Everyone, on every income level— low or high, NEEDS to have a budget. I know, a budget can be a scary word. But a budget is needed no matter how much money you make.

If you have a low income, you definitely need to have a budget, to simply tell your money where to go.

There were many times before I started to do a monthly budget, that I didn’t know where my hard-earned money went. I would get my paycheck and I swear, a week later, my money was gone. My money was like my socks that disappeared from my dryer. I swear, those things sprout legs and just up and walk away. You DO NOT want your money to find legs and run away.

So, how do you budget on a low income?

Budgeting is a simple task, however, it is not always easy, especially in the beginning.

Here are a few steps to starting to budget:

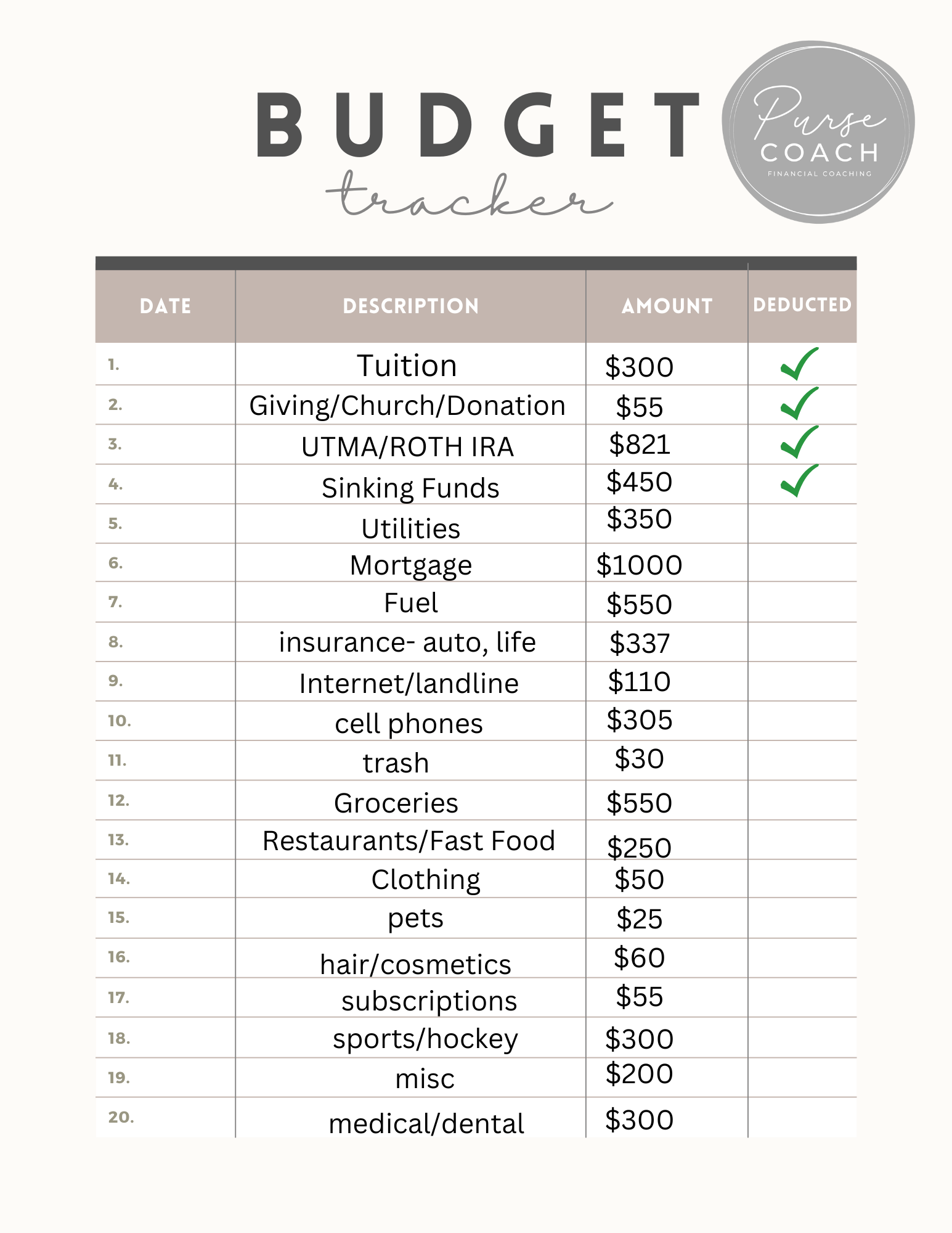

1. Write down ALL of your income (Job, side hustles )

2. Write down ALL of your expenses (bills, food, debt payments)

3. Look over the last 3 months of your spending

4. Prioritize your spending (start with your 4 walls: Shelter, Food, Transportation, and Utilities)

5. Make sure you have a small Emergency Fund (savings account for emergencies)

6. Cut costs- Find places that you can cut out of your spending (lots of times this is going out to eat, pre-packaged foods, snacks, etc)

7. Use Cash- you are likely to spend LESS money when you pay with cash

Make sure you keep track of all your income, including your regular job and any other side job income you may have. I suggest selling household items you no longer use or need to bring in some more money, especially if you are working on paying off debt.

Write down all your monthly and yearly expenses. ALL OF THEM, don’t forget your annual subscriptions or yearly expenses, including taxes, property taxes, insurance, auto registrations, car maintenance, etc.

These yearly or quarterly expenses can easily be forgotten and sneak up on you. I use sinking funds for these expenses. A sinking fund is simply a savings account that you put money into throughout the months or years to save up for something specific. I have a sinking fund for Christmas. So every year January through December I save $100 and then I have $1200 in December to spend on Christmas gifts, food, and decorations. You can use a sinking fund for property taxes if you pay these yearly or bi-annually.

Some of my Cash Envelopes I use to store my money in

I suggest looking at your credit card and bank statements for the past 3 months to get a good idea of how much you are spending on each category each month. Look at how much you are spending on coffee, fast food, groceries, and clothing.

Some expenses are fixed, meaning they don’t change like your mortgage, rent, and sometimes childcare. Some expenses are variable, like eating out, groceries, and entertainment. These are usually the areas you can cut back on.

You want to prioritize your spending. Start your budget by writing down and including your 4 walls. These include your shelter, food, transportation, and utilities. After you account for your 4 walls, add in your other expenses. I usually write down my fixed expenses. You can try and get some of your fixed expenses decreased or cut them out altogether. 2 years ago my husband and I decided to cancel our cable and just use Disney + and Netflix. We are easily saving $100 a month by not having cable. You can try and also get different bills lowered, try shopping around.

Do you have an emergency fund? If not, you NEED one. It is not a question of if an emergency will happen, but WHEN will an emergency happen. Uncle Murphey as in Murphey’s Law will show up on your doorstep, I want you to be prepared for him. No one likes, Uncle Murphey, but having an emergency fund in place will help deter him from stopping by unannounced.

How much should I have in my emergency fund? Well, that is a big debate. Are you trying to pay off debt? Are you debt-free? If you are trying to pay off debt, I suggest having at least $1,000 in your emergency fund. When my husband and I were paying off our debt, we kept $1,500-$2,000 in our emergency fund. I felt a little safer with that amount in our savings than $1,000. I feel like most emergencies now will cost you more than $1000. If you do not have an emergency fund of at least $1,000 right now, STOP everything you are doing and prioritize getting this done! THIS IS AN EMERGENCY!!

Cut costs wherever you can. I try not to buy any more single-packaged crackers and I try to meal plan. Now, I will admit, I am not the best at meal planning, and I go in spurts. I will be good at meal planning for a few weeks and then I will go a month or two without meal planning. But when I meal plan, I 100% spend less money at the grocery store! Again, look at your bills and see if you can get your cable bill decreased or your phone bill cut down. Or cancel your cable bill altogether! While I had debt, I cut WAY back on going out to eat. When you go to a restaurant you are paying for the food and the service. For my family of 5, we almost always spend anywhere from $100-$130 on a sit-down restaurant meal with a tip for the 5 of us. That is a HUGE chunk of my money that I don’t like to spend on eating out.

Meal planning and prepping can cut down on your food costs

Use cash. I know that when I use cash for my spending, I tend to spend less money. There is an emotional component to using cash where I “feel” the transaction (not in a good way). When I use my credit card, I don’t see the transaction until a week or so later. There is a disconnect there. Also, when I go somewhere, I bring a set amount of cash with me and when that is gone, I am not “allowed” to spend anymore. Once the cash is gone, I am out of money.

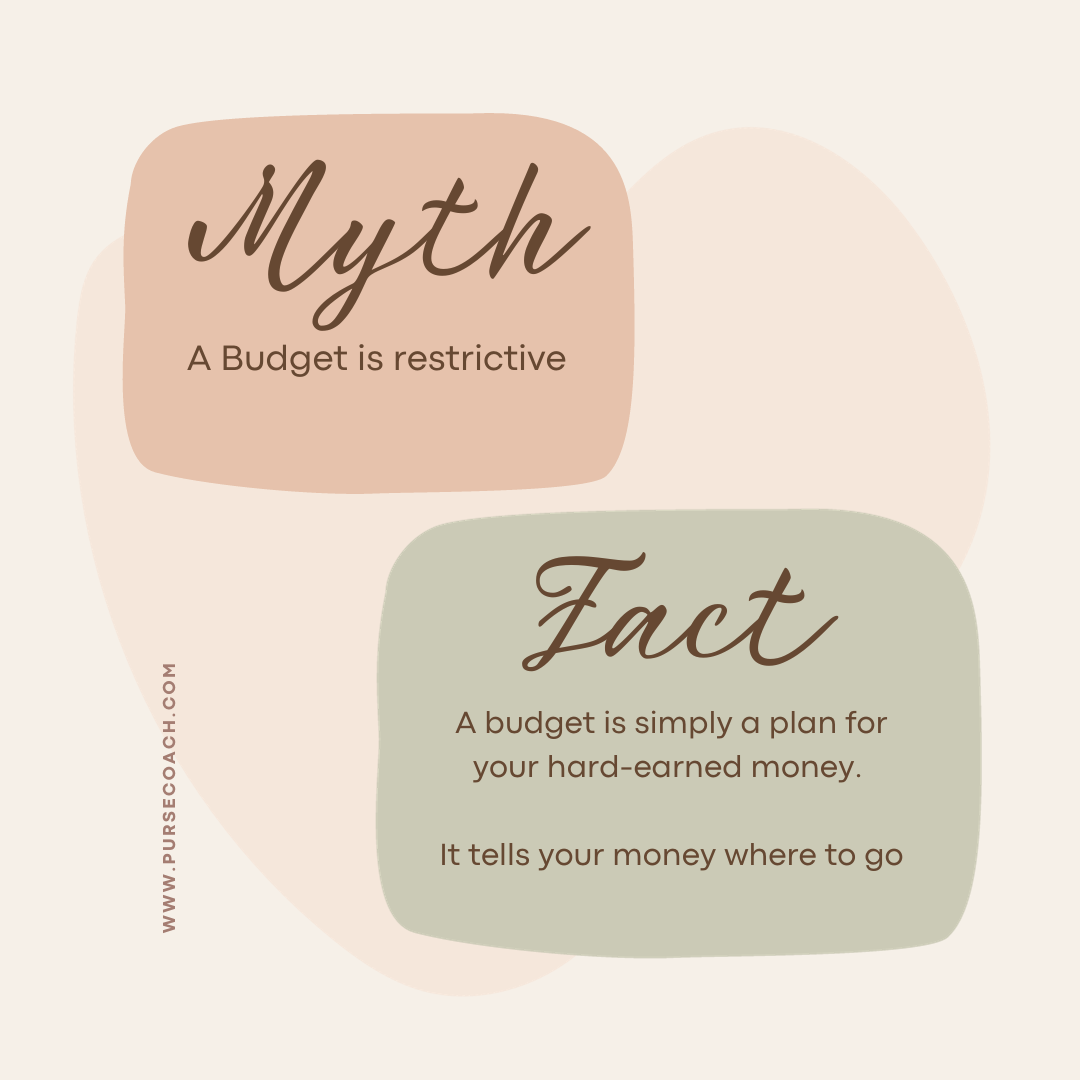

Having a budget does not have to be restrictive. A budget gives you a plan for your money. When you don’t have a plan, your money doesn’t know where to go and it disappears. Don’t allow your money to grow legs and run away. Make a plan and stick to it.

A budget is simply a plan for your hard-earned money. It tells your money where to go

You can use the 50/30/20 budget plan. Spend 50% of your income on needs (mortgage/rent, groceries, utilities, transportation), 30% of your income on wants (clothes, eating out, memberships, subscriptions, Netflix, gym, etc), and 20% of your income on savings (emergency fund, 401K contributions, savings accounts, investments).

If you are spending more than you are making and you have cut your expenses as much as possible you need to increase your income. You can do this in a few different ways. You can ask your current employer for a raise, you can find a higher-paying job, or you can find a second job or a side hustle. You might not need to have a second job or side hustle long-term. Perhaps you work this second job until your debt is paid off and then you can go back to working your main job. You can also sell things. I sold so many of our household items, clothing I didn’t wear any longer and some bags/purses I no longer used. All of this side money went toward paying off my debt.

You may also need to look at downsizing if you are continuing to spend more than you make, you’ve worked hard, taken on a second job and you still can’t make ends meet. We actually sold our gorgeous, 1-year-old destination camper that we only had for a year or two. This was a difficult decision that we had to make as a family. But by selling our camper, we were able to pay off the rest of our debt, and our truck, and put a large chunk of money into our emergency fund. I feel that this was one of the best decisions we made as a family, even though it wasn’t a fun one and it was a difficult one.

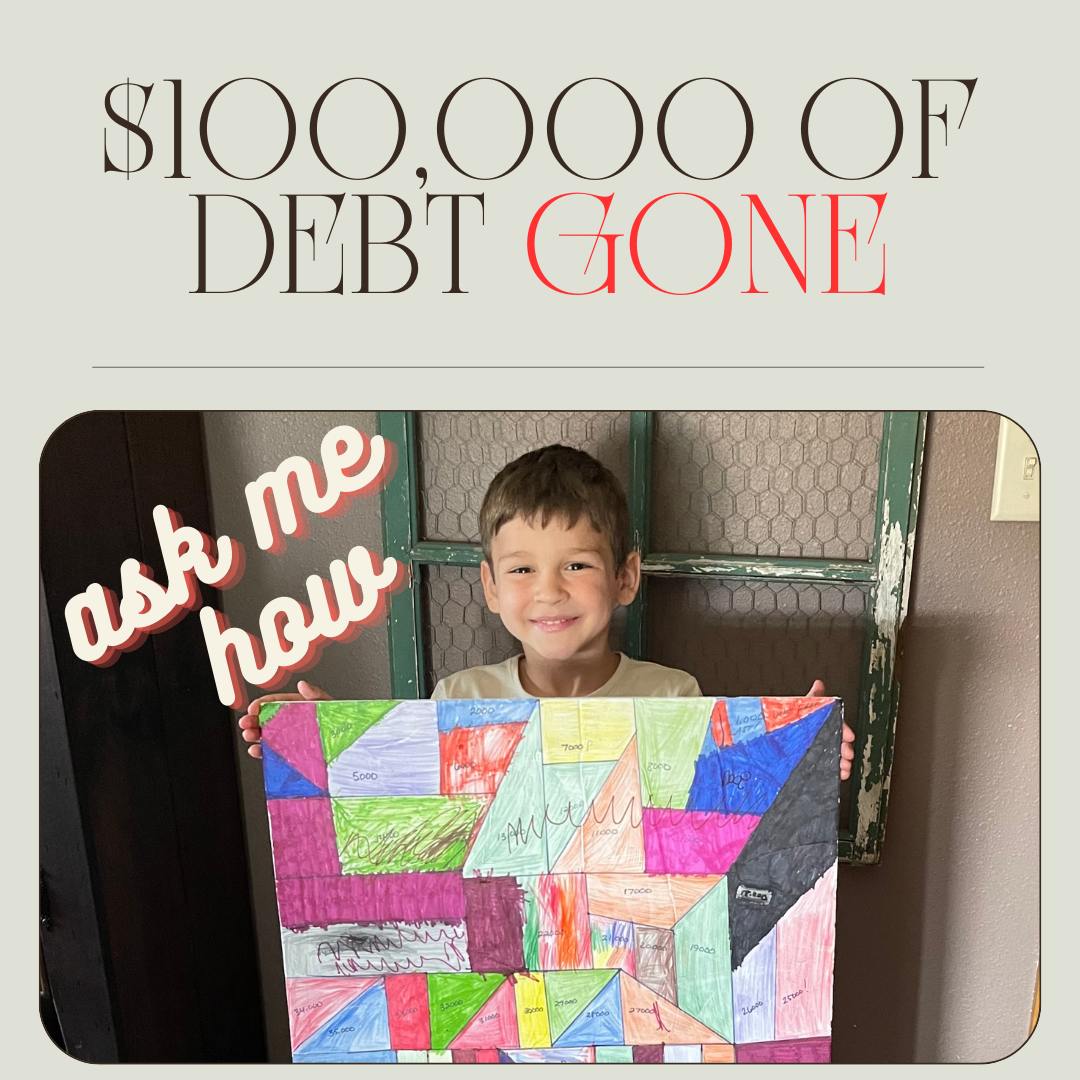

My son holding our debt payoff coloring board. Each shape represented $1000

IT IS SO MUCH EASIER TO GET INTO DEBT THAN GET OUT OF DEBT.

You can wander into debt, without thinking about it much, but you can’t just wander out of debt. I have made the decision to stay debt-free, besides our house, for my family’s personal finances. If this is not your goal, that is ok. Even if you don’t mind having debt, you still need a budget to manage your money. Having a budget is not just for people wanting to get out of debt. A budget is for EVERYONE.

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts