One of the most important things in life is investing in yourself and this is one area of life where I thrive. I do this by taking courses, furthering my education, and focusing on what truly brings me joy. However, there’s one area where I’ve had to learn some important lessons – self-care. I’m the type who can easily become a workaholic, especially with my multiple businesses, and yes, there’s more than one.

But here’s the thing, I’ve come to realize the importance of stepping away from work, even from all three of my jobs, and truly immersing myself in life. I’m a proud mom to three wonderful boys, and I cherish every moment I spend with them- unless they are driving me crazy, LOL. I don’t want them to see me constantly buried in work.

Yet, I also believe it’s important for them to witness me pursuing my passions and working towards my goals. It’s all about finding that balance, isn’t it?

Investing in yourself can come in the form of following your passions, building a business, or learning a new hobby. It can be learning a new life skill, financial literacy, or going back to school. Investing in yourself is about doing things that allow you to grow and improve as a person and it should help your personal and professional life.

When it comes to your finances, it is important to adopt a mindset of continuous learning and actively seeking support to manage your money wisely. I’m not suggesting you need to hire an expensive financial advisor; what I mean is that there are various ways to increase your money knowledge.

Consider diving into research, exploring blogs, listening to podcasts, or even taking a couple of personal finance courses. I have a few that I will link here, https://jessica-s-site-d45b.thinkific.com/collections . Joining a membership program, like my Financial Mission Membership Program is also a great place to start.

Another valuable option is investing in a Money Coach who can provide personalized guidance, education, and support. The key here is to empower yourself with the knowledge and resources you need to make informed financial decisions so that you can be confident to manage your money responsibly as well. Guess what? I too, offer these coaching services, head on over to www.Jesswaynecoaching.com to learn more!

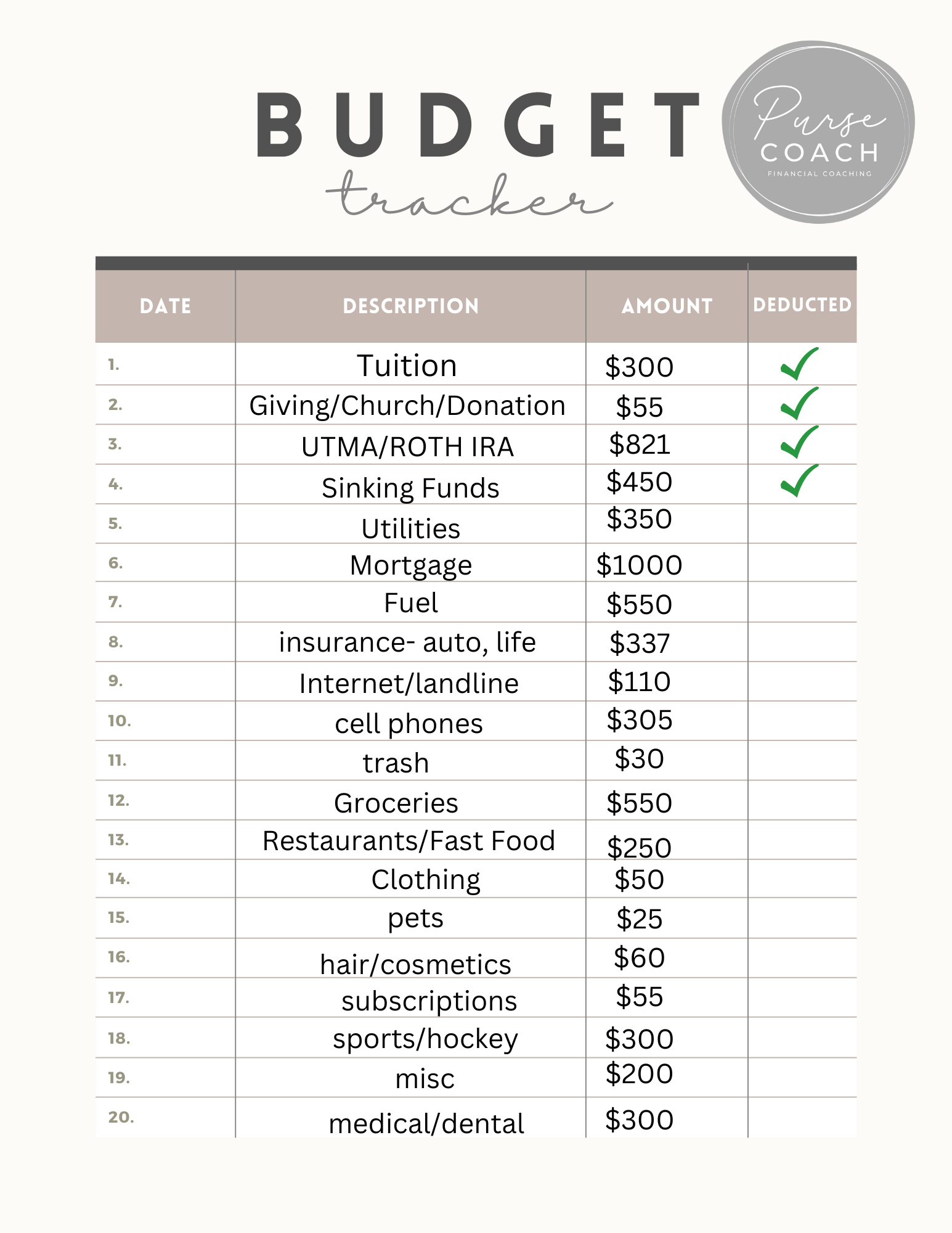

Educating yourself on the importance of creating and sticking to a budget is the first step and the most important. If you are feeling stressed, overwhelmed about your money, and don’t know where to start you are not alone. In fact, 72% of Americans are stressed about their personal finances. Many are living paycheck to paycheck and that is a stressful time. But so many don’t have to be…

Let me explain to you what I mean by that. My husband and I found ourselves living paycheck to paycheck, not because we made a super small income, but because we were choosing to live this way, even though we didn’t realize it. We were spending as much money as we were bringing in each month. We had two vehicle loans, a house payment, and a large camper loan. Luckily, we didn’t have credit card debt, and we had already paid off my student loans.

But even with just our 3 loans, our debts (minus our house) were over $100,000! WOW.

What were we going to do? I felt like we were drowning and I hadn’t realized it was that bad. We were able to make our monthly payments on our loans, but we were finding ourselves having difficulty paying for our other expenses. Yes, we were able to always pay our bills on time. But we weren’t able to save money into our emergency fund. I didn’t feel financially secure and that was scary and overwhelming. We were one unexpected bill away from a crisis situation. In fact, we found ourselves in a crisis situation, in which I had to become a farmer and plant all of our crops one spring when my husband had to have emergency back surgery. Btw, that was during the pandemic and our 3 young children were home with us 24/7, so I was doing “virtual school” with them in the tractor.

Me getting ready to go “farming” in the tractor I named, Big Betty.

You see, most of us were not taught how to budget, about personal finances, and about saving strategies when we were young. I don’t remember much about what my parents taught me about money. I do remember them telling me it was okay to have a credit card, but I needed to pay it off in full every month. This was an amazingly helpful lesson and I am so grateful they taught me that. Thankfully I listened to them and I have never had credit card debt. But that is about all I remember them really teaching me about personal finances and I don’t remember learning about money in school.

So, even if you know not to get into credit card debt, there is so much more to know about money and you need to take the time to invest in yourself to figure it out and learn. I never knew how to figure out how much I could afford to spend on a different vehicle, a vacation, or a house. Or really anything related to budgeting and money.

I’ve made many mistakes when it comes to money. One thing I have done well is investing in myself a ton over the last few years to truly learn how to manage my finances responsibly and I am grateful for that. I am proud of myself for taking the time and energy and making the commitment to learn and grow. It has paid off…big time!

It is now your time to invest in yourself and since you are reading this blog post, I know you are ready. Take it one step at a time, because trying to do too much all at once can lead to feeling overwhelmed and getting frustrated.

Start by joining Financial Mission or by taking my Free Budgeting 101 course! You literally have NOTHING to lose, because it is FREE. Head on over to Jesswaynecoaching.com for the course.

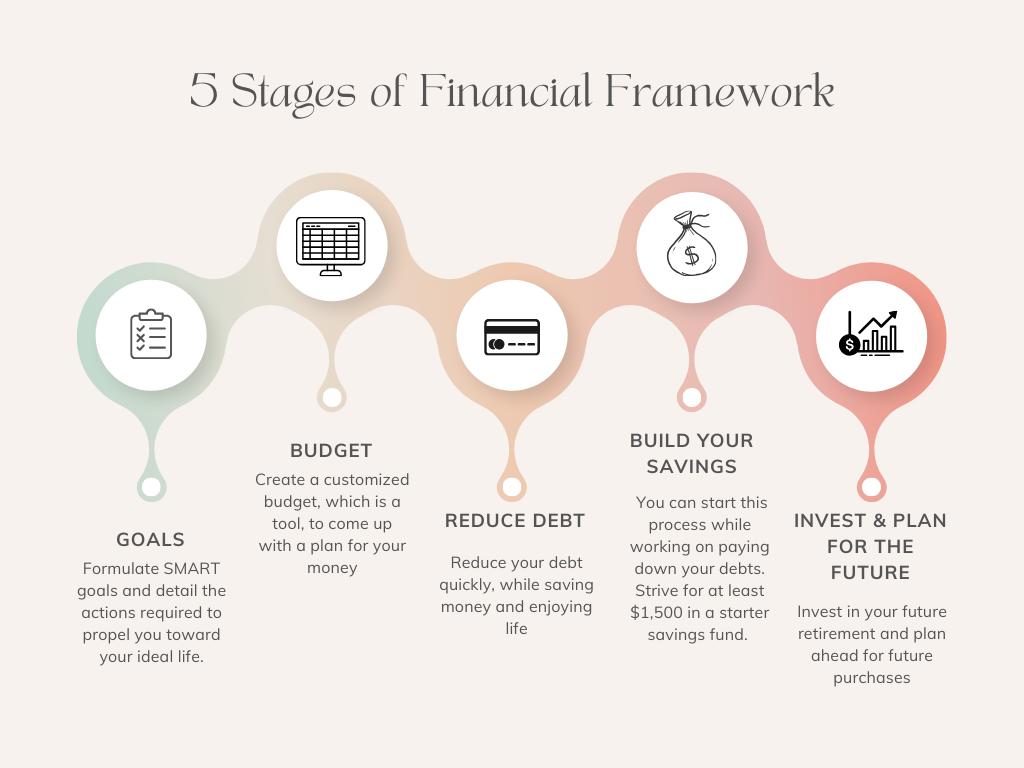

I won’t lie, there is a lot to learn and know in regard to money, but there are steps and a process to make it simpler. Start with creating a budget, coming up with a plan to tackle and pay off your debt, and also make some savings goals to work towards. I encourage you to also learn about house purchasing, investments/retirement savings, and how to live debt-free. Also, a one-size-fits-all-all budget and plan is not realistic.

You are a unique individual and so are your lifestyle, spending, and goals for your life. Your budget and plan should reflect that, it should be personalized to you. The same goes for your savings plan. You might need to save more or less than your best friend or your neighbor. If you aren’t sure where to start, or you feel lost or overwhelmed, hiring a Money Coach is a great place to get guidance, support, and even accountability.

Even if you only retain half of what you read and hear, you will be that much further ahead than you were before. I can guarantee you will know more than the majority of your peers in regard to finances. This is a great area of life where you want to be different than the majority of people!

Now, if you’ve created a budget, cut out as much as possible (truly), and still find that you can’t make ends meet it might be time to figure out a way to increase your income. You are living paycheck to paycheck and you won’t be able to get out of that cycle unless you change your income level. This can include picking up extra hours at your current job (if that is an option), taking on a side hustle or a second job, or doing a deep dive and seeing where you can find a higher-paying job/career. A change and pivot might be needed.

Getting yourself in the right state of mind is just as important as creating a written budget and plan. You need to incorporate a positive mindset to win with your money and really, to win in life. One way I stay in a positive mindset is to be continuing to work on and improve myself and one way I do that is by listening to a lot of podcasts. I love podcasts so much that I even started my own. You can listen to it at https://www.buzzsprout.com/2143456.

The Pivot to Your Passion Podcast—where we talk Life, Parenting, Mental Health, and Money!

I listen to podcasts while driving for work, editing the photos I’ve taken of clients, and doing household chores. I listen to podcasts that focus on personal development, business, finances, life, and crime stories. Such a good mix! LOL

I empower you to start investing in yourself each and every day, Try to improve yourself and your knowledge by just 1% each day. Start small and work your way up, before you know it you will be a wealth of knowledge and living the life you truly want to live.

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts