When I was stressed with my finances and was learning to budget, I didn’t want the budgeting to consume my life and take up a lot of time. I am a busy mom to 3 boys. At the time I learned to budget and “get good with my money”, I worked as a Registered Nurse and had a part-time photography business. So, the way I wanted to budget needed to be quick and simple.

I started by tracking my spending and bills on an app called, The EveryDollar app. I used the free version. There is a paid version where you can link your bank account, but I didn’t want to do that. Plus, I didn’t want to spend any more money on things I didn’t need.

My husband and I had a mountain of debt, $100,000 of debt and that didn’t include our house. So, when I wanted to figure out a budget, I needed the tools and resources I used to be free!

The app was of course on my phone, so it was super easy to pull out my phone at the gas station or the grocery store line when I was making a purchase. Most of the time I use the amazing grocery pick-up order, so I add my expenses into my app on my phone in my car when they are loading up my groceries for me. This saves me time + mental energy so I don’t have to remember to add the expense in later.

The app is easy to use, but you need to get into the habit of entering every single expense! You can “lump” your expenses together. For example, if you shop at Target or Walmart, or a similar store, you can put your food and personal hygiene items on the same budget line or category. This will save you time.

I like to separate my purchases so that I know exactly how much money I am spending on my groceries, personal hygiene items, cleaning supplies, etc. However, I LOVE to budget! So, for me, I like taking the extra couple of minutes to make my budget detailed. I do not recommend this to everyone.

Now, once you have an idea of what your budget categories should be and how much money you need to budget for each category you can cut back on tracking every single expense. There are a couple of quick + simple budgeting methods I suggest using if you do not want to have to continue tracking every single transaction or expense.

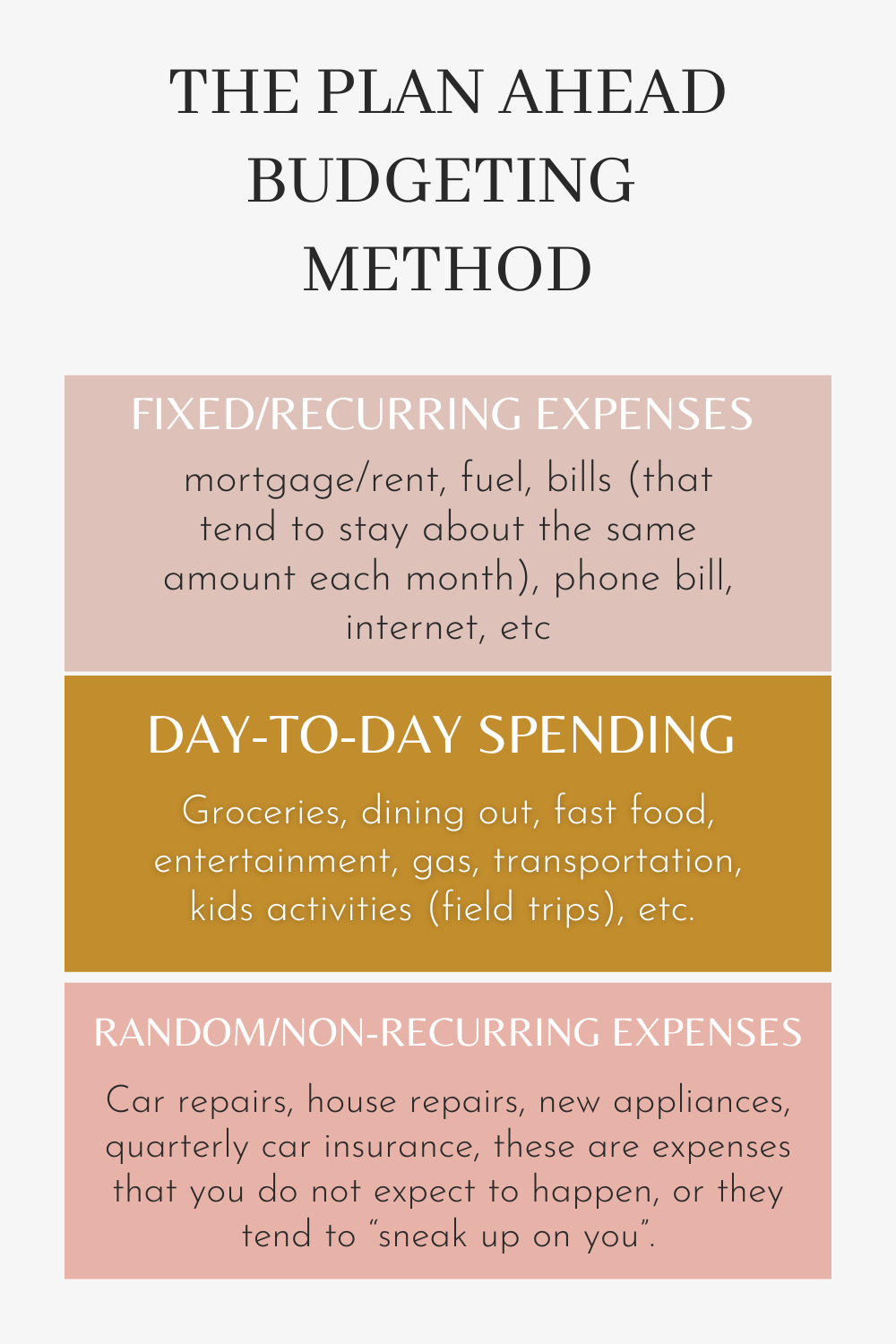

The Plan Ahead and the 50/30/20 budgeting methods are two great methods to use if you are a busy mom or want to lump together some of your expenses. You can lump your spending into “buckets” and spend out of there. I have written a blog post explaining each of these budgeting methods in depth so feel free to read those.

Once you have a written budget. Or you have your budget on an app or on a spreadsheet, you can easily budget in less than 15 minutes per day. You can most likely budget in 5 minutes per day.

Here are some steps to keep you on track with your budget:

-

Add in your transactions onto your app or spreadsheet or on your paper if you are using paper and pen- do this daily so you don’t get behind and forget something

-

Make sure you are not overspending in a category

-

If you are overspending, cut back on spending in that category (if possible)

-

You might need to readjust your budget

-

Create the next month’s budget towards the end of the current month

-

Track and manage your debt payoff

Remember, a budget won’t be perfect, it will change from time to time. It might even change month to month. Some categories or lines on our budgets will stay the same from month to month and some will vary. If you “mess up” or “blow” your budget, forgive yourself and start fresh the next day! Don’t let a mistake ruin the progress you are making.

If you or your household has a variable (not the same) monthly income, I suggest creating a budget based on the lowest monthly household income over the past 6-12 months. For example, let’s say your monthly incomes have been $4900, $5300, $5500, $5200, $5100, and $5300, I would use a monthly income of $4900. This way you will never be “short” on your budget. When you make more than $4900, you can add the extra income to your budget. I suggest putting the extra money into a savings account, onto your debt, or planning ahead and using it for later expenses like auto insurance, auto registration, back to school, holidays, etc.

In the beginning, your budget might take a little longer to figure out because you are figuring out what your budget numbers should be (roughly). After a couple of months you should be able to budget quickly. If you are struggling, ask for help. You can always message me, you can find me on Instagram and Facebook. I LOVE looking at budgets!

This doesn’t mean that you can’t take longer to budget, especially if you are like me and you enjoy budgeting and trying to figure out ways to cut back and save more of your hard-earned money. I do this constantly!

If you haven’t already taken the time to check out my FREE Budgeting 101 online course, I would love it if you would. This course (really it’s just a quick video) is made specifically with YOU in mind. https://linktr.ee/jesswaynecoachin

Also, head on over to my podcast if you’d like to listen + learn while you are doing your dishes, driving the kids around, or folding the never-ending pile of laundry.

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch