Do you feel stuck with your money? Do you feel like you can’t get ahead on your bills or that you are using credit cards to afford your lifestyle? Have you tried to budget and feel that you failed at it? Do you bring in an income? Do spend money? Do you work? If you answered “yes” to any of these questions, you would benefit greatly from hiring a Money Coach.

I love being a Money Coach because I get to help others set and meet their money goals

A Money (Financial) Coach can help you manage your money. By hiring a Money Coach, they will help you create a custom and individualized plan and make goals with your money. You can figure out and google pretty much anything related to money. However, finances are 80% emotions and only 20% head knowledge. This means that even if you KNOW what to do with your money, you might have a hard time with the follow through. There is also no single right way to manage your money. You need a tailored plan for you and your money.

You need a customized plan to become financially secure. Not one size fits all with money

Hiring a Money Coach will save you money. They will help you make and achieve certain SMART goals. Do you like to have an accountability partner? I sure do! A Money Coach will be just that, your accountability partner with your money. They will keep you on track and guide you along the way. A Money Coach will work with you to form new healthy habits that you are happy with.

Hiring a Money Coach will:

1. Save you money

2. Be your accountability partner

3. Help you achieve SMART goals

4. Keep you on track with your money goals and personal goals

5. Form healthy and happy habits

6. Set you up for long-term success

7. Teach you how to prioritize your expenses

A good Coach will set you up for long-term success. Short-term success is fun because you see it right away. You get that hit of dopamine as soon as you see the success. Hopefully, with a good Money Coach, you will see success right away. But you really want to be set up for long-term success. As new habits form, these will allow you to be in it for the long run.

A good Money Coach will save you money and set you up for long-term success

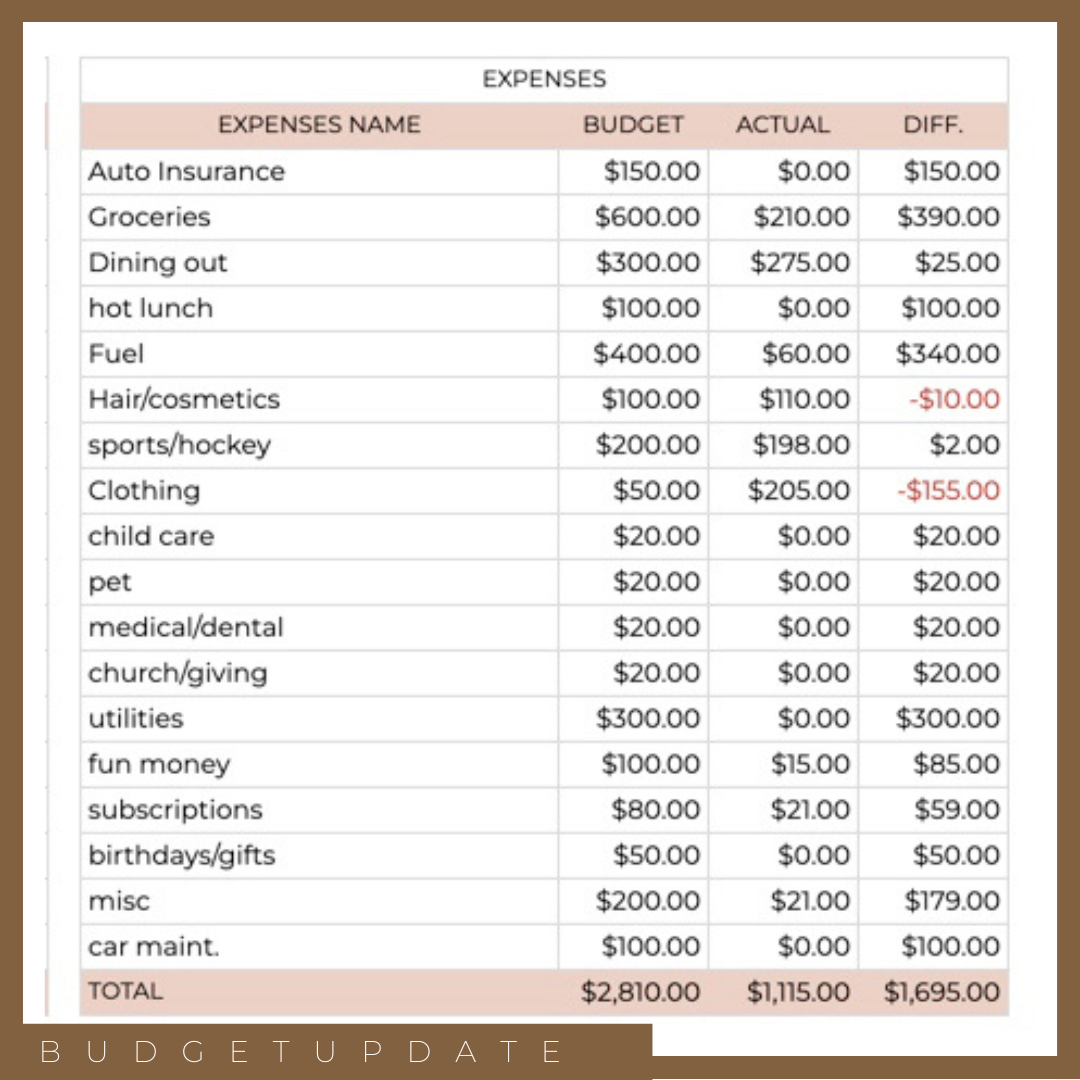

Working with a Money Coach will guide you in how to prioritize your expenses. Together you will come up with a plan on which expenses and debts you should work on paying off first. Coming up with a plan, budget, and goals is part of Coaching. A Money Coach will work hard to save you money on your monthly budget. Ideally, you will put this money into a few places.

1. Pay off debt

2. Save money in an Emergency Fund

3. Save money into sinking (savings) funds for future purchases

4. Save money to start investing in your retirement account

5.. Save money to add more money to your existing retirement accounts

A Money Coach will save you money to start investing more! Your future self will thank you

I got into Money Coaching first and foremost to help others to manage, plan, budget, and save their hard-earned money. You weren’t born with the finance knowledge and know-how. Most families don’t talk to their kids in depth about money. Mine didn’t and my parents were more open about money than most of my friend’s parents were. All I really grew up knowing was to not go into credit card debt. This is a very important money tip to know! I am forever grateful to my parents for teaching me that. However, I wish I knew then what I know now about money. I wish I would have started researching, reading, and listening to all things money and finances related years ago. I cringe when I think about all the money I’ve wasted throughout the years and how much money I could have saved over time.

If you could hire a Money Coach, who would be your accountability partner, friend, support, and empowerment person, who can help you save money, wouldn’t you be jumping in with both feet? I know I would!

Be sure to check out my Financial Mission Membership Program + 1:1 Money Coaching at Jesswaynecaoching.com

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch