Running a small business is a rewarding journey, but it often comes with financial challenges, including managing and reducing debt. Accumulating debt is a common part of business growth, but staying on top of it is crucial for long-term success. If you’re a small business owner looking to reduce your debt and improve your financial health, here are some effective strategies to consider.

For those who are not biz owners, this blog will still be super helpful if you have debt, which chances are- you do, trust me you are not alone in this. So don’t skip over this blog post— You will still find lots of value.

You can also listen to this blog in a podcast form, here is the link, https://www.buzzsprout.com/2143456/episodes/15714338

Debt can be a powerful tool for growing your business, but it can also become overwhelming if not managed properly. High levels of debt can impact your cash flow, credit rating, and ability to invest in your business and pay yourself a fair salary. Trust me, you do not want to get “in over your head” as your biz will be sure to fail. That’s why developing a solid debt reduction plan is essential to ensure your business remains financially healthy and sustainable.

Let’s go over some steps for reducing your debt:

1. Assess Your Current Debt Situation

Before you can effectively tackle your debt, you need a clear understanding of your current financial situation. Start by making a comprehensive list of all your outstanding debts, including the lender, interest rate, minimum payment, and due date for each one. This will give you a complete picture of what you owe and help you prioritize which debts to tackle first.

2. Prioritize High-Interest Debts

High-interest debt can quickly spiral out of control and cost you significantly more over time. Once you’ve assessed your debt, prioritize paying off the debts with the highest interest rates first. This method, often referred to as the “Avalanche Debt Payoff Method,” will help you save money on interest and reduce your overall debt more quickly.

There is also another debt payoff method called the debt snowball method, which many financial experts recommend including Dave Ramsey and Ramsey Solutions. However, I typically recommend using the debt avalanche method to my clients as you save the most money and it makes the most sense. If you have an interest rate in the 20s you NEED to prioritize paying that off before you pay off a debt with an interest rate in the single digits.

3. Negotiate with Creditors

Don’t hesitate to reach out to your creditors to negotiate better terms. Creditors may be willing to lower your interest rate, extend your payment period, or even reduce your total debt if you communicate openly about your situation. A successful negotiation can provide immediate relief and make your debt more manageable. Just be sure you fully understand what the terms are you are agreeing to. Most creditors are NOT your friends, so be sure you comprehend what they are offering you.

4. Consolidate Your Debts

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate or more favorable terms. This can simplify your repayment process by reducing the number of payments you need to make each month. Look for consolidation options that offer lower interest rates or longer repayment periods to ease your cash flow. Again, make sure you know what you are signing up for!

5. Increase Cash Flow with a Side Revenue Stream

If your business is struggling to cover debt payments, consider generating additional revenue streams. This could involve offering new products or services, renting out unused space, or even taking on a side gig. Increasing your income can provide the extra cash needed to make larger debt payments and reduce your overall debt more quickly. I did this when we were paying off our personal debt, in that I picked up additional photography sessions and I worked overtime at my nursing job, while also selling many of our unused items or even some used items that we didn’t need. We were able to pay off $100,000 in less than 2 years!! I have been in the position of feeling like I was drowning in debt, I understand when people say they feel like they can’t get out from under it, but there is a way out.

6. Cut Unnecessary Expenses

Evaluate your business expenses and identify areas where you can cut costs. This might include renegotiating contracts with suppliers, eliminating non-essential services, or finding more cost-effective alternatives, just don’t sacrifice quality!

Reducing your expenses will free up more cash to put toward your debt, speeding up the repayment process. This can be where you hire someone to help you look at your numbers and business closely. This is a service I include in my 1:1 financial coaching program, where I look at your expenses and see what can be cut back on or cut out, and or what may be costing you more in the long run and isn’t giving you a good ROI. You can do this with your personal expenses as well! Head to Jesswaynecaoching.come for more information!

7. Create a Debt Repayment Plan

Once you’ve identified which debts to prioritize, develop a realistic repayment plan. Set specific goals for paying off each debt and establish a timeline for when you want to be debt-free. Stick to your plan and make consistent payments to ensure steady progress. Make sure you have an accountability partner to help you celebrate the small wins and hold you accountable to stay on track.

8. Seek Professional Advice

If you’re feeling overwhelmed by your debt or unsure where to start, consider seeking help from a financial coach or business consultant. These professionals can provide personalized advice, help you create a debt reduction strategy, and offer guidance on managing your finances moving forward. You can find all my information at Jesswaynecoaching.com.

9. Monitor Your Progress

Regularly review your debt reduction plan to ensure you’re on track. Celebrate small victories, like paying off a loan or reducing your overall debt by a certain percentage. Tracking your progress can keep you motivated and focused on your goal of becoming debt-free.

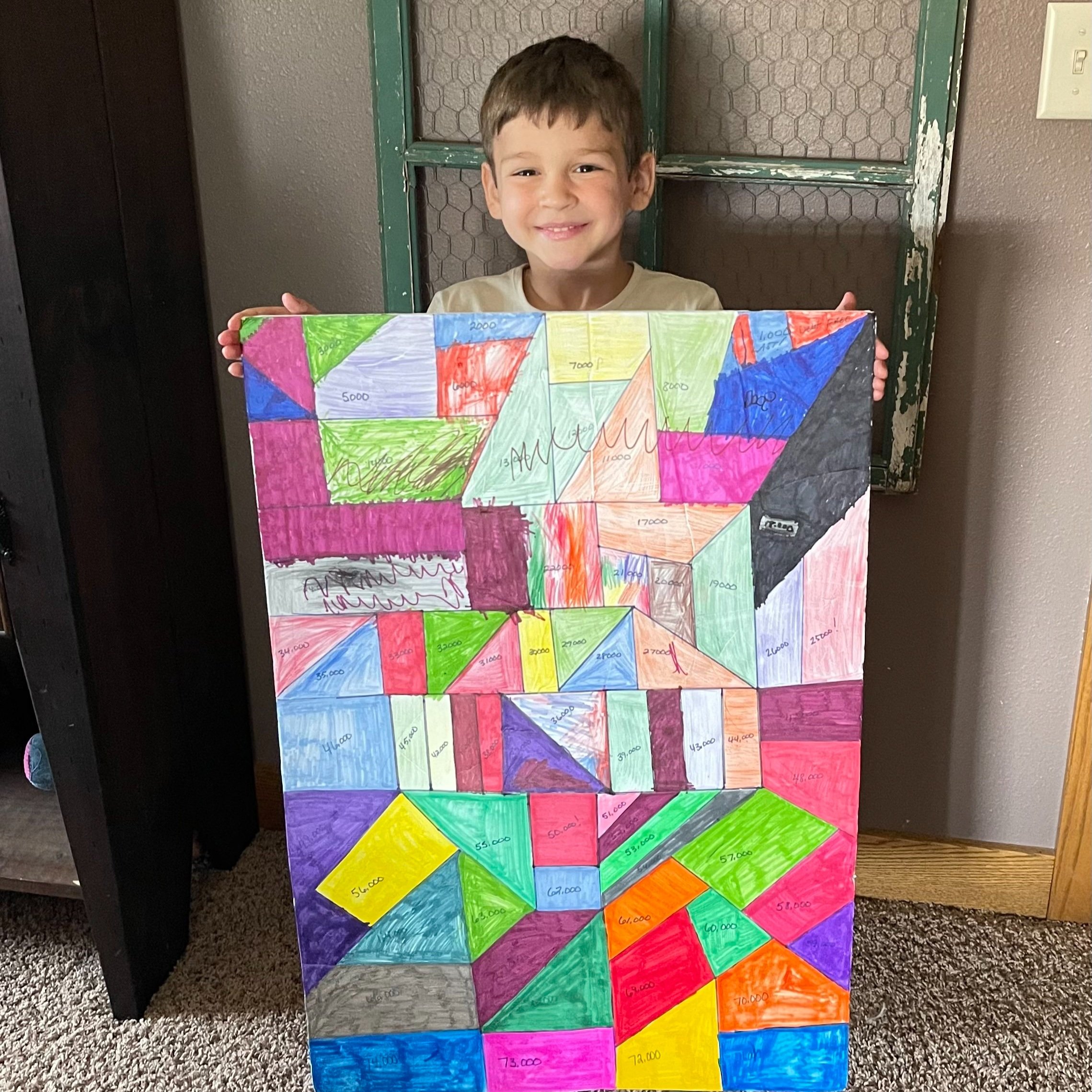

When we were going through our debt payoff journey, we had paid off about $25k of debt, but we had $75k to go. We were getting a tad bit un-motivated, so we created our own debt payoff tracker on a poster board we found in our house. We made 75 shapes that each represented $1,000 of debt and each time we paid off $1k of debt we colored in a shape. My boys used to argue over who got to color in the next shape!

My son, Colton, holding up our debt payoff tracker!

Conclusion: Stay Committed to Your Debt Reduction Journey

Reducing debt as a small business owner is a challenging but achievable goal. By taking proactive steps to assess your debt, prioritize high-interest loans, cut unnecessary expenses, and create a solid repayment plan, you can regain control of your finances and pave the way for a more secure financial future.

Remember, the journey to becoming debt-free won’t happen overnight, but with dedication and discipline, you can significantly reduce your debt and position your business for long-term success.

xoxo

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch