Yes, you read that right. My husband and I were $100,000 in debt. We had a beautiful camper on a permanent camping site and we each had a vehicle loan. Luckily, we had already paid off my small-ish school loans and we did not have any credit card debt. We also had our house payment, but that is separate from the $100,000. We were drowning in debt, and we didn’t even realize it.

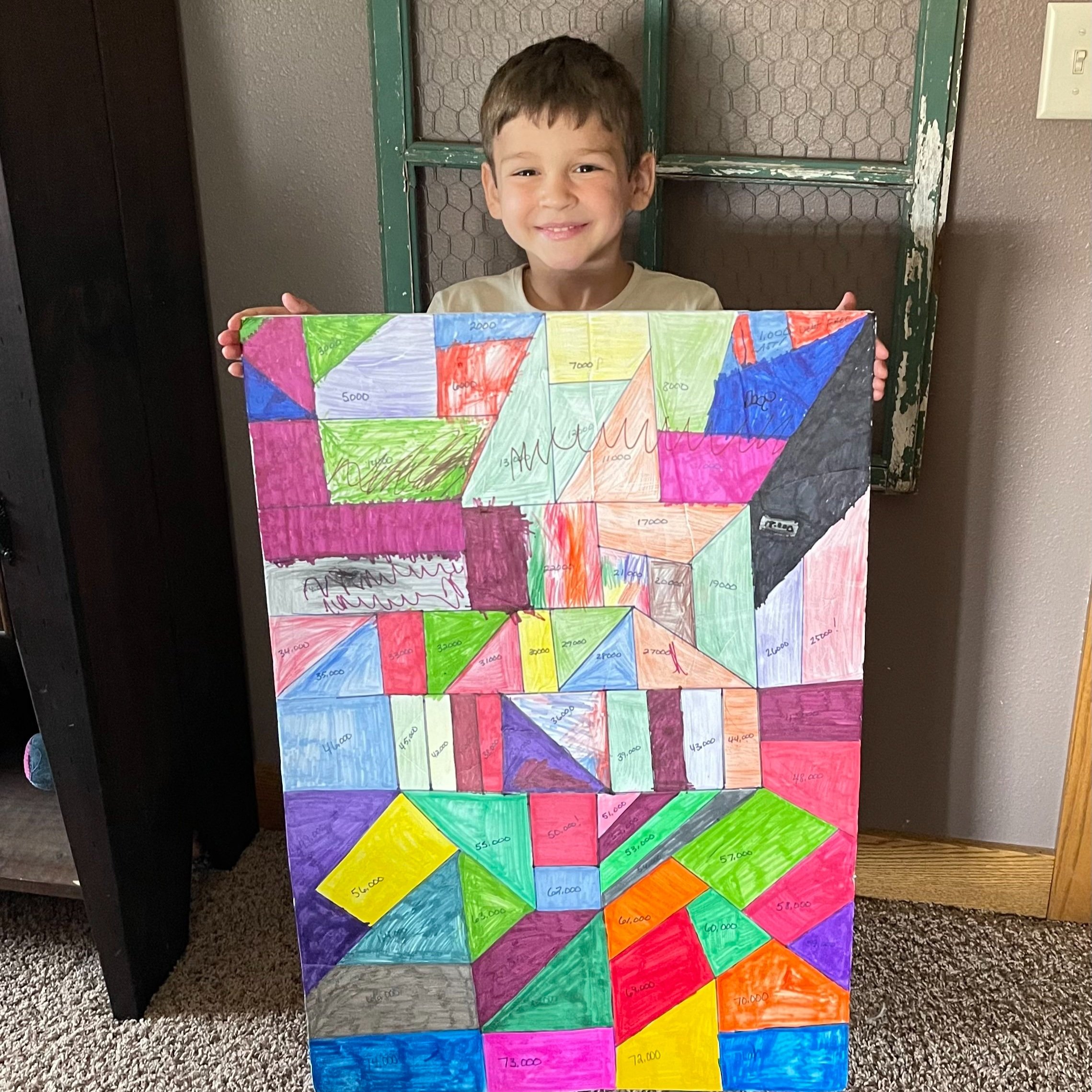

My son holding onto our debt payoff coloring tracker board we made. This helped keep us motivated and on track with our debt payoff journey

In the spring of 2020, my husband, who is a self-employed farmer had to have emergency back surgery, I was furloughed (basically laid off) from my nursing job and I had to plant our farm crops we were not able to afford to hire someone else to plant our crops.

That was a scary and crazy time in our lives. That was also the start of my journey (addiction) to finances!

Me standing next to “Big Betty” when I became a farmer for a spring planting season

I didn’t know how to drive a tractor, let alone plant corn and soybeans. Our kids were also home because there was no school due to the global pandemic. No wait, we were trying to provide them with virtual schooling, while recovering from back surgery, and having a mom sub in as a farmer! I honestly don’t know how we did it. So, there I was driving the tractor for 8-10 hours a day and I usually had 1-2, sometimes all 3 boys riding with me. I have photos of my youngest son taking a nap in the tractor with me and our middle son reading his books for school in the tractor.

Well, long story short, I got the crops planted. They weren’t planted well, but they still grew, and we had a decent harvest that fall.

Looking back, I learned so much during that spring. I started listening to money podcasts and realized I had a love for finances and other people’s financial journeys. I found out that I can do anything I put my mind to, even if I don’t want to do it. See, I didn’t want to plant our crops that spring, but I didn’t have a choice. We couldn’t afford to hire someone to plant all our crops, so it was up to me to do it.

Driving “Big Betty” the tractor with my youngest, Colton sleeping in my arms

During that time, I decided that I wanted to get on track with our money. We ended up paying off six figures in debt and I don’t think we would have done that without the experience we went through of being really scared financially. If I didn’t become a farmer that spring, I don’t think I would have realized what a mess we were in with our money.

I was furloughed for a month from my nursing job. When I returned to work, the hospital was getting very busy. I was able to work as much as I wanted. I worked lots of overtime and I put all that money toward our debt. I paid off my 2019 car loan almost 4 years early by working, working, and working. Throw in a little blood, sweat, and tears and I had a paid-off car. It felt so good to be able to pay off that loan. I also sold so many household items that we were no longer using, or didn’t need. I put all that money towards our debt as well. We were also paying extra on our truck loan and our camper loan. We soon realized that we were not using our camper as much as we would have liked to. We decided to sell our camper and that decision allowed us to pay off our camper, and our truck and also put some money into our emergency savings fund.

Our gorgeous 1-year-old camper that was like our “second home” that we decided to sell to propel us forward in our debt payoff journey. By selling our camper we were able to also put money into our emergency savings fund.

And that is how we were able to pay off six figures of debt in 2 years. Getting scared, working hard, working together as a family, and selling a prized possession that we had. To be honest, it took some convincing of my husband and kids to get on board with selling our camper. The camper was like a second summer home to us. When we talked as a family and as a couple, we decided that this is what was best for our family. I can honestly say that I have not missed our camper once since selling it. I thought I would miss it, but I think I was so relieved of the financial burden that I was so happy to be out from under that large loan. The kids were able to get a large pool since we sold our camper, yes, we bribed them with a promise of a pool if we sold our camper. We have created such amazing memories by swimming, having friends over for pool parties, and just spending some much-needed time at home.

Now, I know not everyone has a large item they can sell to help them get out of debt. However, really take a deep look into your finances and what you “have”. You would be amazed at how much extra stuff you could sell. Maybe you decide to downsize from a brand new or almost new vehicle to something a little older but more affordable. Maybe you decide to eat out at restaurants less often to help you pay off your debt sooner. The goal is to improve yourself through this journey and to change the way you’ve always done things. Working as a team if you are married and with your family if you have kids. Encourage each other and empower one another. I know you can do this!

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts