There are many ways to go about getting yourself out of debt. There are a couple of well known methods to use including the Snowball Method and the Avalanche Method. However, there are also a few other things that will help you get out of debt sooner.

Here are 5 ways to get out of debt:

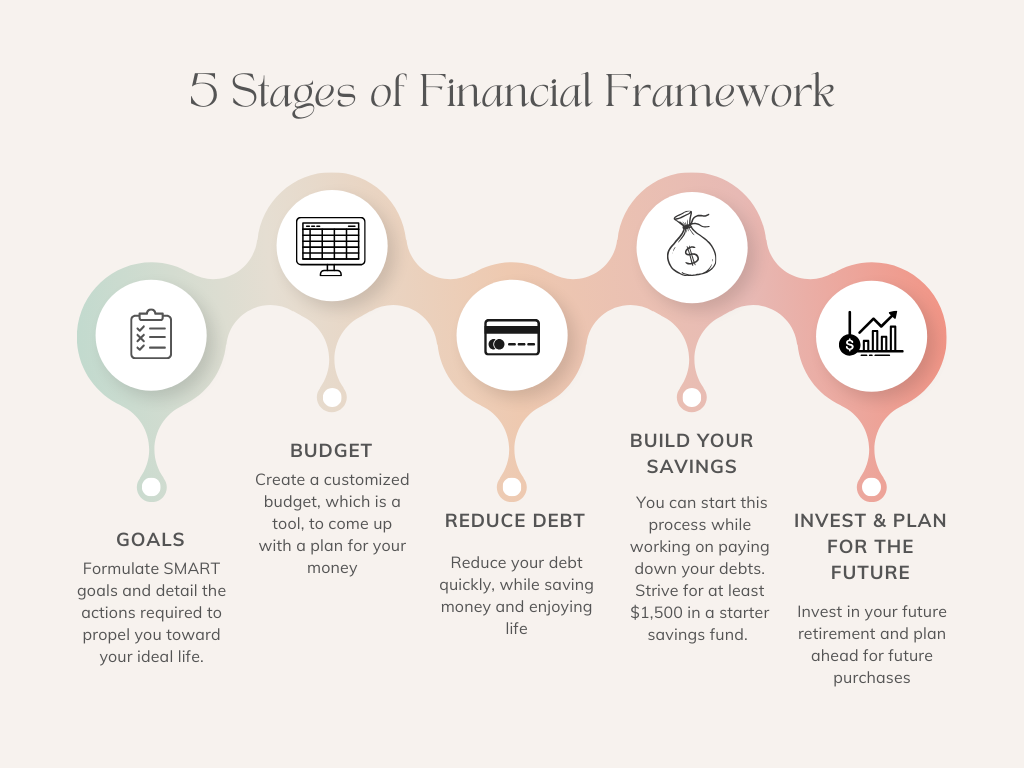

Budget

Prioritize paying off debt

Get a Budgeting Buddy

Get in a good money mindset

Create a goal + work hard to meet it

When creating a budget (especially when you are new to budgeting) keep it super SIMPLE. Keep track of all your income, all your expenses, and create a plan for your money. You can use a fancy spreadsheet, an app on your phone, or take it back to the good old days of a pen and paper to keep track of your budget. I like to use a little bit of all 3, but when you are starting out, keep it simple, cheap, and a process that is going to work for you.

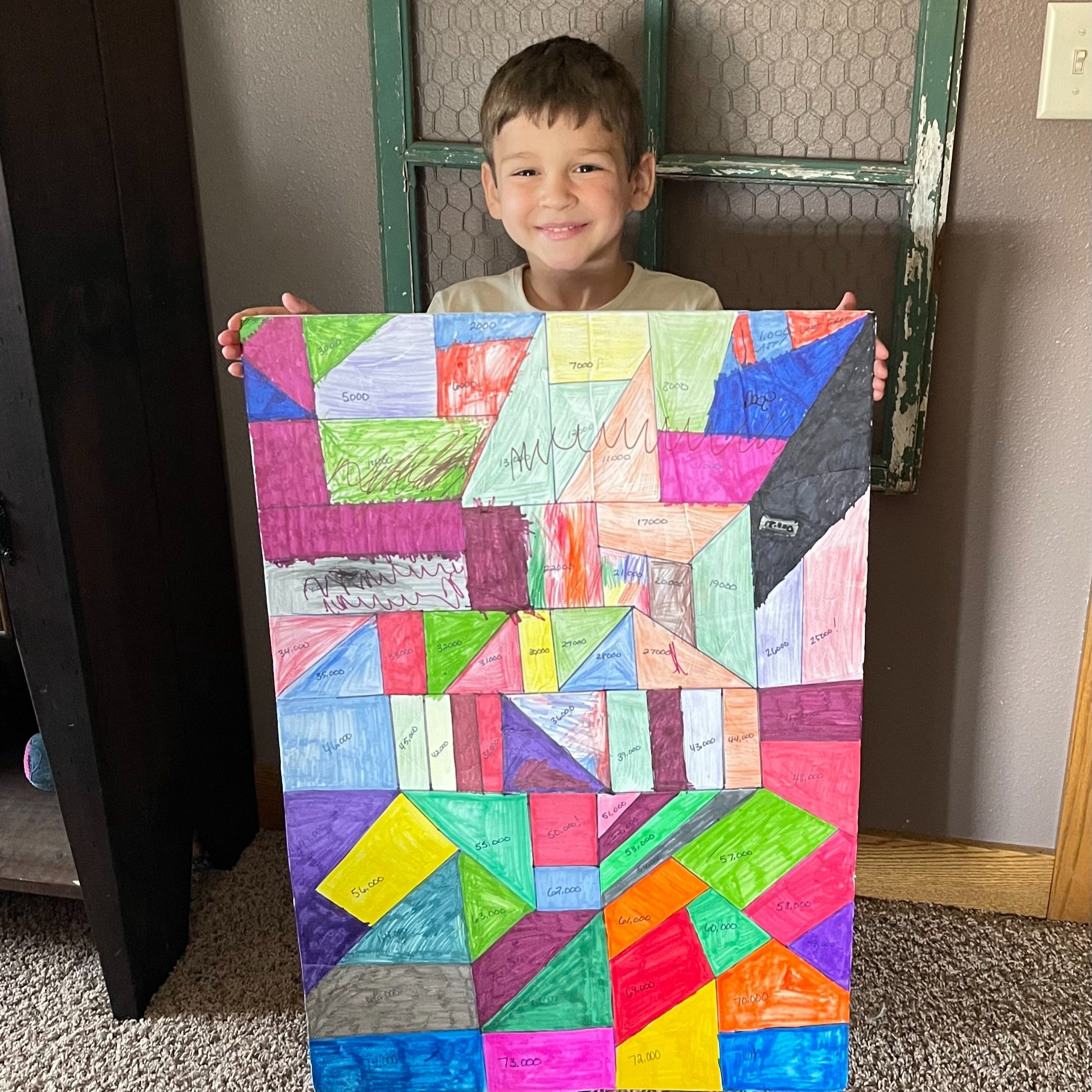

My youngest son holding our debt payoff tracker. We used this to keep track of our debt payoff progress. For every $1000 we paid off of debt we colored in a shape. It was a nice motivator for us!

Prioritize paying off debt this seems like a no-brainer, but not everyone thinks to or realizes that they can pay off their debt (loans) early (usually without consequences). Once in a while, I come across certain loans that only allow you to make a certain number of extra principal payments (extra payments) per month without a fee or some type of consequence. Be sure to check on each of your loans when paying extra to make sure you don’t acquire an additional fee.

Get a Budgeting Buddy someone to keep you accountable and someone who will support + encourage you along your debt payoff journey. I suggest finding someone you trust and someone who has paid off their debt early or in full. They may have their mortgage still, but they’ve paid off their car loans, and student loans, they don’t have credit card debt, etc. Someone who can give you sound advice during your debt payoff journey.

Get yourself a Budgeting Buddy to support + encourage you along your debt payoff journey.

Get in a good money mindset you might need to change how you think about money to set yourself up for success. Your money mindset is based on how you feel + how you think about money. More than likely how you feel and think about money goes all the way back to your childhood. Depending on how you were taught about money, if you were taught anything about money, how your parents dealt with money, and your experiences with and around money. Were there fights in your home because of money? Did you grow up not having enough money? Did you grow up having an abundance of money?

All of these things play into your money mindset. Sometimes our mindset around money needs a little maneuvering, we need to take that puzzle apart, throw some pieces away, put some new pieces in, and rebuild the puzzle.

One way we can work on improving our money mindset is by setting goals with our money. This gives us something to work on + keeps us on track with our finances. Everyone needs to have goals. We all need to have dreams, yes, even us middle-aged and older adults. We need something to work towards + keep us motivated, keep us moving forward, keep us seeking improvement + personal development.

Writing your goals down helps you achieve them. You are putting it down permanently and working towards meeting those goals

Create a goal and work hard to meet it. Make sure your goal is a SMART goal–

Specific

Measurable

Achievable (Attainable)

Realistic

Timely (has a time frame)

By making sure your goals are SMART goals, you are more likely to meet them. Make sure your goals are ones that you truly want to meet. Having a timeframe attached to your goal will keep you motivated.

Paying off your debt early takes time and hard work, but I know you can do it. For a little more motivation you can read my other blog post on how I paid off $100,000 in less than 2 years!!

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts