In this blog post, I am going to cover 5 of the most popular budgeting methods. The cool thing about budgeting is that you have options. You can try one out and if it isn’t a good fit, pick another one that will work better for your life. Budgeting is important so that you keep track of where your money is going. Don’t let your money disappear like your socks in the dryer.

Cash Envelopes:

Most of us are swiping our credit cards every single day, multiple times a day, left and right, up and down, this way and that way, to pay for ALL THE THINGS. But, when you swipe your credit card there is no transaction of handing over your physical, hard-earned money that takes place, and this tends to lead to overspending.

There is a way to take control of your spending and that is by using the cash envelope system. Using cash to pay for your purchases might seem like a blast from the past, however, this classic or old-school budgeting method has stood the test of time and continues to empower individuals and families to take control of their finances and achieve their financial goals.

The cash envelope system is a simple yet powerful budgeting technique that involves using physical envelopes to allocate cash for specific spending categories. You can buy gorgeous and fun envelopes on sites like Etsy or Amazon, you can make your own, or you can use regular envelopes from places like Walmart or Target. You can also get cash envelope binders as well. But, the idea is to spend as little as possible on the actual envelopes, at least in the beginning. I first used basic white mailing envelopes in my beginning cash stuffing days. I then budgeted for and saved some money and bought some prettier, heavy-duty envelopes from Amazon.

Each envelope (pretty or basic) represents a different expense, such as groceries, entertainment, dining out, clothing, back to school, and more. By physically separating and limiting cash for each category, you gain greater awareness of your spending habits and can make informed decisions about your financial choices. When you run out of cash in a specific envelope/category, you don’t get to spend any more money until the next cash-stuffing day- usually payday or at the beginning of the month. This will help curb your overspending.

Benefits of Using the Cash Envelope System:

1. Increased Financial Awareness: With cash envelopes, you can visually see how much you have left to spend in each category, preventing overspending and promoting financial mindfulness.

2. Enhanced Budget Accountability: The system keeps you accountable to your budget, preventing impulse purchases and ensuring that you stay on track with your financial goals.

3. Debt Reduction: By following your budget, you can free up funds to pay off debts faster. Using the debt snowball or debt avalanche payoff methods you can pay down your debt fast, saving you lots of money and stress!

4. Build Savings: Build up your savings for emergencies, short-term and long-term financial goals, and future investments.

Creating Your Cash Envelope System:

Identify Spending Categories: Start by listing your regular expenses and create specific categories, such as groceries, transportation, entertainment, vacations, and more.

Determine Budget Amounts: Figure out a reasonable amount for each category/envelope based on your income and financial goals. Be realistic and ensure that your budget aligns with your overall financial plan and your values.

Label and Organize Envelopes: Label each envelope with the name of the spending category and allocate the predetermined cash amount for each. I suggest keeping a piece of paper, sized to fit in your envelope, to keep track of your deposits and deductions from your envelope. This way you will always know how much money is in each envelope without having to count your money.

1. Implementing the System:

Use Cash for Budgeted Categories: Use cash from the designated envelopes for corresponding expenses. Once the cash in an envelope is gone, do not spend any more money in that category until the next budgeting period.

Regularly Review and Adjust: You are going to need to occasionally review your budget and cash envelope system to assess progress and make any necessary adjustments to better meet your financial needs. A budget is fluid, it changes from month to month.

2. Tips for Success:

Start Small: If you’re new to budgeting or the cash envelope system, begin with a few categories, maybe 5, and gradually add more as you become more comfortable.

Stay Disciplined: Avoid the temptation to dip into other envelopes or borrow from one category to fund another. Don’t rob Peter to pay Paul. Staying disciplined is essential for the system’s effectiveness. Make sure you allow enough money in your envelopes so you don’t feel too restricted, but be realistic about what you can allocate into each category. Budgeting can be tricky when first starting out, but I know you can do it! If you need help, ask me, I LOVE budgeting!!

Combine with Digital Tracking: While using cash for certain expenses, consider digital budgeting tools to track larger, recurring bills and payments. I pay most of my bills, utilities, subscriptions, internet, etc. automatically with my credit card and then I pay off my credit card in FULL every single month.

Types of cash envelope categories:

-

Dining Out / Restaurants

-

Groceries

-

Transportation / Gas

-

Entertainment / Leisure

-

Personal Care / Beauty

-

Clothing / Fashion

-

Household Supplies

-

Gifts / Special Occasions

-

Health / Medical Expenses

-

Travel / Vacation

-

Kids’ Expenses (e.g., school supplies, extracurricular activities, youth sports!)

-

Home Maintenance / Repairs

-

Savings / Emergency Fund

-

Debt Repayment

-

Miscellaneous / Other

-

Utilities (e.g., electricity, water, gas)

-

Phone / Internet / Cable

-

Insurance (e.g., health, car, home)

-

Pet Expenses (e.g., pet food, grooming, vet visits)

-

Education / Learning (e.g., courses, workshops, books)

-

Charitable Giving / Donations

-

Subscriptions (e.g., streaming services, gym memberships)

-

Home Décor / Furnishing

-

Electronics / Gadgets

-

Vehicle Maintenance

-

Travel Savings (for future trips and vacations)

-

Hobbies / Crafts

-

Business / Work Expenses (e.g., supplies, networking events)

-

Savings Goals (e.g., down payment for a house, a new car)

-

Fun Money (for guilt-free splurges or treats)

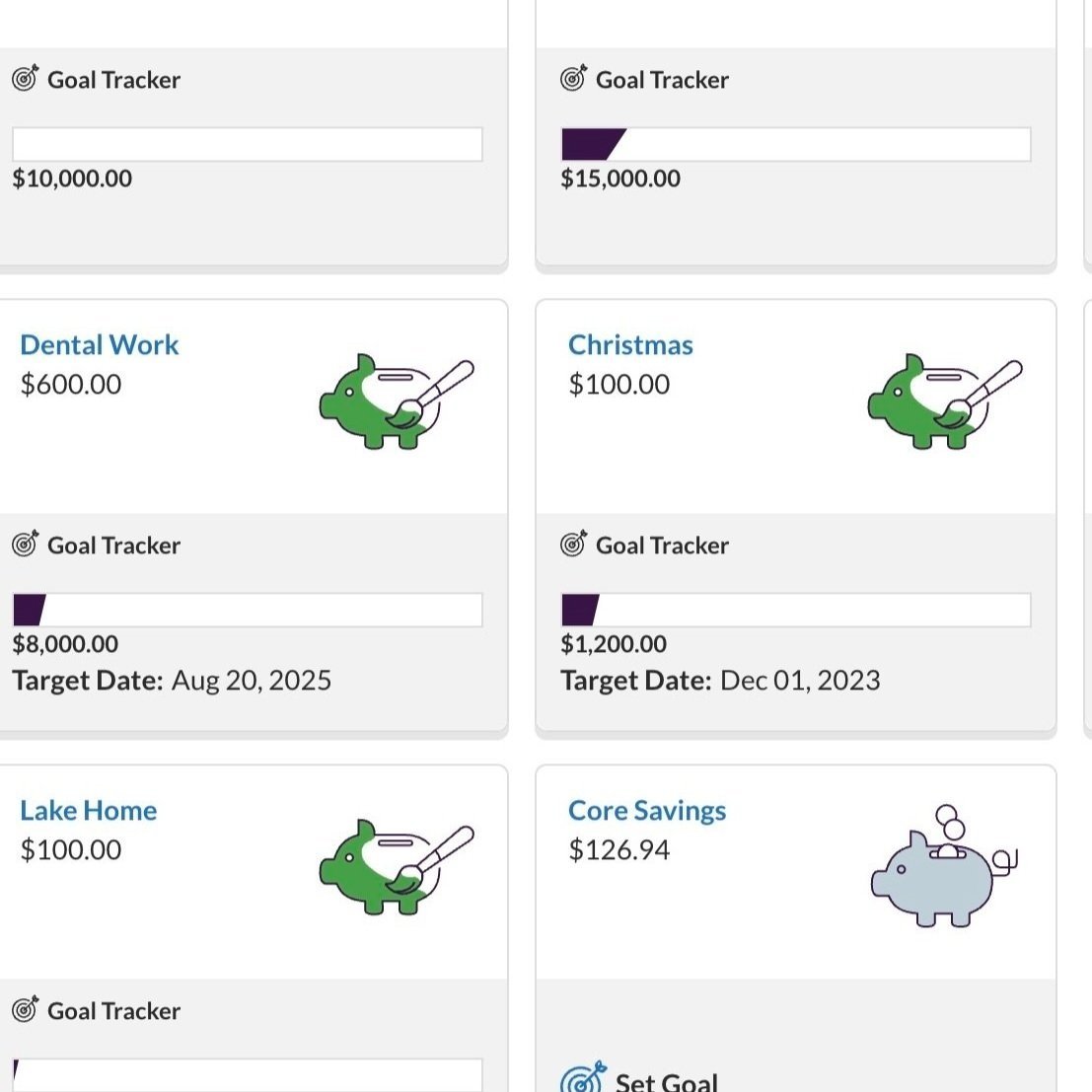

Electronic Savings Buckets: You can also use electronic or online savings buckets or sub-savings accounts instead of physical cash envelopes. I also have some of these for my larger savings goals including a different vehicle, my emergency fund, saving for a house down payment, Christmas, etc.

You can use these savings buckets the same as your cash envelopes, it will just take some getting used to regarding transferring money from the savings bucket into your checking account to pay for items. Again, I suggest using these types of savings accounts for categories that you are not going to be spending out of monthly. Save these for your longer-term financial savings goals.

Example of my savings buckets at Ally.com

The cash envelope system is a time-tested and proven method for taking charge of your finances and achieving financial success. By implementing this budgeting method, you’ll gain greater awareness of your spending habits, hold yourself accountable to your financial goals, and create a pathway to a more secure and robust future. There is no reason to wait, start your cash envelope journey today and witness the transformative impact it can have on your financial well-being.

THE PLAN AHEAD BUDGETING METHOD:

Essentially with The Plan Ahead Budget Method, there are 3 “buckets” that you divide your monthly income into and then you spend out of those “buckets” for all of your spending, including your rent/mortgage, bills, transportation, spending money, etc.

The 3 buckets include Fixed/recurring expenses, day-to-day spending, and Random or non-recurring expenses.

I will show you what is included in each bucket below.

Fixed/Recurring expenses: your monthly bills that typically stay the same or slightly vary in some cases, such as your heating/AC bill depending on the season, but these bills are typically due at the same time each month. Think rent or your mortgage.

Day-to-day spending: Groceries, dining out, fast food, entertainment, gas, transportation, kids’ activities (field trips), etc.

Random or non-recurring expenses: Car repairs, house repairs, new appliances, quarterly car insurance, etc. These are expenses that you do not expect to happen, or they tend to “sneak up on you”. Hello Amazon Prime subscription, seriously who remembers when this is due each year?!?!

You will need to do some prep work for this type of budgeting method. Because most people who are new to budgeting do not know how much they spend on each category of their budget. Or they’ve never had a budget, which was me until I was in my 30s. Don’t feel embarrassed if you’ve never had a budget before. A budget is simply a plan for your money, so your money doesn’t just up and disappear on you. For example, when I was brand new to budgeting I had NO CLUE what I was spending per month on things like clothes, groceries, dining out, entertainment, pet care, household items, etc. Most people don’t.

So, to get started on this type of budget you are going to need to track your spending. You can do that in a couple of ways. You can start keeping track of your spending now, or at the start of a new month, or you can look back at your bank transactions and credit card and debit card transactions for the past 1-3 months to get a good estimate on how much money you are spending in each category.

I am not going to lie, it is a little bit of work upfront, but you have to do this step with ALL the budgeting methods. So, no matter which budgeting method you choose, you will have to track your spending in the beginning.

Once you have a good idea of how much you are spending in each category, then you can estimate how much money you need to allocate to each of the 3 “buckets”.

For the Fixed/recurring bills bucket, you are going to want to save some money into this bucket for all your bills and spend out of this bucket. Say your rent is $1800 a month, well you need to have that $1800 in this bucket. Say your utilities typically range between $220-$280 per month. You will want to lean on the high end of the range. So, I would suggest you put $280 per month into this savings account or “bucket” to pay for your utilities. Hopefully, by putting in the $280 your account will never be zero or in the negative. This will allow a little “cushion” in your account.

For the Day-to-Day spending bucket. Ok, this is where I suggest using cash envelopes for your day-to-day spending, except for fuel. I suggest using a debit card for your fuel purchases because it makes it so much easier!

You will find that after a few months of tracking your spending, you can then estimate how much cash you need to carry with you. For example, if you’ve spent around $800 per month on your day-to-day spending you know to keep around $800-$900 set aside for your day-to-day spending and you can carry and spend the cash. You won’t need to track every single dollar you spend long term. This is great for people who don’t want to be in a spreadsheet all the time.

You can bring out your cash for the whole month and carry it with you, or you can break it down by a week or 2-weeks. However, you choose to do this is up to you and what you are most comfortable with.

For your random and non-recurring expenses, this will be a savings account “bucket” that you have. These will be the BIG peaks and valleys on your journey. You see, you might have a few very low (valley) months of needing to pay for these expenses. But then when you have a month where you have a few of these, or even 1 big random expense, like your refrigerator needing to be replaced, it is a HUGE peak, it is a large amount of money needed right now.

Some of these expenses you will know about but might not remember. For example, if your car insurance is paid twice a year and your car insurance is $450 every six months, you need to put aside $75 per month to cover your car insurance. Because $450 divided by 6 is $75 per month.

Do this same math equation for your car’s tires and oil changes. Things that you know you will need to pay for, but that you don’t need every single month. Vehicle registration is another good example.

I suggest having a savings account with savings “buckets” at an online bank. I personally use Ally.com where I have a High Yield Savings Account (HYSA). These accounts have a higher interest rate on your money than a typical local bank or credit union. Make sure the online bank is FDIC insured and that you know what types of fees they may have and the minimum amount is needed in each account.

Typically, at these types of banks, you can set up as many savings accounts as you would like and there is no minimum amount of money you need to have in each account, or the minimum amount is quite low, around $5-$10.

Just know that it will take a little bit longer for you to have access to the money in your savings account from an online bank. So, if an expense arises and you need the money right away, you might need to use a credit card and then transfer the money to pay off your credit card right away. Or if you have a little bit of time to wait, usually you can have your money in 24-72 hours.

If you have an emergency fund, which I highly recommend having, I would keep that money in a savings account at an online bank.

It is important to be saving not only for emergencies but also for your future goals. Say you want to take a family vacation in a year. You can save per month into a savings account at the online bank. Say you want $5000 for your vacation in 12 months. You would take $5000 divided by 12, to be around $416 per month to save per month for the next year to meet your family vacation savings goal.

You can have savings accounts also called sinking funds or savings buckets for MANY things. Pets, vacations, home repairs, car repairs, clothing, new appliances, a new car, a house down payment, kids’ sports, back-to-school shopping, etc. You can really create a savings account and come up with a savings plan and goal for literally anything.

If you are having a hard time deciding which of the 3 buckets an expense goes into, that is okay. You can just add it to any of the 3 buckets as long as you know which bucket you put your money into for that specific thing and then spend out of that bucket for that expense.

It is really about saving money and planning ahead for future expenses rather than being perfect on which money goes into which bucket.

If you want help setting up this type of budget be sure to reach out to me at https://www.jesswaynecoaching.com/

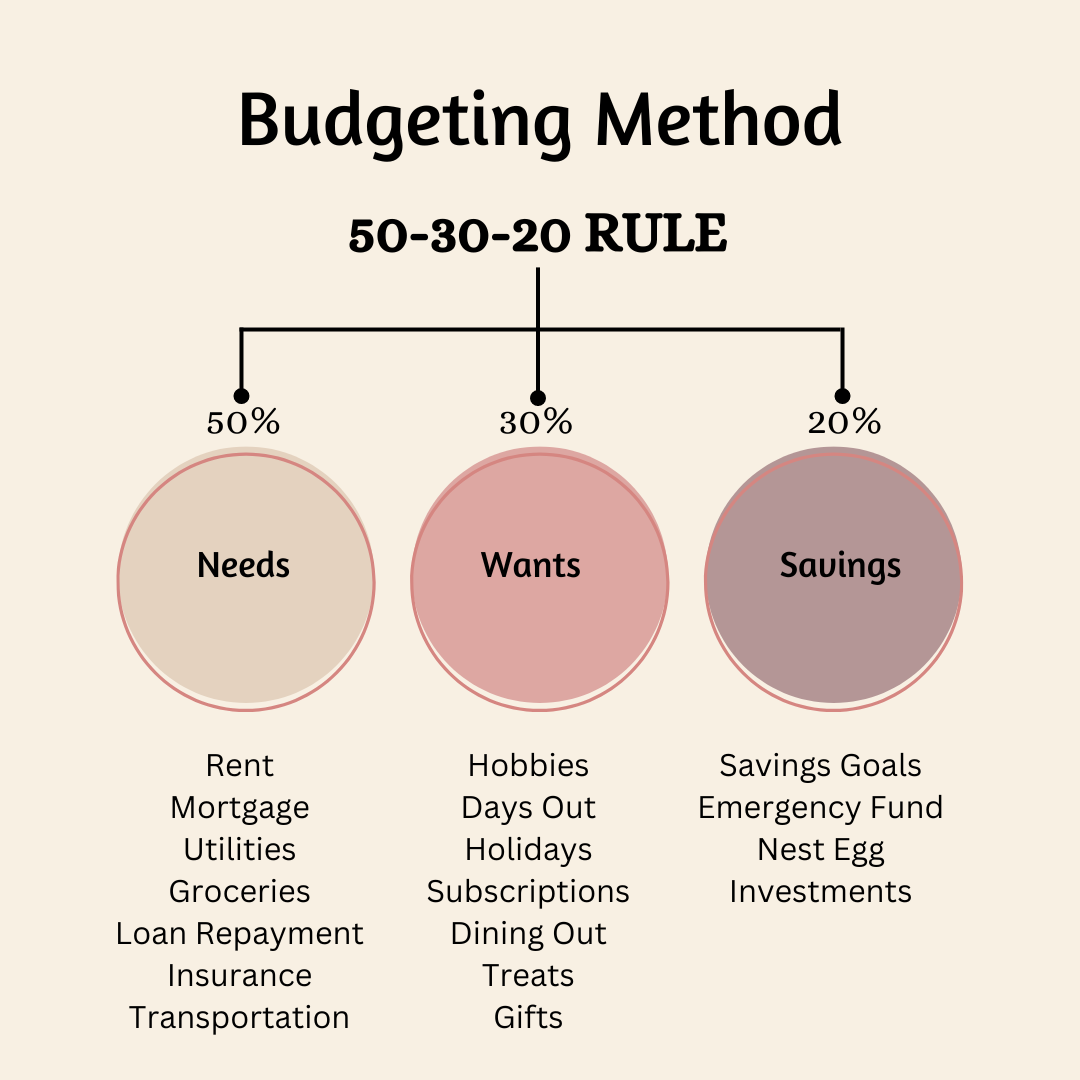

The 50/30/20 Budget Method

Remember, there are multiple ways to budget and it can take a few tries and a few different methods to find your niche and what is going to work for you. I am now going to explain how to budget using the 50-30-20 way.

Basically, ALL of your spending/expenses are going to be split up into 3 categories, much like the previous method we talked about, The Plan Ahead Method. But this is a little different, let me explain. You will split your household income into the 3 accounts based on percentages.

· Necessities/ Needs (50%)

· Wants (30%)

· Savings (20%)

After you get your paychecks for the month. You are going to spend 50% of it on your needs, 30% on your wants, and 20% on your savings. You will want to have already estimated how much money is going to go into each of these 3 categories. (Ahem, you figure this out by tracking your expenses for a while.)

Your needs include your housing, fuel, groceries, minimum debt payments, insurance, health care, and utilities. These are the things that you need in life, your essentials.

Next, your wants category includes things that are not exactly essential or necessary. They may be a need in the future, but not currently and these also are the things you want J. This includes eating out, the internet, (I know this isn’t a need as much as I feel it is), a new purse, a gym membership, and movie tickets. All of these things are not needed. You can cook at home instead of eating out, you can use the internet at a coffee shop or library, you don’t necessarily need a new purse, you can work out at home or go for a walk on your local trail, and you can watch a movie at home. These things are nice to have, but not needed.

Finally, your savings category is going to be 20% of your take-home pay and this includes your retirement investments and your emergency fund. Both are essential nowadays. This category is also going to include your debt repayment which is on top of your minimum monthly payments and this will include your short-term and long-term goals. It is important to try and pay off your debts, especially your high-interest debts as fast as possible.

You also want to make sure you are saving into your emergency fund. It isn’t a matter of “if” an emergency will happen, but “when”. I want you to have some money in your “rainy day” fund to cover your emergencies that are bound to come up. Every household and family should make sure they have an emergency fund in case someone loses their job, has an accident, gets hurt, or your car needs a lot of work done to keep it running and safe. This will help to keep you out of debt or from going further into debt.

THE ZERO-BASED BUDGET METHOD:

The Zero-based budget method is where you make a list of ALL your household monthly income, and a list of ALL your monthly household expenses, and the spreadsheet or the numbers on this list will equal zero. This means you are creating a plan and budget to assign every single dollar you earn a place or job in your budget. That may be that you are spending it on food, rent, mortgage, fuel, or debt repayment, or that it is going into your emergency savings account or into a savings account or bucket for future expenses like, home repairs, car maintenance, or a vacation. The point is that you are giving each dollar a job and a place. Every single dollar you earn for income will be assigned a specific purpose, but you aren’t necessarily spending every single dollar.

If you are using a spreadsheet or The Every Dollar app (this is what I use, the free version), your balance should be zero once you add your income and then minus your expenses (including savings).

I use this type of budgeting method every month and I set it up on a spreadsheet. I track my spending in the Every Dollar app and spreadsheet but this is not what I recommend to everyone because it is double the work, but I might be a crazy money-loving gal who likes to do it this way! Haha. So, I put in my expected monthly household income, then I minus all of my expenses, starting with paying myself first into my retirement accounts, my boy’s savings accounts, and my emergency fund. Then I minus our bills and necessities, and then I spend our money on all other expenses, and in the end, I end up with a zero-based budget. So, I actually use a combination of budgeting methods. I also plan ahead for future expenses that I know will be coming up, think back-to-school, birthdays, Christmas, or holidays, and start saving ahead of time for those expenses.

Now, if I assign $400 this month to fuel expenses and only spend $350 on fuel, I will “roll over” that remaining $50 I didn’t spend on fuel for the month onto the next month. Same with any of my budget line items/categories. So, I may not be actually spending each of those dollars on fuel, food, clothing, or pets, but I will ideally be building up a small amount of money into each of those accounts to use in the future.

For example, clothing, if I budget $100/month for clothing, but we don’t buy any clothes for 3 months, I will have $300 in that envelope or account that I can then use to buy winter clothes, summer clothes, boots, etc.

It is important to track all sources of your household income. For me, I have my nursing income, my husband’s farm income, snow plowing, my photography income, and any items we might sell will also count as income. We also rent out tents, and I of course, have my coaching business. ALL of this is income that we need to keep track of.

You will need to do the same thing. If you are finding that you are not making enough income to cover your bills, and you’ve cut back on all areas in your budget that you can, it might be time for a second job, a side hustle, or to try and find a higher paying job. I can help you with this, as I offer this to my coaching clients. Head on over to https://www.jesswaynecoaching.com/ for more information or feel free to message me on social media.

When creating this type of budget you are going to have your fixed expenses that don’t change, like we talked about earlier. Your rent and mortgage should be the same from month to month. You will also have your variable expenses, the ones that change like groceries, clothing, dining out, car maintenance, etc. So, planning ahead for upcoming expenses using the zero-based budget method is crucial, and rolling over the “extra” unspent money to the next month or future months will be important. Don’t just spend the leftover money on things you don’t need, budget for those!

Some common challenges people may face when using the zero-based budgeting method are:

Income Fluctuations: For individuals with irregular income, it can be challenging to allocate every dollar when there’s uncertainty about future earnings. This budgeting method might require more flexibility in such cases.

Emergency Expenses: Sudden or unexpected expenses can disrupt a zero-based budget. It is essential to have an emergency fund or a category for unexpected costs to avoid derailing your budget.

Overspending in Categories: Some people may find it difficult to stick to budgeted amounts for certain categories. This can result in constantly adjusting the budget or overspending.

Tracking Every Expense: Maintaining a zero-based budget often requires meticulous tracking of every expense, which can be time-consuming and overwhelming for some.

Lack of Financial Awareness: People who are new to budgeting may struggle with this method initially, as it requires a good understanding of your finances and regular tracking.

Budgeting Rigidity: Zero-based budgeting can sometimes be too rigid for those who prefer a more flexible approach to money management.

To address these challenges, individuals can consider the following:

Create a Buffer: If you have irregular income, build a buffer into your budget to account for fluctuations. This ensures you always have enough to cover essential expenses. I usually leave a $300 buffer in my checking account.

Emergency Fund: Maintain an emergency fund to cover unexpected expenses without disrupting your budget.

Review and Adjust: Regularly review your budget and make necessary adjustments. It is okay to modify your budget as circumstances and life change.

Use Technology: Utilize budgeting apps and tools to help track expenses and maintain a zero-based budget more effectively.

Financial Education: Invest time in learning about personal finance to improve your financial awareness and budgeting skills.

Find your Balance: Tailor the zero-based budgeting method to your needs. This is what I do. You can make it as strict or flexible as you’re comfortable with to ensure it works for you and your family.

Your budget is going to change, it might be different from month to month depending on your income, life circumstances, and what time of year it is. Again, planning ahead as much as possible with your finances is key. For example, I save $100 each month from January -December for Christmas, so when Christmas arrives, I have $1200 to spend on all Christmas-related expenses.

Make sure you are regularly checking your budget and expenses to make sure you are staying on track with your budget. It is easy to get off track and go back to your old ways.

I’ve worked with many people who have successfully used and are using the zero-based budget method. It can take a little bit of time to get used to, again make sure to keep a “buffer” in your checking account. I also suggest automating as many bills and savings as possible.

Using this type of budgeting method can help you achieve your financial goals. You can become debt-free, and save for your goals, and for your retirement. It will help you reach your financial milestone quicker!

I highly recommend joining my Financial Mission Membership Program, it is super affordable, and you can cancel your membership at any time, but I don’t think you will want to. You will have a community of other like-minded individuals, you will be held accountable, and have the support of myself and others. It is the place to be when starting your financial journey. Head to https://www.jesswaynecoaching.com/ to join.

Pay Yourself First:

When I make my monthly budget, I don’t start by paying my bills, fuel, and mortgage first. I pay myself first which means that I make sure to prioritize putting money into my emergency savings account, my retirement account, and into my boy’s savings accounts. I am prioritizing making sure that my family is taken care of in the event that I lose my job or my husband can’t work his job (this is how I got started in this whole personal finance and budgeting world). Or when an emergency happens we have enough money to cover that emergency. The average American has less than $400.00 in their savings account. That is unreal to me and is really scary, we are in a crisis situation. I want better for me and I want better for YOU!

I want to make sure that I am able to cover my monthly expenses if something comes up where I’m not able to bring in an income. So, I put money into my savings, then I pay my bills and all of my necessities and needs and then finally I budget in my wants. This includes my discretionary spending, and most of the time this is going to be my day-to-day spending. So, it will include things like eating out, clothing, going out for drinks, entertainment, going to the movies, and things like that.

I pay myself first so that I feel financially safe and secure. By doing this I have less stress, and less overwhelm, and I know financially my family and I are going to be OK when something pops up or when something unexpected happens.

I also plan ahead for things and save for that, for example, my Amazon Prime membership is about $120.00 or so a year, and I am planning ahead and saving for that throughout the year. Remember to save in advance for Christmas, back-to-school shopping, seasonal clothing gear, etc.

I do not want to live paycheck to paycheck, I did that for many many years. I was spending all of the money that I was making and I was saving very little. When I decided to get my finances in a better place, I decided that I wanted to be saving for my current self and saving for my future self. Trust me by saving for retirement your future self will thank you. By saving for upcoming birthdays that are happening in two months… when those birthdays come around you’ll be very happy that you saved money two months ago when you thought about it. You won’t be rushing around, feeling irritable, losing sleep over how you are going to pay for your daughter’s birthday gifts and party.

I suggest trialing out a couple of these budgeting methods and seeing which one is the best fit for your personality and lifestyle. Make sure to start by tracking your expenses and spending for 3 months, create your budget while tracking your spending, and try to stick to your budget. Delve into all things personal finance to get a wide overview of money management. I have a podcast, Pivot to Your Passion as well where I share a lot of helpful information on finances, life, parenting, mental health, and business. https://pivottoyourpassion.buzzsprout.com Make sure to have your starter emergency savings and then beef this up once your high-interest rate debt is paid off. I would love to connect with you on social media, Facebook and Instagram, Jess Wayne Coaching. I am proud of you for taking time out of your busy day to invest in yourself.

xoxo

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts