What to Include in Your Budget: A Comprehensive Guide to Financial Planning

Filed in Finances

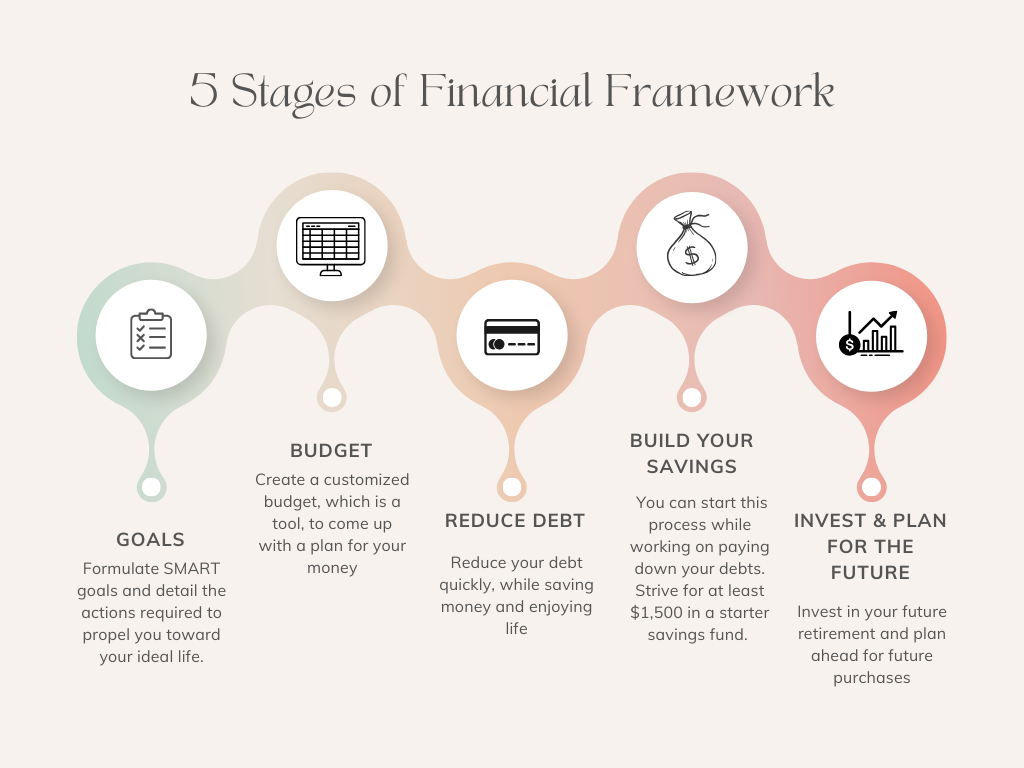

Budgeting is a huge part of financial planning, helping you take control of your money and work towards your financial goals. In this blog, we’ll explore the key steps you should include in your budget to create a well-rounded and effective financial plan to meet your money goals!

Step 1: Assessing Your Income

-

You need to know how much you (or your household) make each and every month.

-

If you have various income sources, such as salaries, freelance work, passive income, or side hustles, you need to keep track of the income for all of these.

-

If you have irregular income, I recommend creating your budget based on the lowest amount you could bring in per month. For example, say your monthly take-home pay has been $3,700, $4,100, $3,900, and $4,000 over the past 4 months. I would create a budget based on a monthly income of $3,700. That way you won’t ever be in the “red” you will always have enough money or more than enough. The months you make more than $3,700, the “extra” money can be used to pay off your debt if you have any, or your emergency savings account, or into another sub-savings account, like a savings account for Christmas, car maintenance, or a vacation.

My husband farms, so his income is inconsistent. I budget a low monthly income every month for his portion of our household income. This way, any additional money is put back into the business or used elsewhere.

Step 2: Listing All Expenses

-

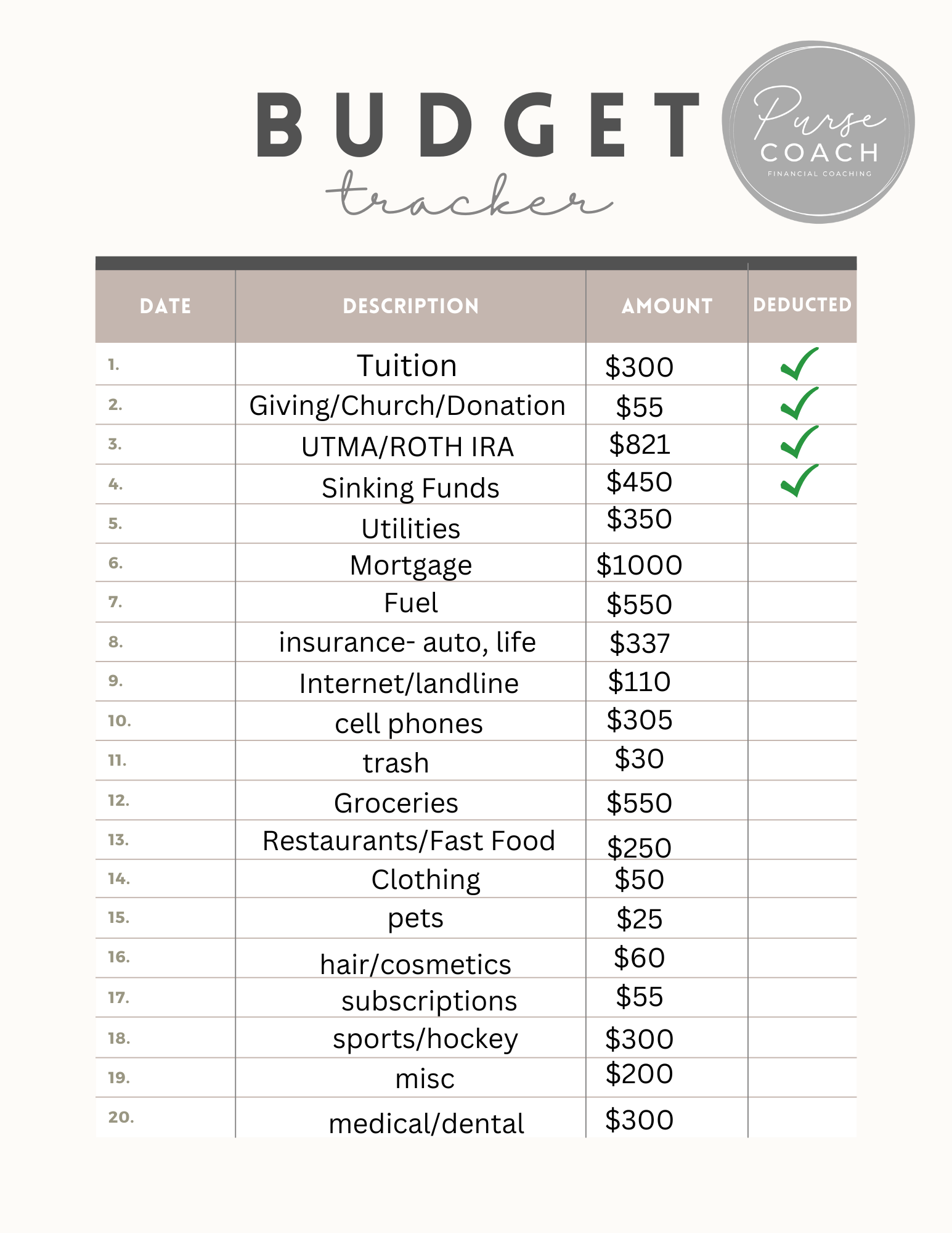

First, you need to determine which expenses are the most important or what expenses you NEED to have/pay for. Prioritizing your expenses will allow you to see which items you must include on your budget, and if needed, which expenses you can decrease or not spend money on at all. This may be a long-term decision or a short-term one.

It is important to understand that you might not be able to afford everything you want right now. For example, I would LOVE to be able to upgrade our boat, get my hair cut, colored, and styled every 6 weeks, and have my kids be able to play all the sports they want. However, right now, we are unable to pay for all of these things. My kids get to choose 3 sports each, we are using our older, smaller boat for now, and I get my hair colored every 8 weeks or so. (I just started coloring my hair a few months ago to cover my greys).

My point is, you need to prioritize which activities and expenses are the most important to you. Some of my clients say having a housecleaner is a top priority for their mental health. So even though they have credit card debt, we keep their housecleaner on their budget. In doing this, my client then had to decide which area they would “cut back on”, they chose to stop dining out.

Now, let’s talk about fixed expenses, these are more of your expenses that you most likely will need to pay for and have included in your budget. These can include things like your rent/mortgage and utilities. Yes, your utility bills might be a little different from month to month, but overall they are about the same.

Variable expenses are not fixed, these are things that change month to month that you need to keep track of. Things like groceries, dining out, and transportation. These still need to be included in your budget.

In addition to your regular monthly expenses, there are also occasional expenses that you must plan ahead for. These may not occur on a monthly basis, but they are inevitable, and you need to be prepared to pay for them. Examples include insurance premiums that are paid annually, subscriptions with yearly fees, and unexpected car repairs. Allocating a specific spot in your budget for saving towards these expenses is crucial to ensure you don’t end up spending more than you earn. By planning and setting aside money for these irregular costs, you can maintain a balanced budget and avoid financial strain.

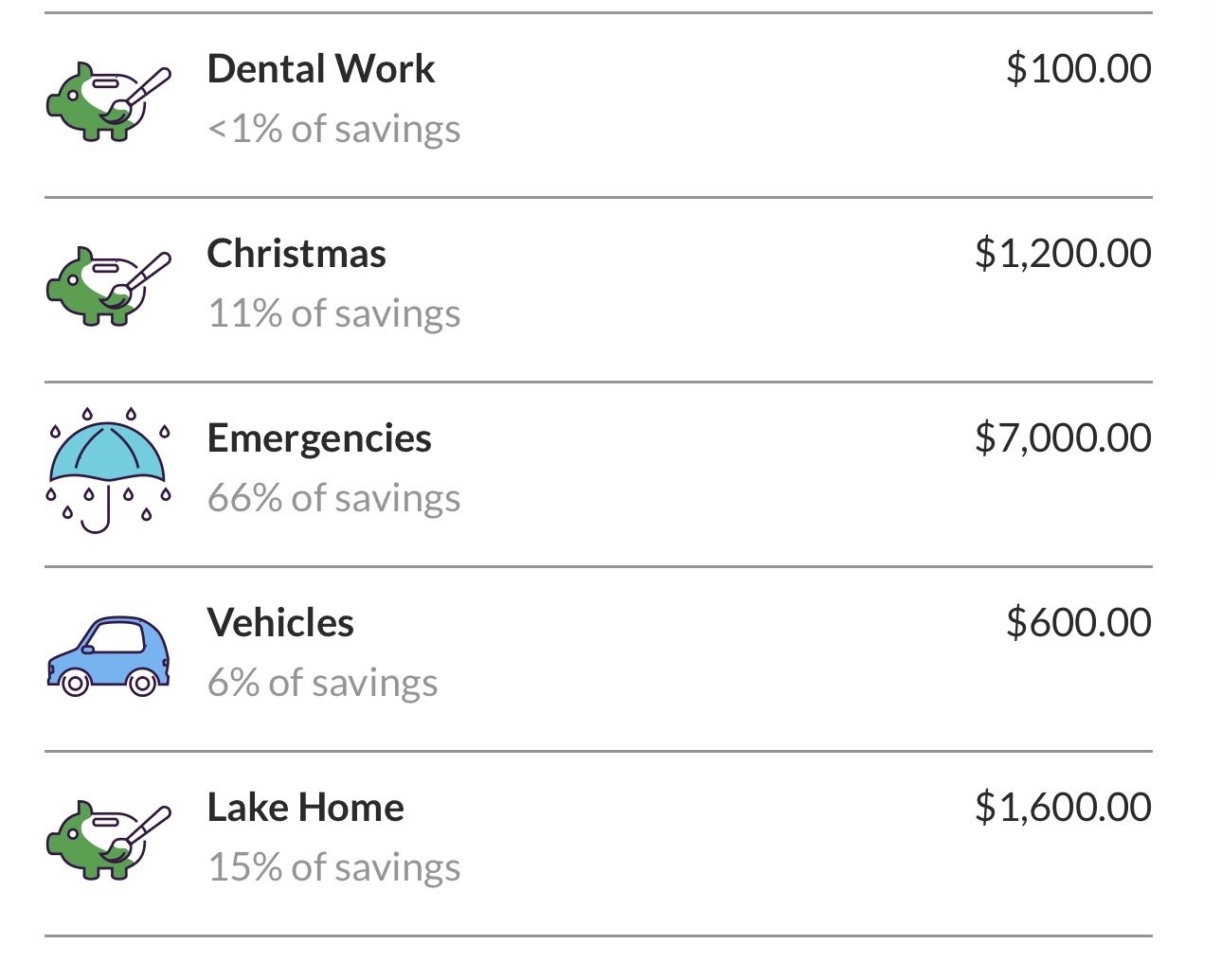

You can use a cash envelope budgeting system or an online sub-savings accounts or savings buckets, (sinking funds), to store your money in for these unexpected but expected expenses.

My cash envelopes that I put money into every month to save for categories on my budget.

Step 3: Allocating Funds for Savings and Investments

Setting aside money for short-term and long-term savings and investments is important and it will set you up for financial freedom. Coming up with a plan and specific goals will help you achieve your financial goals faster.

I want to talk to you about different types of savings accounts. There are different ways to plan ahead and save money. The place where you keep this money isn’t as important as the fact that you need to save money and figure out how much to save.

Saving for an emergency is your top priority in your savings plan. You need to save for emergencies because it isn’t a question of “if” an emergency will happen but “when”. You might go months or years without having to use your “rainy day” or emergency money, but then you might have multiple emergencies happen in a couple of weeks or months. You NEED to have an emergency fund.

We had 2 (actually 3) emergencies in 1 month in 2023. A broken arm, a broken car, and another ER visit! We were so grateful we had our emergency fund to use for these unexpected expenses.

I recommend having at least $1,500-$2,000 in an emergency savings account if you are working on tackling your debt. Some financial experts say $1,000, but honestly, most emergencies these days will cost you more than $1k.

If you are debt-free, CONGRATS, you then get to work on saving at least 3-6 months’ worth of your monthly expenses into an emergency fund. If you are self-employed or you don’t have a stable job, (seasonal, sales, etc,) you should have 12-18 months of expenses saved up in your emergency account. I know I know, this sounds like a lot of money because it is! But you will be so thankful you have the money there when you have a low-income month, you get injured, or you lose your job.

Okay, so we’ve talked about the importance of having your emergency fund in place. Now, let’s talk about your short-term and long-term goals (minus retirement). Let’s say you want to take a vacation to Jamaica (I got married there, it is gorgeous). You want to take your vacation in 12 months and you want to have $5,000 to spend on your entire vacation. That means you need to save approximately $400 per month for the next 12 months to have $5,000 to spend on your tropical getaway.

We take an annual family vacation that we pay for in cash. No credit card debt to go on vacation. So far, since paying off our debt, we’ve gone to South Dakota, Florida, and Tennessee

Now, let’s say you also need to save for Christmas coming up in 4 months while saving for that vacation. You want to save $2,000 for Christmas in 4 months. This means you need to create your budget to save $400 per month for your vacation, plus, $500 per month for your Christmas savings. That means you need to be saving $900 per month just to cover these two expenses! WHOA, that is a lot of money.

Now, you could put Christmas and your vacation on your credit card and pay it off after a few months. But, by doing this, you will be paying MUCH more than the $6,000 for Christmas and your vacation. It is so much better to plan ahead and save as much as possible for these upcoming events.

I personally have multiple savings buckets and cash envelopes that I put money into monthly. I even have some accounts that I might not save monthly but every other month or every 3 months, depending on my budget for those months. Right now, I am currently saving for back-to-school, Christmas, Vacation, Car and home repairs, a new stove, dental work, a lake home, my emergency fund, youth sports, and a different vehicle. I might be missing some. I also save money automatically for each of my 3 boys into a UTMA (Uniform Transfers to Minors Act) account. My boys will get this money when they turn 18 years of age.

Examples of savings buckets from Ally.com

Time to talk retirement savings. I am NOT a retirement advisor or expert by any means. But I do actively save money for my retirement and have while paying off our $100,000 of debt. I have an employer match, 403B retirement account at my nursing job that I put 4% of my gross income into every month. This is automatically deducted from my wages before I get my paycheck. My husband and I then put money into a ROTH IRA automatically on the 1st of every single month. This is done automatically so I don’t have to manually transfer the money and I don’t really need to think about it. I am saving WAY more money by having this automated than I would be if I had to transfer it over monthly myself.

It is very important that you are saving for your future self. I personally am not banking on Social Security to be around when I retire, so I want to make sure I have enough money saved up to retire in my 60s, if not before. I would love to be able to retire with enough money to enjoy retirement, not be worried about how I am going to be able to pay for my heat in the wintertime. Also, did you know that the average monthly price of rent at a nursing home is $9,000? That $40,000 you have saved when you retire isn’t going to get you many months of caregiving when you need it.

If you are thinking to yourself, “How am I supposed to save for all of these things when I can’t even pay my bills?” Allow me to help, I offer an exclusive 1:1 private Money Coaching. You can find more information at www.Jesswaynecoaching.com

Head on over to www.Jesswaynecoaching.com for all my information on my blog, podcast, Financial Mission Membership Program, self-paced online courses, and my 1:1 money coaching program. There is something for you at every price point!

Many financial experts recommend saving 10% of your annual household income into a retirement account every year. However, if you aren’t able to contribute that amount yet, automate what you can contribute and work towards increasing that amount every year. The earlier you start saving for your retirement the more you will have due to compound interest. You can even set up your contributions to increase automatically every year.

Whenever I get a raise at work, I take a certain % of my raise and put it towards retirement as well. So, say I get a 3% raise at work, I put 1-2% towards my retirement account and add 1-2% for our spending.

If you want to get a head start on your savings goals, try selling items in your house you no longer use or want. You can also pick up a second job or a side gig like, babysitting, housesitting, dog walking, mowing lawns, etc.

Selling clothing, household items, garage and outdoor items can get you started on paying off your debt and building up your emergency fund

Step 4: Considering Debt Repayment

Debt repayment can be ugly and you may want to ignore it, but don’t do that! You need to repay your debts and loans that you agreed to pay back and you want to do that quickly, especially if you have high-interest rate debt. This is where your budget comes into play and tracking your spending. You can see where you are spending your money, and determine where you can cut back on expenses so you can pay off your debt faster.

The average American has close to $100,000 of debt, so if you have debt you are not alone. But managing and dealing with your debt can feel incredibly lonely. Trust me, I know because I’ve been there.

Our gorgeous 1-year-old destination camper we sold to propel us forward in our debt payoff journey. By selling our beloved camper, we were able to pay off our remaining debt and also put some money into our emergency savings fund, win-win

Now, some people’s goal is not to be completely debt free. Some of my clients are ok with having a car payment forever, some are ok with student loan debt being paid at a slower rate than their credit card debt, and some want to be 100% debt-free. It is really what your goals are that determines how fast to pay off your debt and if you will find yourself back in debt again. I will support you no matter what your debt goals are.

I am a firm believer that every situation is different and that your plan for your money will be different. My plan for my money looks different than my best friend’s, my parents, or the guy down the road’s plan. You need to take into account your lifestyle, where you live, your goals, and your current financial situation to determine the best money plan for you. This is where a financial coach can really help! Especially one who does not believe in a one-size fits all approach.

In paying off your debts, there are two main types of debt payoff methods, the Snowball and the Avalanche. I have a blog post that goes into detail on those two methods you can read it here, https://www.jesswaynecoaching.com/blog/snowball-versus-avalanche-debt-pay-off-methods

I recommend each of these methods at different times for my clients. You can also do a mix of both, I know crazy, huh? That is actually what I did in paying off our debt. The main thing is to use a method and come up with a plan that will work best for YOU.

Step 5: Factoring in Discretionary Spending

When you create your budget, make sure you add in a category or two for discretionary spending, that is guilt-free spending. Things like dining out, entertainment, hobbies, and personal indulgences. Things that fill your bucket!

Make sure you don’t restrict your budget so much that you don’t get to enjoy any of your money. But also, make sure you are paying all of your bills on time, paying off your debt at a good speed, and planning ahead and saving money. You need to find that balance between enjoying life and also meeting your financial goals. You can do it!

I LOVE a good purse and bag. I purchase a new coach purse about every 5 years. Create your budget so you can still buy things you love!

Step 6: Planning for Future Goals and Expenses

We discussed how to save for different things, but I want to talk about long-term financial goals (e.g., buying a house, starting a family, saving for a wedding or your kids’ college)

Did you know the average cost of college tuition, in the United States is roughly $20,000, and that does not include room and board or a food plan!? The average cost for a 4-year college is over $100,000. How are our kids/parents going to pay for this?

Sure, our kids can take out student loans, but those need to be paid back and they are paid back with interest, sometimes a HIGH interest rate too. Saving for your retirement is step one in saving for the future, but then I recommend saving for your children if you have the means to do that.

I agree with many that these kiddos need to work while in school and pay for some of the college tuition and expenses. However, taking out huge loans for them to go to college is not always the best. It is important to teach your kids that if they take out these loans they will need to pay them back, even if they don’t graduate. Many kids and their parents think that if they flunk out of college they don’t have to pay back the loans. Ummm, nope, they are still responsible for the student loans.

Come up with a savings plan for your kids when you are able to financially do this. Whether that be a 529 account for their schooling or a different type of account like a UTMA or even just a savings account (I recommend a high-yield savings account if you are choosing to do a savings account only). If you are thinking, like me, I have 3 boys and one of them might not go to college, it is still important to plan for it, save for it, and if they don’t go to college they can use the money to start their own business or as a down payment for their first house, or their wedding, etc.

Speaking of weddings, what are your goals for your children’s future weddings if they choose to get married? Are you going to be in a stable financial place to help pay for their dream wedding? Nowadays, many parents are taking out personal loans to help contribute to their son or daughter’s wedding. How about you start saving a little bit of money each month to help pay for their wedding? Again, if your child doesn’t get married, that money isn’t wasted. It can be used on anything, for them or for yourself!

Our wedding was intimate and amazing. A destination wedding in Jamaica with 30 close family and friends. Super budget friendly!

One more thing quick before you go on your way, back to your busy day. I want to remind you that it is vital to review your budget and make adjustments from time to time. A budget is meant to change. It might be the same for a month or two, but it is fluid and most likely will change from month to month. Usually these aren’t huge changes rather smaller tweaks. I create a fresh new budget every single month and love it. It’s like a fresh start, like the feeling you get every New Years.

Remember, keep track of all your monthly household income, all your monthly household expenses, debt, and savings goals. Create a customized plan (budget) for your finances and watch your debt shrink and your bank account grow. There are different ways to track your spending, including an old-fashioned pen and paper, an app, or a spreadsheet. Use what works best for you!

If you loved this blog and you are feeling encouraged and ready to tackle your money, would you do me a favor and share it with 3-5 of your friends? Thank you and be sure to make today a great day!

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts