The New Year will be here before you know it and I want you prepared to begin the year off right with your finances and money.

One of the first steps you can take to make 2024 the best year yet, financially speaking is by setting goals. Here are 5 ways to prepare your finances for an abundant 2024.

1. Setting Financial Goals for The New Year.

Make sure these goals are SMART goals, Specific, Measurable, Achievable, Realistic, and Timely-that they have a time frame attached to them.

I always have the same Christmas Savings goal every single year to save $100 from January through December so that in December I will have $1,200 to spend on Christmas, including gifts, food, travel, etc.

I want you to make sure you are making your goals known, write them down on a piece of paper, and make sure they are SMART Goals.

2. Create Your Budget and Stick to it!

Create your budget, using one of the many budgeting methods that I’ve taught in my courses, blog, and podcast. Pick a method that will work best for you and your unique situation.

This is how I make my budget each and every single month, after I add in my monthly household income, I “pay myself first” by automatically saving money in my retirement and emergency savings account. I suggest you do this plus also add any upcoming expenses that you need to start saving for now. For example, Vacation, new appliances, vehicle maintenance, sports/activities for kids, annual insurance or car registration, etc.

I then add in my monthly bills, again, I try to automate these as much as possible. Automating your bills will keep you from forgetting to pay them and getting a late fee.

The last part of my budget is to take my leftover money for the month and budget it out for my day-to-day spending, this includes things like clothing, groceries, dining out, and entertainment- AKA Date Night—which doesn’t really happen in my house.

3. List Out ALL Your Debts and the Details

It is time for us to talk about your debt, yes, I know, this part stinks. You don’t want to think about it, you want to pretend it doesn’t exist because it overwhelms you and makes you start to sweat. I understand, I’ve been there. But it is so much better to face your debt head-on and tackle it, pay it off, and be done with it once and for all.

This is what I did when I paid off $100,000 of debt in less than 2 years. It wasn’t pretty, it wasn’t fun, but it sure was worth it.

Gather up ALL your information on your debts, the total balance due, your monthly payment, and the interest rate.

Next, get a free debt payoff calculator, I used an app during my debt pay-off journey, put in the details you just gathered, and see when you will be debt-free! Play around with this, what happens to the debt-free date when you pay the minimum monthly payments? How about when you add an extra $50 per month to your debts, or an extra $100, how about if you could add an extra $300 per month to your payments?

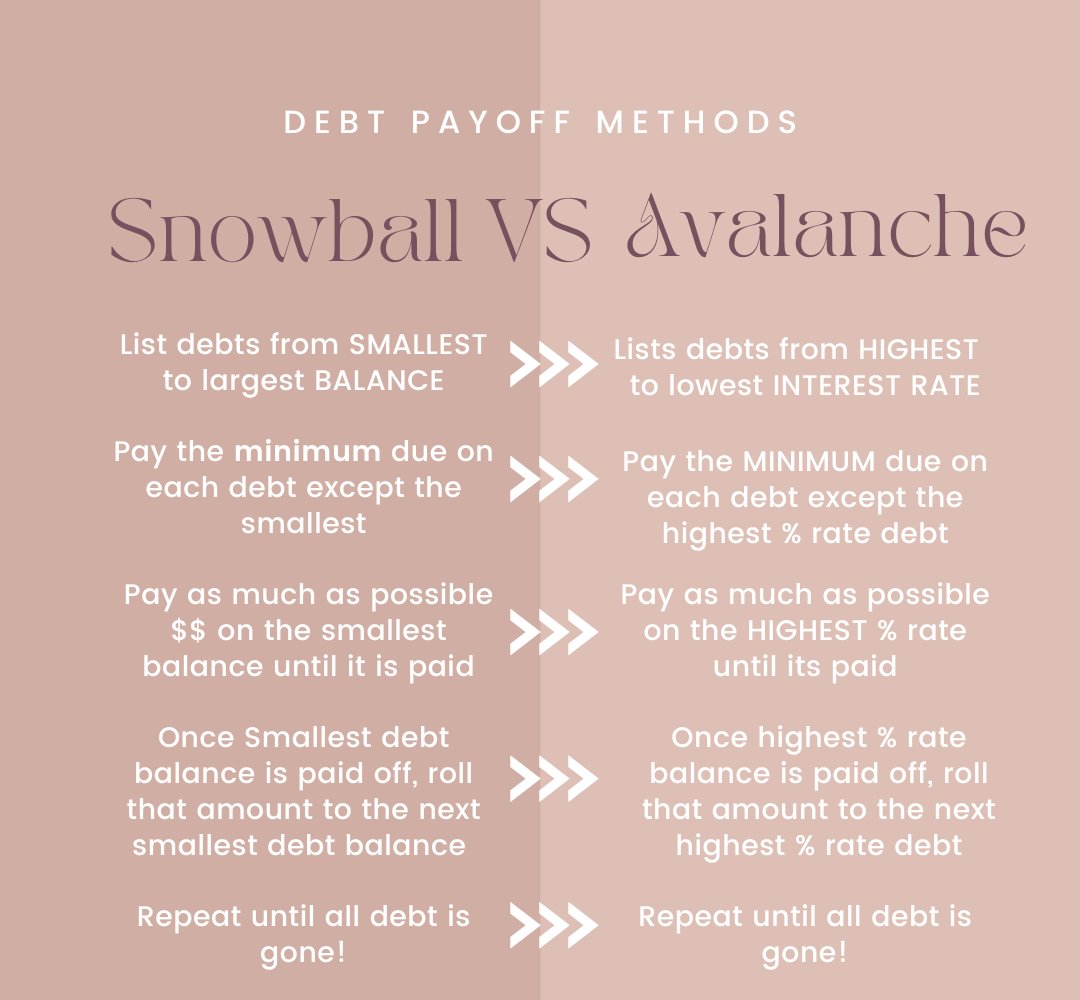

You can also see the difference if you pay off your debts using the Snowball debt payoff method versus the Avalanche debt payoff method. If you haven’t read my blog post on the two main debt payoff methods, read it here, https://jesswaynecoaching.com/blog/snowball-versus-avalanche-debt-pay-off-methods

One way I was able to pay down my debt quickly was by selling items from my home. I sold everything, so many things, garage items, clothing, shoes, kitchen gadgets, garden tools, etc. Some items I wanted to sell and some I sold because I knew it would help me get out from under my debt and if I wanted or needed the item in the future I would be in a much better place financially to purchase the items again.

I also worked a ton of overtime at my nursing job. It was during the peak of the Covid-19 pandemic so I was able to work as many hours as I wanted to.

4. Cut Back On Discretionary Spending

You might think you aren’t overspending a whole lot, but if you aren’t tracking your spending you likely do not know exactly how much money you are spending on all the things, especially the “extras”.

When I paid off my mountain of debt, my family and I had to cut back on our spending a ton. The first month I tracked our spending, we spent $1,000 on groceries and $1,000 on going out to eat! In one month! Now, we are spending less than $1,000 on both of these categories combined and we have gone through inflation!

Things you can likely cut back on, subscriptions, you know Hulu, Spotify, Netflix, Prime, Disney +, want me to keep going? Call your insurance companies and see if you can get a better rate. Cell phone plans, food, and entertainment are two areas most people tend to overspend. You can almost always cut back on food, both groceries and hitting up the drive-thru and restaurants.

5. Build Up Your Savings

I used to put money into our savings account when I thought to do it. Now, I automatically save every month into my retirement accounts, my emergency savings account, and my 3 boys’ savings accounts. I can guarantee that I am saving more money by automating this than I was before and it took the stress of thinking about doing it off my shoulders. Automate and forget it.

While paying off your high-interest rate debt, be sure to have at least $1,500-$2,000 in your savings account.

Also, make sure you are saving into your retirement, trust me your future self will thank you. If your employer offers a match, take them up on it, that is FREE money!

After your high-interest rate debt is paid off, it is a good rule of thumb to have at least 3-6 months of your monthly expenses in a savings account to be used ONLY for emergencies. It is not a question of “if an emergency will happen but when”. Emergencies are going to happen, and we don’t know when, so be prepared by having 3-6 months of money set aside to cover the bills.

Ideally, you want to build this up quickly after you have paid off most of your debts, not including your house, but for sure your high-interest rate debts. You can also save while you are paying your debts off, I am not opposed to this.

Everyone’s situation is unique, and you need to decide what you are comfortable with in regard to your money. Will having $3,000 in your savings account while paying off your credit card make you feel safe and secure? If so, then go ahead and do that. What works best for you is best!

Planning ahead and saving money for upcoming expenses is also part of building up your savings. This will help prevent you from going further into debt or going back into debt.

So, there you have it, 5 ways to prepare your finances for an abundant 2024. It is never too early or too late to get your finances on the right track. If you aren’t sure where to start, please reach out to me, at Jesswaynecoaching.com, I would love to help you.

xoxo

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch