I want to decode this concept of living paycheck to paycheck. Many of us say we are living paycheck to paycheck, and we truly believe that, but that is due to the choices we are making with where we are choosing to spend our money.

Some of us spend all our income on our bills and necessities with no money left. However, many of us spend all our income on our bills, necessities, and wants, with no money left to save. I want to show you how to maximize your income and teach you how you can save first, then spend, and break the cycle of living paycheck to paycheck.

Ditch the living paycheck to paycheck lifestyle

Let’s address the elephant in the room: so many of us are guilty of living above our means. We often choose to turn a blind eye to the reality that we can’t truly afford the lavish lifestyle we have created. We find ourselves yearning for the latest designer handbag, new car, stylish furniture, or the newest gadgets, but the truth is, many of us lack the financial means to pay for these indulgences upfront. Instead, we resort to taking our loans or financing options, only to end up paying far more than the original cost in interest and fees. We convince ourselves that we can “afford” the minimum monthly payment, falsely believing that it equates to being able to afford the item itself.

Here is the thing, we are paying so much more than the store price tag on that new iPhone. You really aren’t getting that shirt on sale if you are charging it to your credit card and then not paying off the balance in full every single month before the due date.

I want you to maximize your income, all the money you bring home. I want you to learn how to save first, spend on necessities, and then spend on your wants. Spending money on yourself and the things you want is important as well. I want you to enjoy life and be able to spend money guilt free. But you need to do it by prioritizing your values, dreams, and goals.

I automate my savings and I encourage you to do the same. Every single month I have money transfer from my checking account to my retirement account and to my boy’s savings accounts. I also put money into my emergency savings fund. I do this at the beginning of every month. By setting this up automatically, I am saving way more money than if I had to manually save/transfer the money to my saving account or retirement accounts.

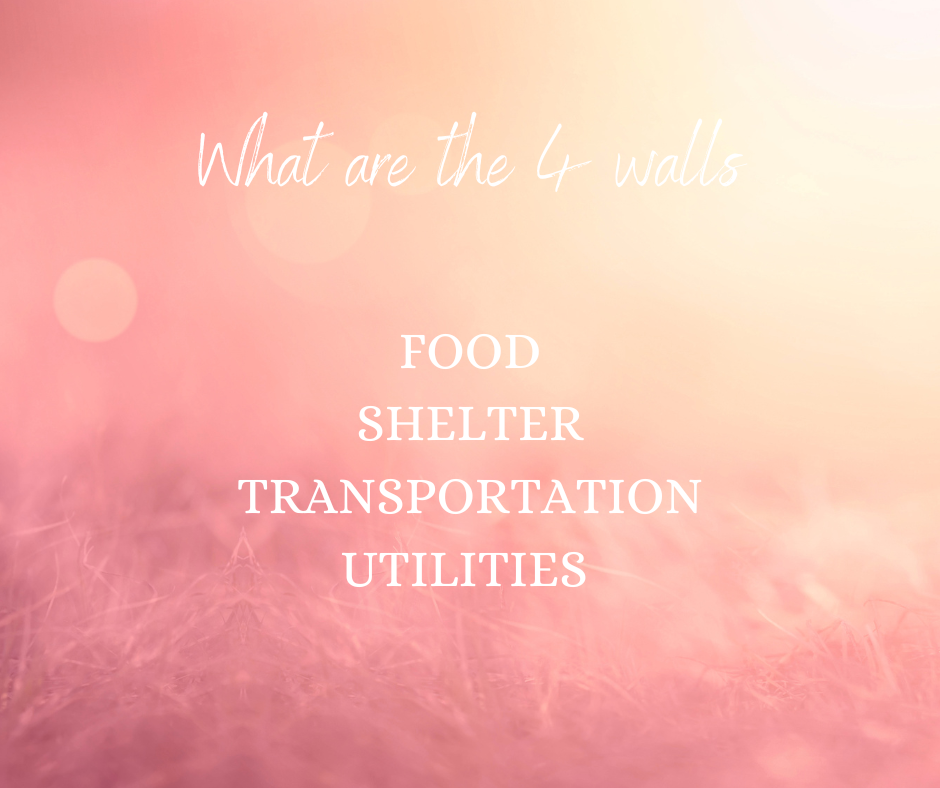

Of course, we need to pay for our needs, it is important we cover our four walls, including our shelter, food, transportation, and utilities. Food includes basic groceries, with minimum to no dining out. Transportation includes your fuel and minimum car loan payment. Make sure your income can cover these bills.

Make sure your income covers your “4 walls” at a minimum. Shelter, food, transportation, and utilities

If you were to lose your job or your partner lost their job, you need to have enough money in your savings to be able to cover your “4 walls”. When you start building up your emergency savings account, at a minimum you want your four walls monthly expenses multiplied by 3-6 months in that account. If you are self-employed, you want to have 12-18 months of expenses saved. Yes, I know, that can be A LOT of money. My husband farms, aka he is self-employed, so we need to be building our emergency savings account to house 12-18 months of our monthly expenses.

It is important to save for your long-term goals (retirement, house down payment, vacation home) and short-term goals (vacation, Christmas, home repairs). Coming up with a savings plan is just as important if not more important than planning any other part of your budget. I want you to remember that creating a budget is simply creating a plan for your money and where it is going to go.

Saving money for our goals will allow us to live a rich life

If you don’t plan out where your money is going to go, it will disappear. It will grow legs, get up, and walk away! Seriously, everyone needs a budget, no matter what your monthly household income is, high or low.

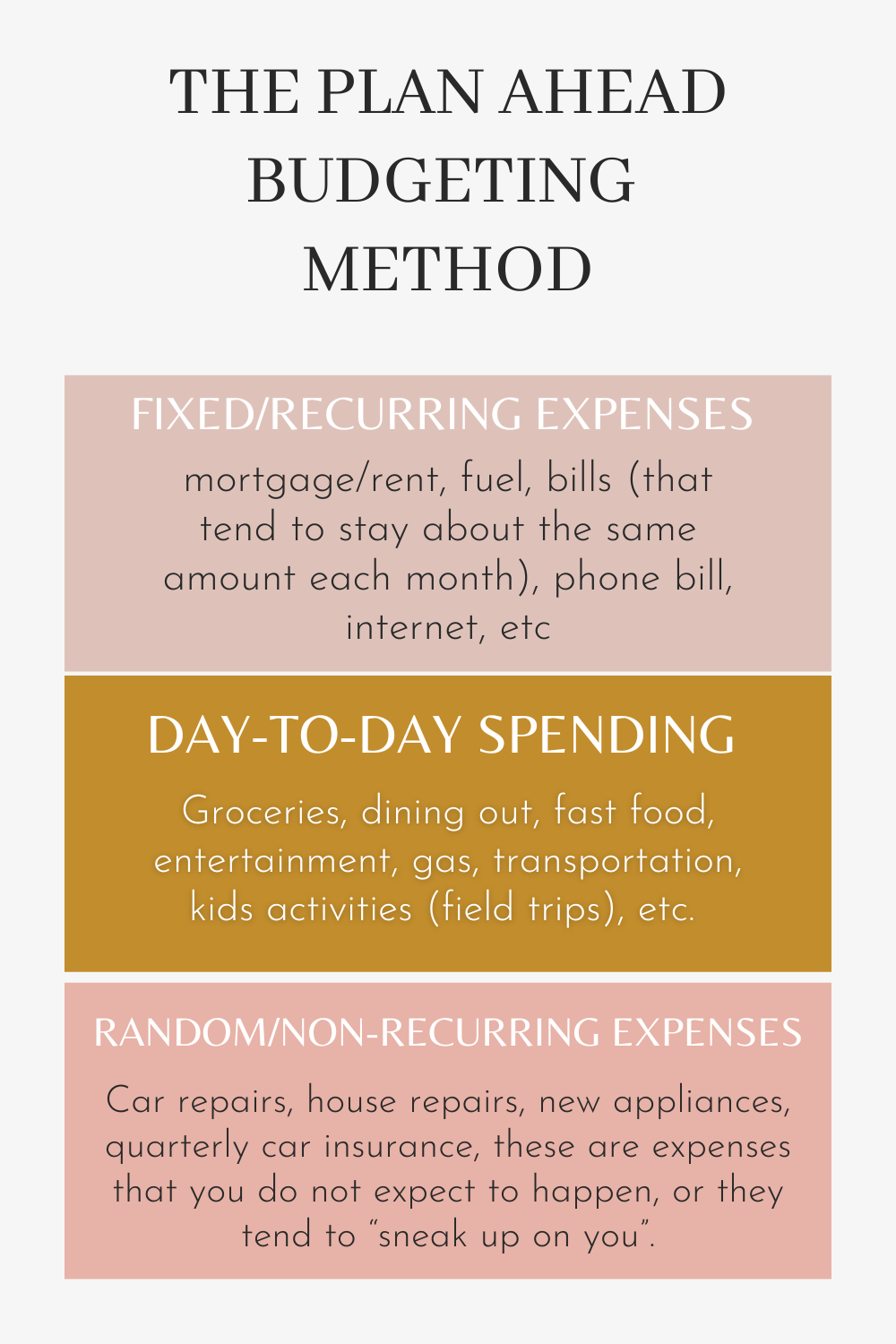

There are different budgeting methods you can use, including The Plan Ahead, 50/30/20, The Zero-Based Budget, Pay Yourself First, and Cash Envelope System. Depending on your lifestyle and personality will depend on which budgeting method you use. You might want to try a couple of them and see which one fits best. Or you might choose to use a combination of budgeting methods like I do. I pay myself first and then use the zero-based budgeting methods.

The Plan Ahead and the 50/30/20 budgeting methods are the simplest and least time-consuming methods. You essentially have 3 buckets to put your money into and spend out of.

I do suggest in the beginning of your money journey to make sure you are tracking all your spending. This will be a tad bit time-consuming, but it is so worth it. You will soon know where you are spending your money and how much money you are spending in each category. This will allow you to create your budget, using real and accurate numbers. Remember, you do not need to track every single dollar you spend forever, this can be tracked for a few months. Really you are tracking your spending to see where and how much money you are spending.

When I first started tracking my spending, I was completely taken aback (and not in a positive way) by the staggering amount of money I was spending on food. It was mind-boggling to see that I was averaging $1,000 a month on groceries and an additional $1,000 a month on dining out! It was an eye-opening realization that left me thinking, “This is absolutely insane!”

I am now pleased to report that I spend approximately $500 per month on groceries and $300 per month on dining out. Which is a drastic decrease in our food spending. Just for reference, our grocery bill does not include our meat. We farm, so we grow our own beef and chickens, and the butcher bill is separate from the above numbers.

My point is, I had absolutely no idea about the extent of our monthly expenses, not just food expense. It was a genuine shock. Needless to say, we quickly made significant cuts to our budget and I strongly encourage you to take a thorough look at your own numbers and identify areas where you can cut back on. It can lead to substantial savings and financial progress.

While it’s true that many of our fixed expenses and bills are non-negotiable, there are still opportunities to potentially reduce some of them. I highly recommend reaching out to your insurance agencies, subscription companies, and credit card providers to explore the possibility of negotiating lower bills or payments. You have a 50/50 chance of them actually agreeing to decrease your expenses, so it’s definitely worth making that phone call and exploring the potential savings.

Let’s dive into our everyday spending and explore areas where many of us can make significant reductions. Take a moment to reflect on your own habits. How frequently do you eat out at restaurants? Is it a weekly occurrence or even two to three times a week? And what about hair appointments? Are you getting your hair cut, styled, and colored every 6-8 weeks? I am guilty of this one! Perhaps you also indulge in monthly nail appointments or tanning sessions. And let’s not forget those impromptu toy purchases for the kiddos every time you step foot in a store. Kwik trip runs multiple times a week or day? Yep, trust me, I’ve been there too. But when I found myself drowning in debt, I made some drastic changes. I had to let go of many of the day-to-day spending I was doing on my wants and focus on my priorities. We also cut back extensively on eating out, opting instead for packing our meals and prioritizing meal-prepping, even though I am not great at this. These changes made a world of a difference in our financial journey.

I strongly believe in the importance of enjoying life and prioritizing self-care, even though I am not the greatest at indulging in guilt-free self-care. It’s essential to treat yourself and indulge in activities that bring you joy and relaxation. However, it may be necessary to find a balance and make some adjustments. Even small steps towards saving and allocating that money toward paying off debt or building your savings and retirement accounts can have a significant impact.

Every little bit adds up and contributes to your overall financial well-being. So, while I encourage you to continue enjoying life and taking care of yourself, I also encourage you to consider how these choices align with your long-term financial goals. By finding that balance, you can make meaningful progress toward a more secure and prosperous future.

This particular season of life, marked by debt and financial uncertainty, is not permanent. It’s important to remember that if you’re actively taking steps to overcome these challenges, your situation will improve.

Saving for your retirement is crucial, and your future self will undoubtedly thank you for it. One highly effective strategy is to automate your savings, particularly for retirement. Personally, I’ve seen substantial savings each month by automating my retirement contributions. However, it’s not just about retirement. I encourage you to save for upcoming events later this year and in the next year. Think about your goals and aspirations five years from now, even ten years from now, and start setting aside money for those things you truly want to achieve. By taking a proactive approach to saving, you’re investing in a brighter future and ensuring that you have the means to enjoy the things that matter most to you down the road.

What are your future dreams and aspirations? Take time to write down what you want your future to look like in the near future 2-3 years from now and in the long term future in 10+ years.

When you’re saving for various things, such as upcoming events, activities, or experiences later this year, it’s essential to recognize that you can’t spend every single dollar you earn. Let’s say you’re saving for your son’s upcoming birthday party and his gifts. To make it happen, you need to plan and actively set aside money for it. Start by determining how much you’re willing to spend and then calculate how much you need to save. This proactive approach ensures that you have the funds you need and allows you to make intentional decisions about your spending, aligning your financial priorities with your desired experiences.

I prioritize planning ahead and saving for a wide range of expenses throughout the year and I encourage you to also. These include important occasions like Christmas and birthdays, as well as recurring expenses such as bi-annual insurance payments, holidays, gifts, pool maintenance, sports activities, pet care, dental work, my son’s orthodontic treatment, and even car and home repairs. These are just some of the categories I actively budget for, ensuring that I have the necessary funds when these expenses arise. It’s worth mentioning that I also maintain a separate savings account specifically designated for emergencies, which is distinct from the funds allocated for Christmas and vacations. This approach allows me to stay prepared for unexpected financial challenges while also being able to enjoy planned experiences without dipping into my emergency fund.

As you can see, I must save quite a bit of money each month to plan ahead for future expenses. I don’t want to find myself in a situation where my son’s hockey registration to be due and I am faced with a $1200 payment, that I can’t afford. Instead, I aim to have already planned and saved for such expenses, ensuring that I have the necessary funds readily available. This proactive approach helps me maintain control over my stress and anxiety, knowing that I am financially prepared for whatever comes my way.

Remember, achieving financial freedom and breaking free from the paycheck-to-paycheck cycle is a transformative journey. It requires your commitment, motivation, and hard work. It’s important to recognize that it won’t be flawless, but striving to make it as close to perfection as possible is truly worthwhile. Embrace the process, stay determined, and keep pushing forward toward a more secure and financial future.

Take a listen to my podcast about Ditching the paycheck-to-paycheck lifestyle cycle at https://www.buzzsprout.com/2143456/13054072

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts