Crisis Financial Planning: Managing Money During Emergencies or Disasters

Filed in Finances

What would happen if you or your significant other lost your job or their job, or you had a medical emergency, or a premature baby that needs to have a lengthy stay in the NICU, or a natural disaster tore the roof of your house off? How about if you were in a car accident and your car needed a bunch of body work done to it, or it just needed some repairs like mine did a few months ago that cost me $4,000. How about if your credit card was stolen or your identity and you needed to use cash on hand to pay for things? Are you prepared financially to handle some of these emergencies that could arise?

Let’s talk about how to plan for a crisis situation and how to manage your money during emergencies or disasters.

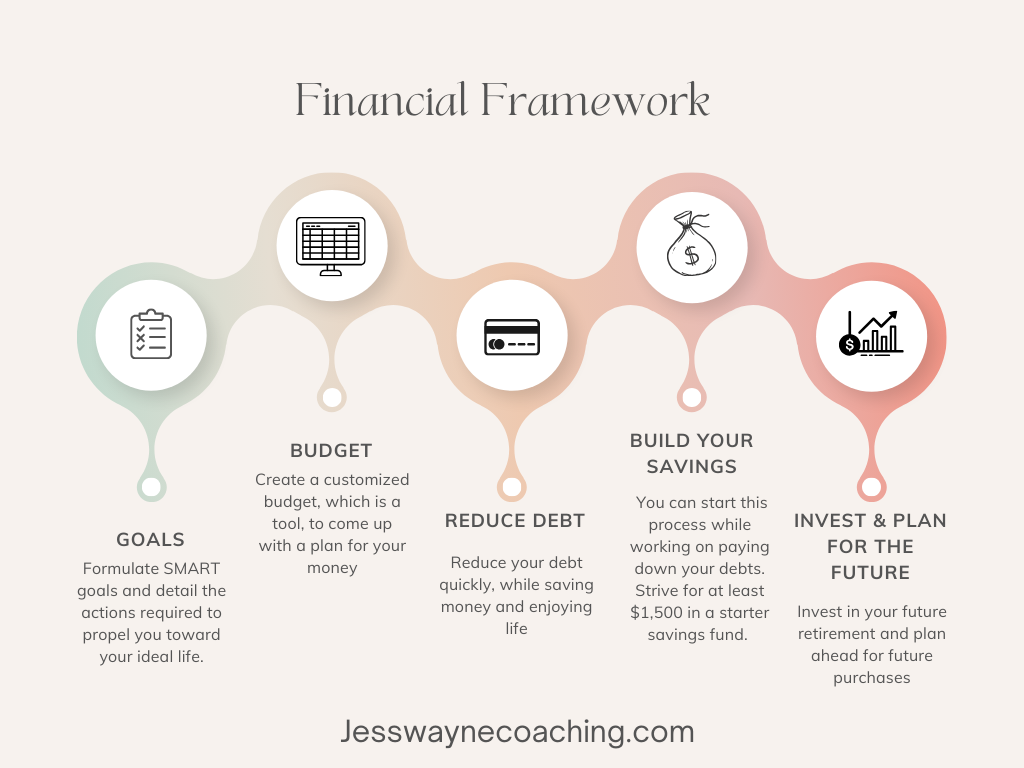

First and foremost, having an emergency savings account fund is key. You, my friend, need to have one, with at least $1,500 in it. Even better, is if you can get that savings account to $2,000. If you don’t, this is an emergency in itself.

You need to pick up extra hours at work, pick up a second job, and sell items from your home to get this amount of money into a savings account fast! This money will ONLY be allowed to be used if an emergency happens and to pay for that emergency. And if you use the money from this account for an emergency, you need to prioritize getting this account built back up ASAP. This is what I did when I was paying off our mountain of consumer debt.

Now, if you have debt, especially high-interest rate debt which is for sure a double-digit interest rate, so 10% or higher, but could be considered at 8% and higher, having a starter emergency savings amount of $1,500-$2,000 is a good place to start. When your debt is paid off, besides your house, first CONGRATS, and second, it is then time to work on building up your fully funded emergency fund of at least 3-6 months of expenses. Ideally 6 months plus!

If you are self-employed or have an unstable or seasonal job, it is suggested to have 12-18 months of expenses in your emergency fund. Which I know is A LOT of money! But this money is hanging out in your savings account to bail you out if/when an emergency happens.

When I was paying off my debt and building my emergency fund, which I am still currently working on, I did this by selling lots and lots of items. I sold a variety of things including, outdoor items, gardening things, sporting equipment, shoes and clothes, kitchen gadgets, garage items, and so on. Some items I wanted to sell and some I did not. We even sold our gorgeous 1-year-old camper. This propelled us forward in our financial journey to allow us to feel safe and secure.

You can also pick up a second job, side hustle, or extra hours at your current job. Again, this is what I did. I worked so many overtime hours at my nursing job while we were paying off our mountain of debt. I was able to keep going strong and stayed motivated because I knew it wasn’t long-term, I knew it was to meet my financial goal of paying off $100,000 of debt. I didn’t burn out because it was for a certain time frame.

I swabbed a lot of noses during the peak of the COVID-19 pandemic and also picked up shifts in the hospital being an extra hand when we were overflowing with patients.

Once we paid off our consumer debt, I cut back on all the extra hours I worked as a nurse. I didn’t want to burn myself out, because I’ve done burnout before and I have made a promise to myself to NEVER do that again. Now we are currently working on building our fully funded emergency fund, but I am not picking up crazy extra shifts to do that, I am budgeting for and building up that savings account.

During emergencies, individuals often encounter some financial challenges that can significantly impact their financial well-being. Some typical challenges are:

1. Income Disruption: Job losses (fired, laid-off), reduced work hours, or business closures can lead to a sudden and severe reduction in income, making it difficult to cover essential expenses.

2. Increased Expenses: Emergencies may bring unexpected expenses, such as medical bills, home repairs, or evacuation costs. Even traveling costs, like spending more money on extra gasoline or lodging if you have a sick kiddo or loved one in the hospital. These unplanned financial burdens can strain budgets.

When our middle son, Bryson was 2.5 weeks old he ended up getting RSV and bilateral pneumonia. He was hospitalized an hour away from our house for almost 3 weeks. Between the travel, extra fuel, and medical bills we zeroed out our savings account. Little did I know then, that it was our emergency fund. But, it took us years to recover from that. We were also in over our heads in debt, so that surely didn’t help.

3. Debt Accumulation: To cope with immediate financial needs, individuals might resort to borrowing or using credit cards, leading to increased debt and interest payments. There are ways now to help prevent this, obviously, the number one way and the best way is to have an emergency fund, but another way is to start a donation program or a Go-Fund-Me account. I wish these would have been more popular when my son was ill. Even a few extra hundred dollars for gasoline and food would have been helpful. Luckily, we didn’t have lodging expenses because we were blessed to be able to stay in the Ronald McDonald House/Rooms for about ½ the nights, and for the other ½ I stayed right in his hospital room because I wouldn’t leave the hospital during his hospitalization.

4. Market Volatility: For those with investments, economic downturns during crises can result in market losses, affecting the value of their portfolios and long-term financial plans.

5. Limited Access to Resources: During emergencies, accessing financial resources or assistance programs may become challenging, exacerbating financial strain.

6. Uncertain Future Planning: Individuals may struggle to make informed financial decisions about savings, investments, and retirement planning due to the uncertainty surrounding the crisis. If someone is diagnosed with cancer and the plan is for a 2-year treatment, your life is pretty interrupted for the next 2 years at a minimum. It is difficult to plan for the future and make wise decisions when in the midst of turmoil.

7. Emotional Stress: Financial stress during emergencies can contribute to mental and emotional strain, impacting overall well-being and decision-making. When my tiny little 6-pound baby was hospitalized and super sick, we didn’t know if he was going to make it or not. I can tell you, I was NOT in the right state of mind to make any big, important decisions during that time. Luckily for us, this was only for about 3 weeks, which felt like forever, many individuals are not so lucky, and their emergencies, especially when medical last months to years.

Understanding these challenges is crucial for developing effective strategies to navigate financial crises and emerge with greater resilience.

Never in a million years did we imagine or plan to have our baby hospitalized for almost 3 weeks due to a virus. Without our emergency savings we would have ended up with so much debt from this life event.

When going through this difficult time as a family, just writing out our bills was another task that didn’t seem important, but we knew it was. When you are faced with an emergency situation, it is a good idea to write out your top tasks/priorities that you need to get done.

Make sure you know and have a system AHEAD of time (before an emergency happens) on paying your bills and having a plan for if you aren’t home for an extended period of time how your bills will be paid and how/who will manage all the other household tasks. This is where automating as much as possible is key.

I recommend setting up automation for your bills and savings. This is super easy to do, and once you set it up you can essentially forget it.

Many people have their accounts all managed online which can be a huge benefit as well. However, if you are the one sick in the hospital, that might not benefit you much at all. So having a backup plan/person is important.

Life insurance and health insurance are very important as well, especially if your family relies on your income. TERM life insurance is what you want to go with, NOT WHOLE. Health insurance is also needed for everyone, there are many different types and price ranges for health insurance, however, as most of you know it is not cheap, but it is worth it. When our son was hospitalized for those 19 days, luckily we had health insurance but we still had to pay around 10K for his hospital stay. This might sound like a lot, and it is. But his overall medical bills, just for the hospitalization, not including all the follow-up visits was over 200K! Thank God for insurance.

Have you heard of a crisis budget??

A crisis budget is different than your regular budget because this is the budget that you would live off of if you were in a crisis. If you lost your job, if your child is severely sick or sick for a long time and you are off work for a while. This can be a bare-bones budget- like all your necessities, and bills, and you cut back on all the other things. No discretionary spending, cut back on all the things you don’t need.

During a crisis situation, you will only be spending money on essential things.

Here are some tips for reducing expenses during a crisis:

Cut back on things like :

Cable

Subscriptions or memberships you won’t be using

Dining out

Entertainment

Clothing

If you’ve had a huge emergency or life crisis, tragedy, or event in your life that affected you financially. Please know that it will take time to get through that. It will take time to build your savings back up or get out of debt from that event. It will take time to process the grief, trauma, etc., and know that you are not alone. Please seek out support and resources if needed.

Your mental health and physical health are super important, if you end up in debt, or without savings, but you had to focus on surviving and healing that is ok.

After the dust settles, then it is time to focus on rebuilding your savings and paying off your debt.

xoxo

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts