I want you to imagine what your life looks like in 5 years from now with your dream job, your dream life, if everything turned out exactly how you pictured it.

What does it look like? What does it feel like? What have you accomplished? Have you left your current job? Has your family size changed? Are you going on an annual family vacation? Have you taken that girls’ trip? Are you saving for your future goals, both short-term and long-term? Have you remodeled your kitchen? Are you happy, like truly happy and fulfilled?

Now come back to me and think about what the steps are you need to take to get yourself there.

I am the first person to say, I used to cringe when I heard the term, “budget”. But then, I found myself in a crisis situation, where I had to plant our farm crops, hundreds of acres in our fields one spring when my husband, who is a farmer, was recovering from emergency back surgery.

The sad thing is, I didn’t just decide one day to be better and more responsible with my money, nope, I had to wait for life to hit me square in the face. But, I want better for you. So, let’s dive into what a budget is quickly.

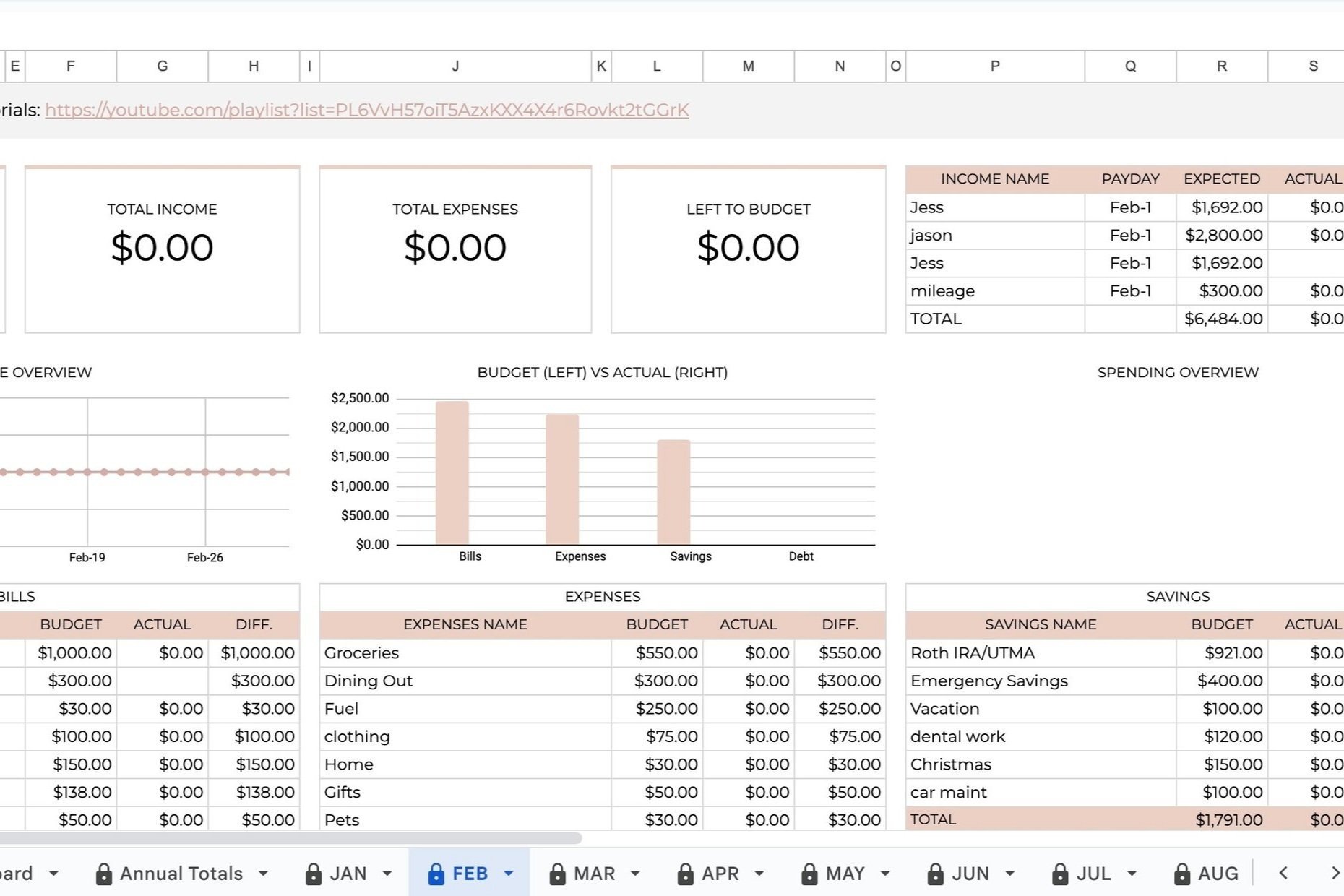

A budget is simply a plan for where your money goes. I assign all of my monthly household income/money a place to go. So, every dollar I make and am paid I assign it a job, that job might be to pay for fuel, groceries, for my house, or into my savings. So, I might not be SPENDING every single dollar but I am assigning every dollar a place to go.

This is what it means to “live below your means”, to put some money into your savings, and retirement, and save money for an emergency and for your future expenses. You are not spending every dollar you make.

This is critical to making sure your finances are in a good place.

Your budget aka plan for your money should reflect your values. Meaning what you value, and what is important for you should be included in your budget. For example, if you value giving back to the community, charities, or your church, you should have a line on your budget for this. As a family we value youth sports, our boys play different sports each and so we have a hefty amount allocated each month on our budget for hockey, baseball, and football. If you value your pets, travel, or something else make sure to include this on your budget. But know that by having a higher budget for youth sports or travel, you need to cut back on a different area of your spending and budget.

Now, let’s say you have big dreams that you want to go after, you will need to include that in your budget. So, how do you do that?

It depends on what your dreams are and what they will require. It will also depend on your current personal finances and where those are at. Will you be able to cash flow your big dreams, can you create a vision and plan going forward so you can use your personal finances to make your dreams a reality. Or will you be looking at taking out a loan to make your dreams come true?

Planning ahead for this big dream and starting to save for it as soon as possible will be important. If your big dream is a tropical vacation, you can save up money for a couple years and go. If your big dream is a lake home, well this is going to take a little, (ok, a lot) longer and you will likely need to save for a down payment plus take out a mortgage. If your big dream is to start or grow your own business, is this something you want to pay for in cash or are you willing to take on a business loan?

I am not 100% against debt and loans. I believe debt is a tool and it can be used responsibly. However, I am a firm believer in not getting “in over your head” and making sure you are educating yourself on loans and debt so you know exactly what the terms are of the loan. How much of a loan are you taking out, how much is the monthly payment going to be, and how much will you be spending over the lifetime of that loan.

For example, when we bought our gorgeous 1-year-old destination camper it was for sale for around $50,000. We took out a loan, put down a smallish down payment and I remember reading in the paperwork that when we paid off the loan we would be paying OVER $70,000 for the camper! That is HUGE. Over $20K was going to interest!

Credit cards are the worst for interest rate percentages. They can be upwards of 28-30%! By paying the minimum payments you are likely to never pay off the credit card balance or it will take you a LONG time to and by long time, I mean YEARS.

If you have $20,000 of credit card debt and say it has an interest rate of 22% and you pay $500 a month on that balance, it will take you 73 months to pay off the credit card! And you will have paid $16,441 in interest!! So, if you have credit card debt this is a crisis situation! You need to pay off your credit card debt as soon as humanely possible!

Ok, moving on…let’s talk about one of my favorite topics, dreaming your BIG, big, big dream and vision for your life. What lights your soul on fire? What is it that you want your life to look like and feel like?

It’s about sorting through your mix of desires, figuring out what truly drives you and gives you energy. I want you to envision a life where your actions align with your values, where every move is a step toward your big vision. This process involves peeling back layers to reveal the core of your dreams. It’s a journey of self-discovery guiding you to a future where your big dream is more than a possibility; it’s a concrete path you’re excited to pave. So, start paving my friend!

In order to make your dreams and big vision for your life a reality you need to have a strategy. I want you to have an exit strategy for leaving your “9-5” to pursue your business, or a strategy to building your dream lake home, or a strategy for taking an annual family vacation, or for giving more to charitable causes.

Setting up your strategy can be as in-depth as you want or need. It can also be more of a type of goal-setting strategy, but make sure it’s a SMART goal, meaning, your goals are Specific, Measurable, Achievable, Realistic, and they have a Time frame attached to them.

For example, if you want to save $5,000 for your annual family vacation every single year and you save all year long, so 12 months, you would need to save $417 per month to meet your goal of $5,000 every year.

You can also do this for your pricing or income strategy for your business and how you will know when you can leave your 9-5.

Let’s say you determine that you need to be making $70,000 at your business yearly. How much is that per month? Well, it is just over $5800 per month. How many sales is that for you, courses, coaching programs, etc?

If you are selling online courses at $600 each, that is 9.7, so say 10 courses per month you need to sell to meet your income goal. Then strategize how many months in a row you feel comfortable with to be meeting this goal before you are ready to put in your notice at your day job.

This is one of my actual online courses available! Go to https://www.jesswaynecoaching.com/coachingservices to sign up!

Just an FYI, it won’t be a perfect calculation, there is risk involved, and you will have to decide what you are comfortable with and what you aren’t comfortable with.

Also, do you need to match your current day job income dollar for dollar? What about benefits? Will you want to be making more than your wage now to allow for health insurance and a retirement account? Or are you willing to go part-time at your 9-5, while you are building your business? Or perhaps you are comfortable leaving your current job once you are bringing in ½ of your current income, knowing that you will have more time and energy to pursue your business and bring in more income and profits.

Each of us is going to have different comfort levels with these decisions and goals. I am not a risk taker, so I want to be making near my income now at my nursing job before I would be comfortable leaving it. I would also want to have a hefty emergency savings before I put in my 2 weeks’ notice.

Having an emergency savings fund is an important step to becoming financially secure

There is a balance and strategy to all of this. I would love to help you with your goal setting, plan, and strategy. Reach out to me on FB or IG or set up a call with me so we can chat.

If you have a goal of owning your lakeside oasis, I feel you, my friend, I have this same vision and goal for my life! However, this will, again, take planning to make this become a reality. How much money are you able to and willing to save per month for a downpayment? Do you want to buy land and build and how much does that cost or do you want to buy a fixer-upper or a move-in-ready place? Have you thought about renting it out to help cover the mortgage on it? These are all good things to think over BEFORE you purchase something!

Creating a budget comes in handy here. Again a budget is just a plan for your money and it helps you reach your goals faster!

My personal budget includes my retirement savings along with my short-term and long-term savings goals. I set up my savings to automatically transfer from my checking account to my savings account, which I keep at an online bank, in a high-yield savings account, so I am getting a higher interest rate on my money being housed there, plus I can’t access my money immediately. This is a thought-out system so I can’t transfer money while I am waiting in line at the store and wanting money for a gorgeous new bag I found.

Planning in advance for your big aspirations and dreams is important. Most of us need to spend months to years saving for some of our goals. This allows you to feel even better when you make the purchase, after saving and saving and saving for something and then being able to pay cash, it is the best feeling! Plus, I love watching my savings grow.

What if you have a whole lotta dreams? Well, I can help you prioritize which ones to save for first, second, third, and so on. Some savings or goals will need to be prioritized first or second even if they aren’t the super fun ones! For example, if you just found out your child is going to need braces, but you really wanted a newer boat…well, the braces will likely take priority. Your retirement savings should come before your children’s college fund. But you can save for both of these at the same time too. Your leaking toilet will come before a new kitchen countertop (if it is only being replaced because you no longer like the color of it).

I want you to make sure that you are celebrating your small financial wins when you are building your savings. There are not too many BIG WINS in life, so it is important to celebrate our smaller wins. This will help keep you motivated as well. You can also use savings trackers or goal trackers. I have my goal trackers for my different savings buckets (accounts) at Ally.com which I absolutely love.

Remember to give yourself grace if and when needed. Your budgeting and saving aren’t going to be perfect, with automation it can come close to perfect, but there are going to be times when you “mess up”. Give yourself grace, jump back on the wagon, and start back up ASAP. Don’t give up on your goals and dreams because of some bumps in the road.

Life isn’t perfect, things are going to arise, and you have to deal with it, make a decision, and move on. Don’t get discouraged, keep your chin up and keep moving forward. One step in front of the other.

I know you have BIG dreams for your life. You want more out of life and I am so here for it all! I feel the same. Planning and coming up with a strategy to balance All. The. Things. This will allow you to feel in control of your progress toward your dreams and will allow you to create the life you WANT to live.

XOXO

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch