Emergency Fund- when Murphy shows up, be prepared

Having a fully funded emergency fund or what my grandpa called, a rainy day fund, is a must!

I suggest having at least 6 months’ worth of expenses in your emergency fund. Some experts recommend 3 months and some recommend having up to 12 months.

You guys, it is not a matter of “what if”, it is a matter of “when”. An emergency is going to happen. Uncle Murphy, ahem, Murphy’s law, is going to come knocking on your door. I want you to be ready when Ol’ Murph shows up.

What expenses do I include to figure out how much my emergency fund should be?

There are a few ways to figure out how much money should be in your emergency fund. You can go off of your 4 walls: food, shelter, transportation, and utilities. Or you can go all out and include ALL of your monthly expenses (including restaurants, fast food, fun money, date night, new clothes, etc) and what you budget for/what you spend monthly. You could also decide to go with a number that might be in between these two.

I personally want more than my 4 walls in my emergency fund. If my husband or I lost our job, and we had to rely on our emergency fund to get us by, I would want to be able to spend more than what our 4 walls are until we find a new job. This would also allow us to take a little more time finding the right job instead of feeling the pressure to take the next job that is offered to us, whether that job is a good fit or not.

If I lost my job, I also do not want my 3 kids to suffer if I can prevent that. So I would rather have more in my emergency fund, so my boys can still continue to play hockey and we can still have some fun until I find a new job. I don’t want to tell my kiddos they can’t go to their friend’s birthday party because we can’t afford a gift or fuel to drive there because I skimped on my emergency fund contributions!

Do you have job security? Are you or your partner self-employed? If you are self-employed or you don’t feel like you have a very secure job, you are going to want to have 6 months or more in your emergency fund. Remember the beginning of the pandemic and how many people were furloughed, laid off, or lost their jobs? Yeah, I am a Registered Nurse and I was furloughed for a month. I thought I had the most secure job on the planet!

My husband is self-employed, he farms. So, again, we are going to fund 6+ months in our rainy day fund.

I can not give you a specific number for what you should save in your emergency fund. However, most say between $9,000-$30,000 is a good range. I am aiming to have $20,000 in our emergency fund to feel comfortable, but then I am hoping to increase it to $30,000. If my husband and I were both fully self-employed I would want to double that.

You can store your emergency fund money in a simple savings account at a local bank, I suggest using a credit union. Or you can use an online bank, that has a high-yield savings account, this will have a higher interest rate.

You want this money to be easily accessible, so that you can get it out fast, but not so easy that you are tempted to use this money for something that does not count as a true emergency, like a new dress for your work Christmas party.

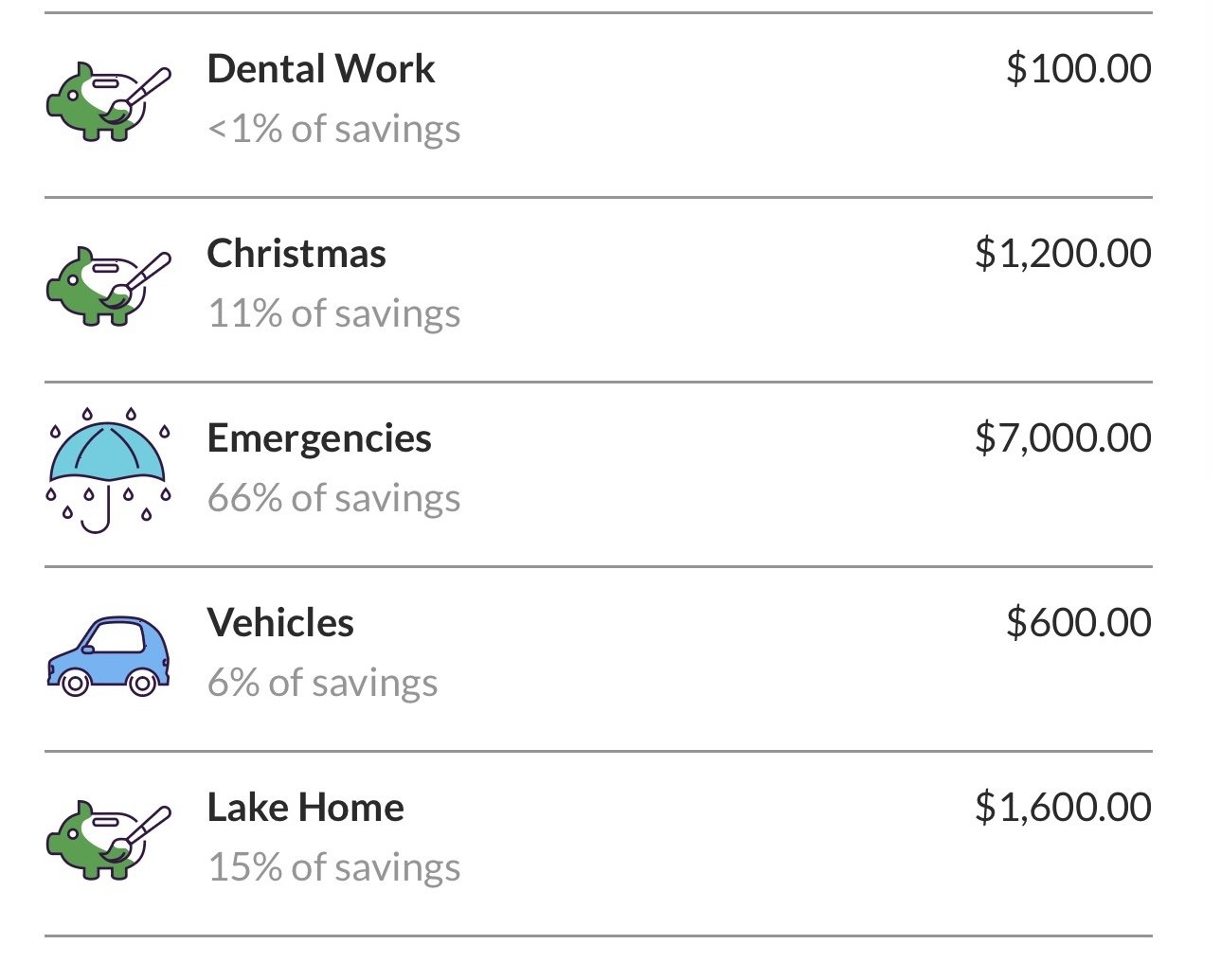

Snapshot of an online high-yield savings account “buckets”

It is important to have an emergency fund even if you currently have debt. However, I would not have a fully funded emergency fund if I had consumer debt. When my husband and I were paying off our debt, we had between $1500-$3000 in our emergency fund. Some experts say to have a maximum of $1,000 in your emergency fund while paying off debt, but to me, this is too low of a number. Most emergencies will cost you more than $1,000 these days.

Remember, every little bit helps. There are times when I add $25 to our emergency fund and at other times I add $300. Just keep saving. You can automate your savings, so with every paycheck you add a certain percentage of it into your emergency fund right away. This is called paying yourself first.

I have been working on building our fully funded emergency fund for about a year now. I estimate it will take me another 18-24 months before I hit my $20,000 goal. And then another year to hit $30,000. The main point is to keep adding to that savings account, every little bit helps.

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts