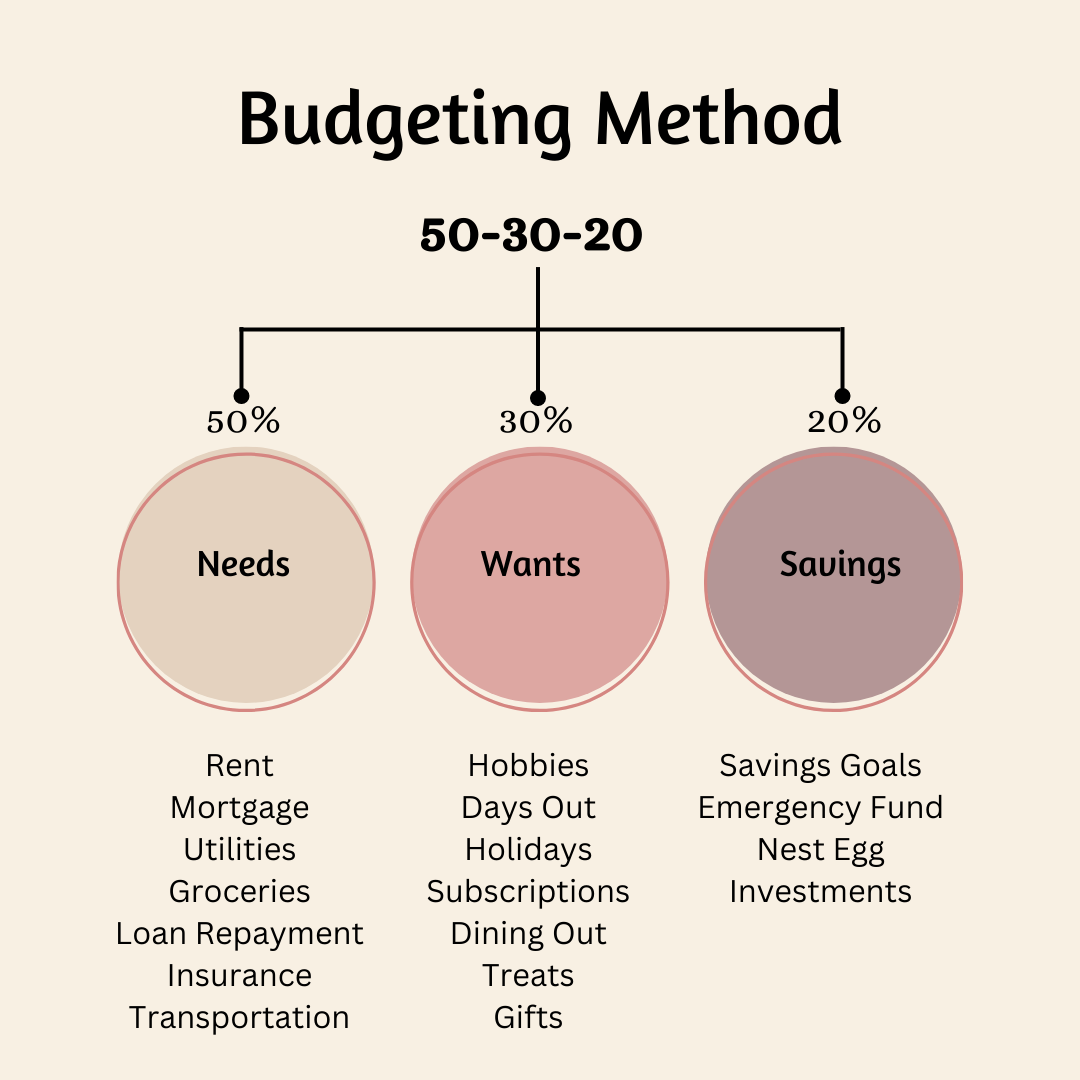

There are multiple ways to budget. It can take a few tries and a few different methods to find your niche and what is going to work for you. I am going to show you how to budget using the 50-30-20 way.

Use a paper and pen, free app, or a spreadsheet to track your expenses and spending

Basically, ALL of your spending/expenses are going to be split up into 3 categories.

· Necessities/ Needs (50%)

· Wants (30%)

· Savings (20%)

After you get your paychecks for the month. You are going to spend 50% of it on your needs, 30% on your wants, and 20% on your savings. You will want to have already estimated how much money is going to go into each of these 3 categories.

Your needs include your housing, fuel, groceries, minimum debt payments, insurance, health care, and utilities. These are the things that you need in life.

Next, your wants categories include things that are not exactly essential or necessary. They may be a need in the future, but not currently. This includes eating out, the internet, a new purse, a gym membership, and movie tickets. All of these things are not needed. You can cook at home instead of eating out, you can use the internet at a coffee shop or library, you don’t necessarily need a new purse, you can work out at home, and you can watch a movie at home.

Finally, your savings are 20% of your take-home pay and this includes your retirement investments and your emergency fund. Both are essential nowadays. This category is also going to include your debt repayment which is on top of your minimum payments. It is important to try and pay off your debts, especially your high-interest debts as fast as possible.

You also want to make sure you are saving into your emergency fund. It isn’t a matter of “if” an emergency will happen, but “when”. I want you to have some money in your “rainy day” fund to cover your emergencies that are bound to come up. Every household and family should make sure they have an emergency fund in case someone loses their job, has an accident, gets hurt, or your car needs a lot of work done to keep it running and safe. This will help to keep you out of debt or from going further into debt.

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts