You have to prepare for things to pop up out of nowhere and you are responsible for paying for them. When you are deciding between renting and buying a home, remember that the rent is the most you will pay for that house. A mortgage is the least you will pay for the house. As a homeowner you are responsible for every breakdown and fixing that your house and the things in your house needs, ie appliances, ac/heating, snow removal, lawn care, etc. I am all for homeownership but it is not cheap.

6. PRIORITIZE PAYING OFF DEBT

Paying off debt, especially high interest rate debt is a MUST. Paying off high interest rate debt in itself is like an emergency! You NEED to pay them off as quickly as possible. If you have a credit card with 20%+ in interest rate and you pay only the minimum payment, it is going to take you years to pay it off. In fact, sometimes you wouldn’t even be able to pay it off because of the balance and interest rate. You NEED to prioritize eliminating your debt and ditch that debt for good! I have a course specifically on this, head to https://jessica-s-site-d45b.thinkific.com/collections. You could also go to Jesswaynecoaching.com and click on the courses tab at the top to get access to my courses. Putting in the time and energy to figuring out why you have debt and how to pay it off and stay out of debt is important.

Some of us have debt because we had a sick child or a premature baby and we have a lot of medical debt. Some of us have a mountain of credit card debt. And some of us have car loans, student debt, and personal loans. Most debt is avoidable and we should really commit to ourselves that we are not going to take on any more debt. That we are going to pay off our debt as quickly as possible. That we are going to teach our children about money, debt, and to avoid it at all (most) costs.

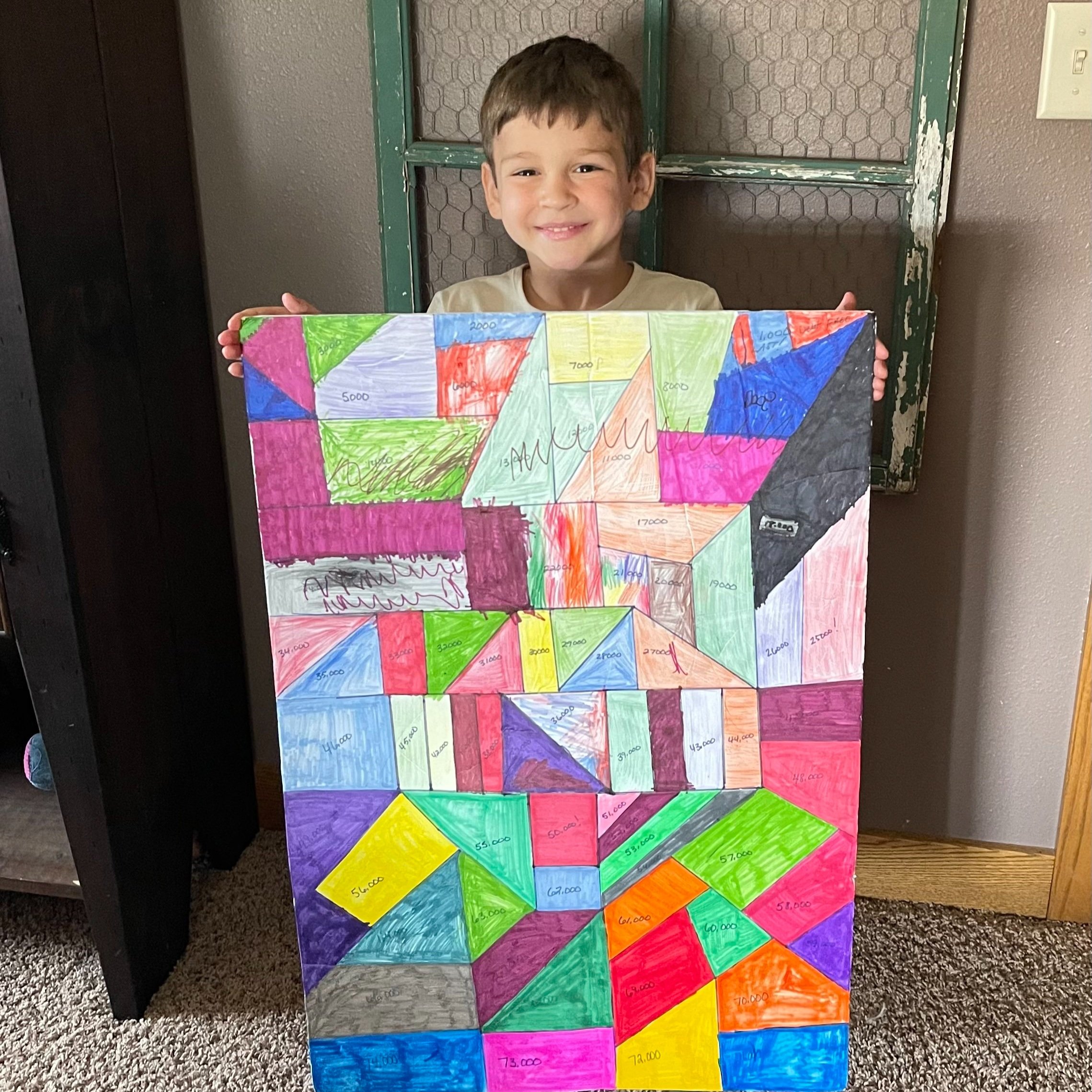

My son holding our debt payoff tracker

7. SAVE FOR YOUR FUTURE (Retirement and savings goals for the long-term)

Saving for your future is super important. If you aren’t saving for your retirement, who is? A topic that isn’t fun to talk about is that social security might not be there when you or I retire. I am hoping it will be, but I am not banking on it. Pun intended. There are many ways to save for your retirement. Many employers have a 401K or 403B option, this is one way I am saving for my retirement. I have my 403B retirement on an automatic withdrawal from my paycheck before I even get paid. I have it set up as a % rate of my pay. I also have a Roth IRA that I automatically send money to each and every month on the 1st of the month. I know that by automating these funds I am saving way more than I would if I had to think about putting money into the accounts and manually send money there.

I love goal setting and working to meet my goals. I love thinking about what I want in the future. What do you want in 2-3 years? How about 5 years? 10-20 years? What are you doing right now to meet those goals? Most of our goals will require money, even if the goal itself doesn’t have a number in it. Make sure your goals are SMART goals.

8. DON’T ALLOW LIFESTYLE CREEP TO KNOCK YOU OFF YOUR FINANICAL PATH

Typically as we age our income increases and most of us encounter lifestyle creep. Lifestyle creep is where, as you make more money you spend more money.

You buy the nicer car, upgrade your house, and purchase more expensive things. You might even tell yourself I deserve to buy this because I’ve worked really hard and I’m making more money than I have ever made. I know, I have said those things. I have bought things because I felt I deserved them, or I wanted things because my friends had them. We’ve upgraded our vehicles and light fixtures in the house. Nothing is wrong with this if you can afford to upgrade your things.

The problem is, most of us can’t afford the nicer car, the granite countertops, and the new appliances. But for some reason we think we can because we just received a 3% pay raise at work. We end up taking out a larger car loan, put the appliances on a 0% interest rate credit card (fyi it doesn’t stay at 0% for long), and take out a home equity line of credit to remodel our house.

I always wonder how families made it work to raise a family of 6 or 8 in a teeny tiny 1200 square foot house. Nowadays the average family home is over 2,000square feet, and our family sizes has decreased significantly. But somehow, we still feel like we don’t have enough space and money!

Don’t let lifestyle creep keep you broke. Now, I am not saying you shouldn’t spend your raise at work or your money. You work hard for that money. But remember to pay yourself first, save, create a budget, set goals, and work towards them. We should all be able to enjoy our money.

9. TRY USING CASH & PAY YOURSELF FIRST

For most people, using cash to pay for purchases, actual physical cash in hand, tends to save them more money. The transaction of handing someone your hard-earned cash and them giving you an item allows you to feel something.

When you use a credit card or a debit card you don’t have the same feeling. I use cash for a lot of my day-to-day spending. I also use a credit card and debit card too. I electronically pay my bills and then use either a card or cash for my other purchases.

I pay myself first every single month. What does that mean exactly? Well, I have it set up automatically that on the 1st of the month, every single month, my retirement Roth IRA and my boys savings account money comes out of my checking account and it goes into those accounts. I don’t have to transfer the money or think about it. It is set up automatically!

I know that my paying myself first, I am paying myself more than if I waited until the end of the month or pay period to see how much money I have left over. One of the first line items on my budget every month is my Roth IRA and UTMA for each of my 3 boys.

I also put money into our emergency savings account each month. I then pay my bills and create a zero based budget off the remaining money each month.

I know for a fact that by paying myself first and automating these payment that I am saving more money than I would if I just did it manually.

10. AUTOMATE

I just talked about this, but automating your savings and bills is a fantastic idea! You can set it up once and forget about it. You don’t have to remember to pay the bill each month or transfer the money into your savings account.

Life is busy, really busy, so automation takes one thing off your shoulders so to speak. The only thing I have to remember is that the money is coming out of my account on the 1st of every month.

You can automate many things, not just finances. It helps keep things running smoothly. I also have my 403B (work retirement account) automated as well. That come out of my pay before I get my paycheck deposited into my checking account. I HIGHLY recommend automating your retirement and emergency savings account at a minimum.

These 10 things will help you to live below your means. Remember, living below your means is not a bad thing. It is keeping you in a good place financially speaking. If you or your partner lost your job, you want to have a plan in place prior (to losing your job) where you are not spending every dollar.

My ultimate dream “my rich life” is to have a cabin on a lake

Saving some of your money is so important. Just because you can pay for the minimum monthly payment on a loan does not mean you can afford it. Really think about what is important to you in life and work hard to achieve those goals and dreams. Cut back on spending in other areas of your life that are not as important to you. As Ramit Sethi says, “Live your rich life.”

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch