I make a monthly budget, yes, monthly, each and every single month. Why? Well, because this has allowed me to FINALLY ditch debt for good and build up a big juicy savings account! I now feel financially secure and my mental health has improved tremendously.

The Financial Framework I use with my clients

When I make my monthly budget, I don’t start by paying my bills, fuel, and mortgage first. I pay myself first which means that I make sure to prioritize putting money into my emergency savings account, my retirement account, and into my boy’s savings accounts. I am prioritizing making sure that my family is taken care of in the event that I lose my job or my husband can’t work his job. Or when an emergency happens we have enough money to cover that emergency. The average American has less than $400.00 in their savings account. That is unreal to me, that is really scary, we are in a crisis situation. I want better for me and I want better for YOU!

I want to make sure that I am able to cover my monthly expenses if something comes up where I’m not able to bring in an income. So, I put money into my savings, then I pay my bills and all of my necessities and needs and then finally I budget in my wants. This is my discretionary spending, and most of the time this is going to be my day-to-day spending this is going to include things like eating out, clothing, going out for drinks, entertainment, and going to the movies, things like that.

I pay myself first so that I feel financially secure so that I feel safe and so that I have less stress, less overwhelmed, and then I know financially my family and I are going to be OK when something pops up or when something unexpected happens.

I also plan ahead for things and save for that, for example, my Amazon Prime membership is about $120.00 or so a year, I am planning ahead and saving for that throughout the year. I’m also saving for Christmas all year round so that I know when Christmas time comes around I have enough money to cover that expense and I’m not frantically searching and stressed out and picking up extra hours at work come November and December to pay for Christmas gifts!

Using cash envelopes is a great way to save money for different categories as well.

I do not want to live paycheck to paycheck, I did that for many many years. I was spending all of the money that I was making and I was saving very little. When I decided to get my finances in a good place I decided that I wanted to be saving for my current self and saving for my future self. Trust me by saving for retirement your future self will thank you. By saving for upcoming birthdays that are happening in two months… when those birthdays come around you’ll be very happy that you saved money two months ago when you thought about it. You won’t be rushing around, feeling irritable, losing sleep over how you are going to pay for your daughter’s birthday gifts and party.

I also make sure that my budget is a zero-based budget, which just means that I am assigning every single dollar that my husband and I are making each month a place. I assign it somewhere to go, I assign it a “job” and that may be it into my savings account. I might assign $300 to go into my retirement account, I might assign $500.00 for our groceries, I might assign $30.00 for our pets for the month, and so on. I am giving every single dollar a job but that doesn’t necessarily mean that I’m spending every single dollar each month.

Example of a Zero-Based Budget

I also automate as much as possible, so I have it set up automatically so that my retirement accounts, my savings account, and my boys’ savings accounts are being added to every single month. I set it and forget it and it takes a huge weight off of my shoulders and I don’t really have to think about it. Plus I’m saving way more money by doing it this way.

So, I am encouraging you to set it up so your money goes into your savings account every month or every week automatically. Set this up today and don’t worry about it anymore. I have my savings set up at Ally.com which is an online bank. My savings go into a High-Yield Savings Account that gets more interest on my money being “housed” there compared to a local bank or credit union. This money is safe and secure and I don’t have to worry about it.

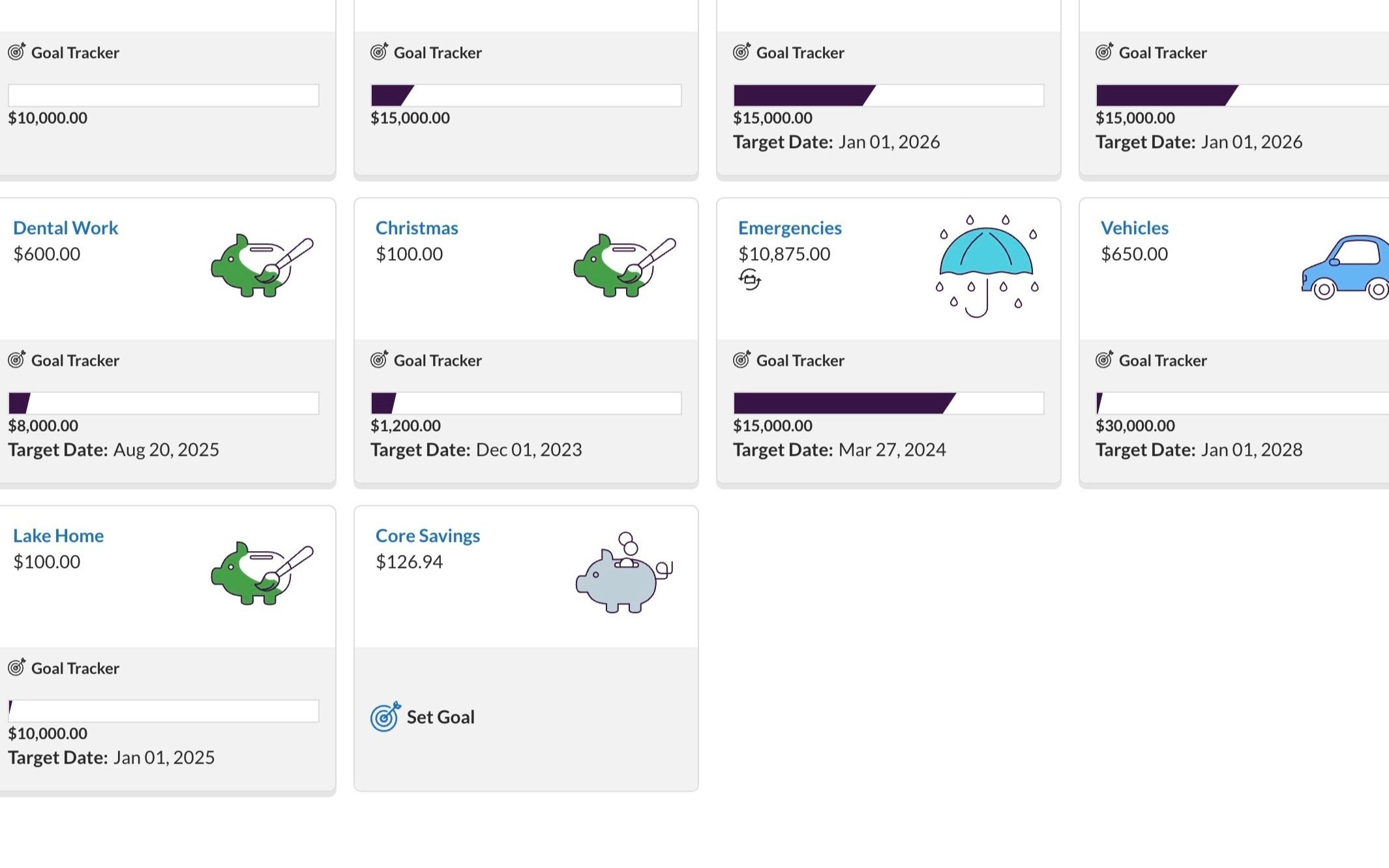

Savings buckets at Ally.com

I also love the savings “buckets” at Ally.com where I can move my money into different buckets that are labeled for different things that I am saving for. Some of my buckets are dental work, a different car, emergency savings, vacation, and a cabin. These are different categories/things that I am saving for. I can set up savings goals and I can see my progress towards those goals. It is so fun!

xoxo

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts