Budgeting Basics for Busy Moms: Tips and Tricks to Create and Stick to a Budget

Filed in Finances

As a busy mom, juggling numerous responsibilities can make budgeting seem like a daunting task. However, creating and sticking to a budget is essential for managing your family’s finances and achieving financial stability.

I didn’t create my first budget until I was in my 30s, don’t feel bad or embarrassed if you’ve never had a budget, or if you’ve tried to budget but it hasn’t stuck. We all have to start somewhere. But I know you are here, reading this blog post because you are ready to handle your money in a different way.

Here are some practical tips and tricks to help you master the art of budgeting without feeling overwhelmed.

1. Set Clear Financial Goals

Begin by setting clear and realistic financial goals. Make sure these are SMART goals- Specific, Measurable, Achievable, Realistic, and Time-bound. Whether it’s saving for a family vacation, paying off debt, or building an emergency fund, having specific objectives will motivate you to stick to your budget. Write down your goals and keep them somewhere visible to remind yourself of what you’re working towards.

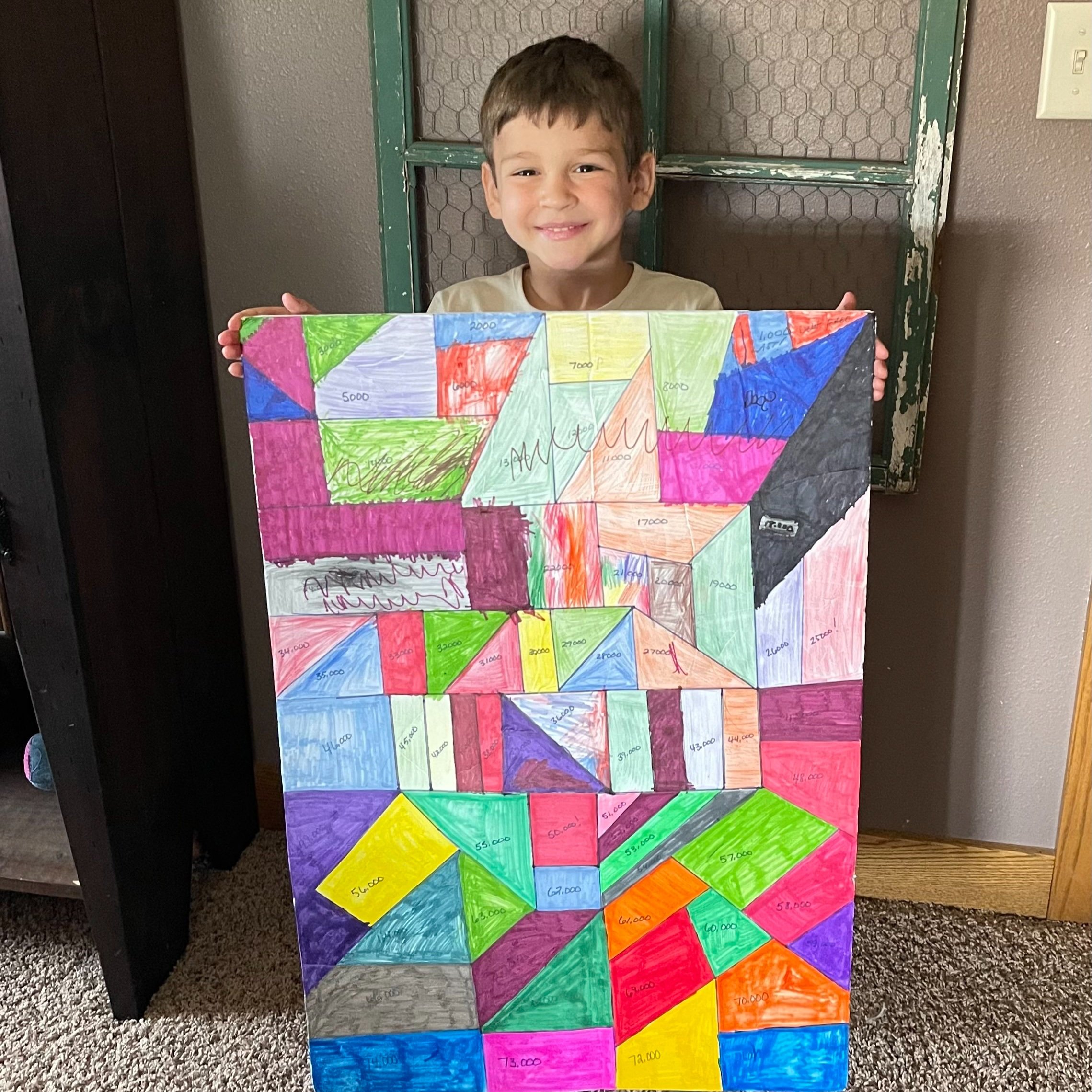

When we were working on paying off our mountain of debt, you know that $100,000 of consumer debt we had…we created a debt payoff tracking board where we took a white poster board, added up the debt we had left to pay, and made shapes on the board. Each shape represented $1,000 worth of debt. So every $1k we paid off in debt we got to color in a shape. This got the kids involved, kept us motivated, and it was so fun to see the progress we were making. In fact, our boys used to argue over who got to color in the shapes each time. There are lots of debt payoff and savings trackers online for free or to buy, check out Etsy!

My son, Colton holding our homemade debt payoff tracker.

2. Track Your Income and Expenses

Understanding where your money comes from and where it goes is crucial. Start by listing all your sources of income, including your salary, spouse’s income, and any side hustles. Next, track your expenses for a month to get a clear picture of your spending habits. Categorize your expenses into fixed (rent, utilities, insurance) and variable (groceries, entertainment, dining out) costs. Tracking your spending isn’t something you need to do long-term, however, I typically recommend tracking for at least 3 months to get a good estimate of how much you are averaging spending in each category. This should help capture some of those one-off expenses, like quarterly subscriptions, or misc. items that aren’t bought every month.

If you end up realizing that tracking your spending is keeping you on track with your budgeting and goals, or you like tracking your spending (like I do) then by all means—keep tracking! I LOVE tracking our spending, but I am kinda weird like that.

Be sure to check out my FREE Budgeting 101 online course, https://jessica-s-site-d45b.thinkific.com/courses/free-budgeting-101-course

3. Create a Realistic Budget

Based on your tracked income and expenses, create a budget that reflects your financial situation and goals. Allocate your income to cover your essential expenses first, then assign funds to your financial goals and discretionary spending. Use budgeting tools or apps to simplify the process and ensure you’re not missing anything. Remember to prioritize saving for a starter emergency fund, this would be to save $1k as quickly as possible, then aim to save one month of living expenses, then focus on paying off your high-interest rate debt, and finally work on building up your fully-funded emergency fund of at least 6 months of living expenses. This is to keep you from going back into debt or further into debt. Emergencies are going to happen, you could get sick, your roof might start to leak, you could come home and your freezer could be at 70 degrees, you or your spouse could lose your jobs, or your kids could get sick. The list is endless…car breakdowns and repairs…seriously prioritize having an emergency savings account to be only used for an emergency.

We had 3 emergencies in one month, we were so grateful for our emergency fund. Here is a picture of my middle son, Bryson when he broke his arm.

4. Prioritize Needs Over Wants

It’s easy to get tempted by non-essential purchases, especially when you’re busy and looking for convenience. Prioritize your spending by distinguishing between needs and wants. Focus on covering your family’s necessities before allocating money for extras. This discipline will help you stay within your budget and avoid unnecessary debt. I always say, if it is a TRUE NEED-buy it, if it is a WANT, wait at least 24 hours before buying—chances are you will decide you no longer want that item.

5. Embrace Meal Planning

Food can be a significant expense for families. Save money by planning your meals in advance and creating a grocery list based on your plan. This approach reduces impulse buying and food waste. Consider batch cooking and using leftovers creatively to stretch your food budget further. Look inside your freezer, fridge, and pantry and meal plan based off of food and ingrediants you already have. Also, don’t go grocery shopping while hungry or with your kids if you can help it!! Take it from me, you will spend WAY less money following these tips.

Here is my blog on Meal Planning and Prepping to Make your Budget + Time Go Further, https://www.jesswaynecoaching.com/blog/meal-planning-and-prepping-to-make-your-budget-time-go-further?rq=meal%20planning

6. Automate Savings and Bill Payments

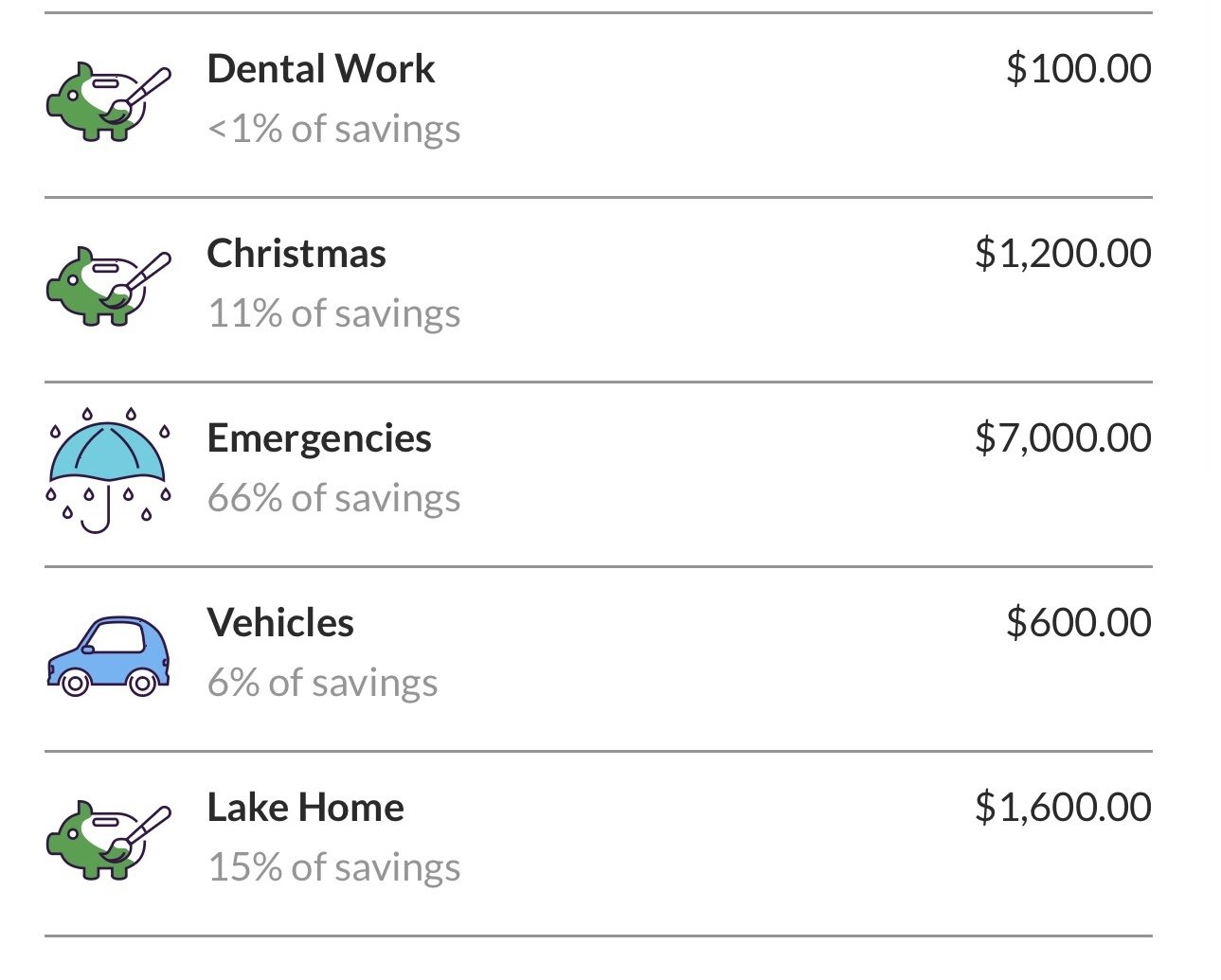

Automating your savings and bill payments ensures you meet your financial commitments without the risk of forgetting. Set up automatic transfers to your savings account and schedule bill payments to avoid late fees and maintain a good credit score. This automation also frees up mental space for other important tasks. I use Ally.com for my emergency fund and some of my other savings goals. They have a High-Yeild Savings Account (HYSA) where I am currently getting over 4% in interest and they have cool savings buckets and goal trackers. Ally is FDIC-insured and safe! I highly recommend a HYSA.

Sample of what the savings buckets look like on Ally.com

7. Involve the Whole Family

Budgeting is more effective and fun when the entire family is on board. Involve your spouse and children in the budgeting process. Teach your kids about money management and the importance of saving. When everyone understands the family’s financial goals, it’s easier to work together to achieve them. Trust me, having a husband who likes to spend money plus 3 boys who love all things sports, having their “buy-in” with our budget, spending, and money goals comes in handy. It is still a struggle for all of us to agree on how much we spend and on what, but talking about this often between all of us helps!

8. Review and Adjust Regularly

Your financial situation and goals may change over time, so it’s essential to review your budget regularly. Set aside time each month to assess your income, expenses, and progress towards your goals. Make adjustments as needed to stay on track and ensure your budget remains realistic and achievable.

Listen, I know you are busy, so this doesn’t need to take hours and hours. If you look at your budget weekly, every few days, or daily this will go a lot faster. Try taking 5 minutes every day to track your spending and make sure you are on track with your spending for the month. Also, create a new budget every single month, many of the categories and amounts will stay the same but some will change.

Make sure you are doing an annual review of all your goals, financial and non-money related. This will help you overall with making your dreams a reality. Be proactive in your approach, don’t wait until things are too “bad” before you start making changes. If you need help with setting up your budget, creating your plan, knowing what the heck I mean by tracking your spending, message me, I would love to walk you through this and I offer a deep dive budgeting session and 1:1 financial coaching. Head to jesswaynecoaching.com for more information or message me on FaceBook or Instagram at Jess Wayne Coaching.

9. Find Affordable Entertainment

You don’t have to spend a lot of money to have fun with your family. Look for free or low-cost activities in your community, such as parks, museums, and local events. Get creative with home-based entertainment, like movie nights, game nights, and DIY projects. Some of our favorite memories and activities we do as a family and with friends is often free or low-cost. Bonfires under the moonlight—count me in!

10. Seek Support and Resources

Don’t hesitate to seek help if you’re struggling with budgeting. There are numerous resources available, including my financial coaching. I also offer online courses, a podcast—Financial Mission, https://podcasts.apple.com/us/podcast/financial-mission/id1680788605, and community workshops. Surround yourself with a supportive network of friends and family who share similar financial goals and can offer encouragement.

Conclusion

Budgeting may seem challenging, especially for busy moms, but with the right strategies, it can become a manageable and even empowering task. By setting clear goals, tracking your income and expenses, and prioritizing your spending, you can take control of your family’s finances. Remember, the key to successful budgeting is consistency and regular review. Start small, stay committed, and watch as your financial confidence and stability grow.

xoxo

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch