First, there are MANY ways to budget but today we are going to talk about The Plan Ahead Method. The Plan Ahead method of budgeting is a wonderful and easy way to budget. It works great for busy moms and those who do not want to spend hours creating and managing their budgets.

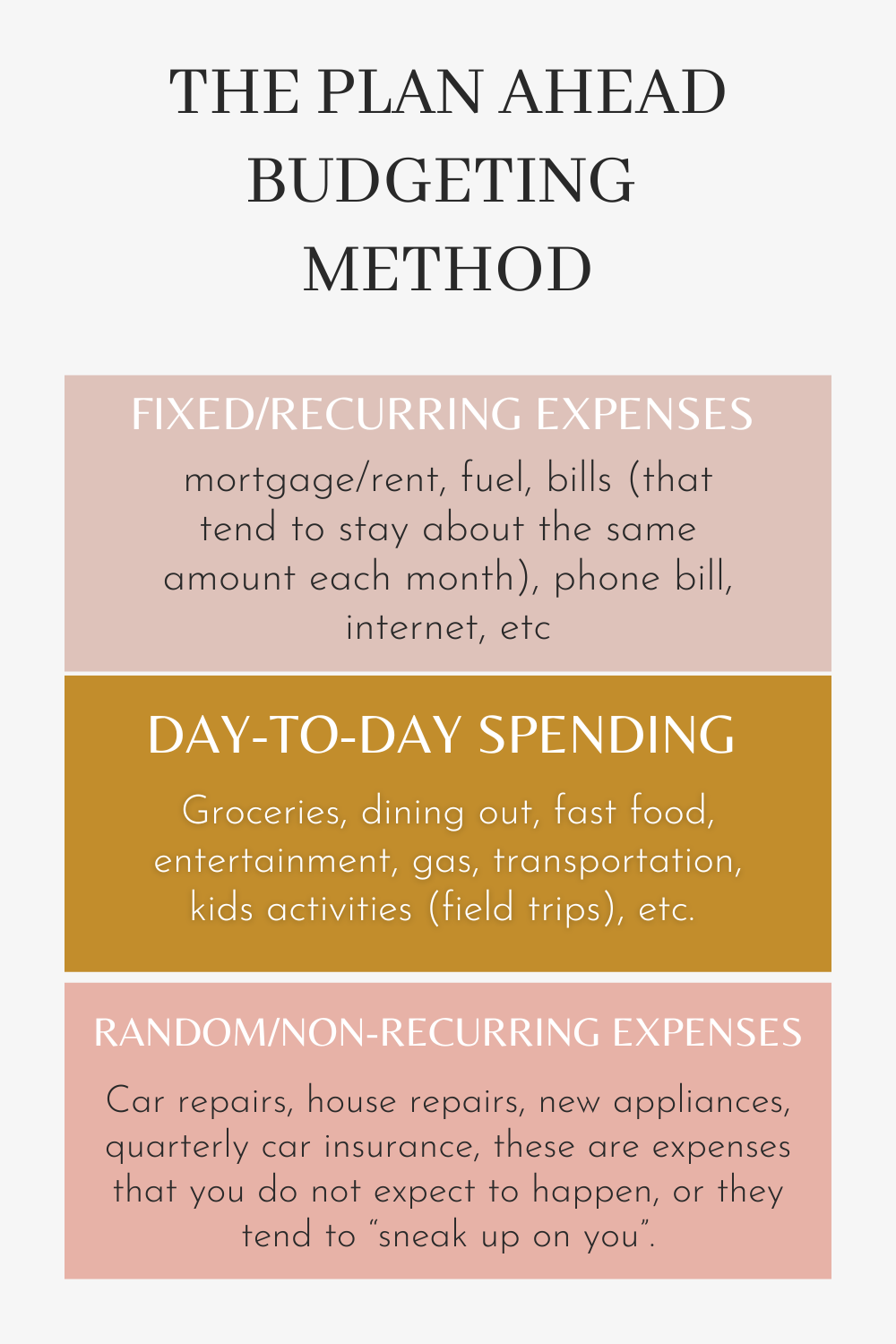

Essentially with The Plan Ahead Budget Method, there are 3 “buckets” that you divide your monthly income into and then you spend out of those “buckets” for all of your spendings, including your rent/mortgage, bills, spending money, etc.

The 3 buckets include Fixed/recurring expenses, day-to-day spending, and Random or non-recurring expenses.

I will show you what is included in each bucket below

Fixed/Recurring expenses: your monthly bills that slightly vary in some cases such as your heating/AC bill depending on the season, but these bills are typically due at the same time each month.

Day-to-day spending: Groceries, dining out, fast food, entertainment, gas, transportation, kids activities (field trips), etc.

Random or non-recurring expenses: Car repairs, house repairs, new appliances, quarterly car insurance, these are expenses that you do not expect to happen, or they tend to “sneak up on you”.

You will need to do some prep work for this type of budgeting method. Because most people who are new to budgeting do not know how much they spend on each category of their budget. For example, when I was brand new to budgeting (if you don’t know this, I didn’t start budgeting until I was in my 30s) I had NO CLUE what I was spending per month on things like clothes, groceries, dining out, entertainment, pet care, household items, etc.

So, to get started on this type of budget you are going to need to track your spending. You can do that in a couple of ways. You can start keeping track of your spending now, or at the start of a new month, or you can look back at your bank transactions and credit card and debit card transactions for the past 1-3 months to get a good estimate on how much money you are spending in each category.

Keep track of your spending to get an idea of how much you need to put in each “bucket”

I am not going to lie, it is a little bit of work upfront, but you have to do this step with ALL the budgeting methods. So no matter which budgeting method you choose, you will have to track your spending in the beginning.

Once you have a good idea of how much you are spending in each category, then you can estimate how much money you need to allocate to each of the 3 “buckets”.

For the Fixed/recurring bills bucket, you are going to want to save some money into this bucket for all your bills and spend out of this bucket. Say your rent is $1800 a month, well you need to have that $1800 in this bucket. Say your utilities typically range between $220-$280 per month. You will want to lean on the high end of the range. So I would suggest you put $280 per month into this savings account or “bucket” to pay for your utilities. Hopefully, by putting in the $280 your account will never be zero or in the negative. This will allow a little “cushion” room in your account.

For the Day-to-Day spending bucket. Ok, this is where I suggest using cash for your day-to-day spending, except for fuel, I suggest using a debit card for your fuel purchases. This way you won’t have to track every single day-to-day spending transaction you complete. You will find that after a few months of tracking your spending, you can then estimate how much cash you need to carry with you. For example, if you’ve spent around $800 per month on your day-to-day spending you know to keep around $800-$900 set aside for your day-to-day spending and you can carry and spend the cash.

You can bring out your cash for the whole month and carry it with you, or you can break it down by a week or 2-weeks. However, you choose to do this is up to you and what you are most comfortable with.

Using cash for your Day-to-day spending is a great idea!

For your random and non-recurring expenses, this will be a savings account “bucket” that you have. These will be the BIG peaks and valleys on our journey. You see, you might have a few very low (valley) months of needing to pay for these expenses. But then when you have a month where you have a few of these, or even 1 big random expense, like your refrigerator needing to be replaced, it is a HUGE peak, it is a large amount of money needed right now.

Some of these expenses you will know about but might not remember. For example, if your car insurance is paid twice a year and your car insurance are $450 every six months, you need to put aside $75 per month to cover your car insurance.

Do this same math equation for your car’s tires and oil changes. Things that you know you will need to pay for, but that you don’t need every single month. Vehicle registration is another good example.

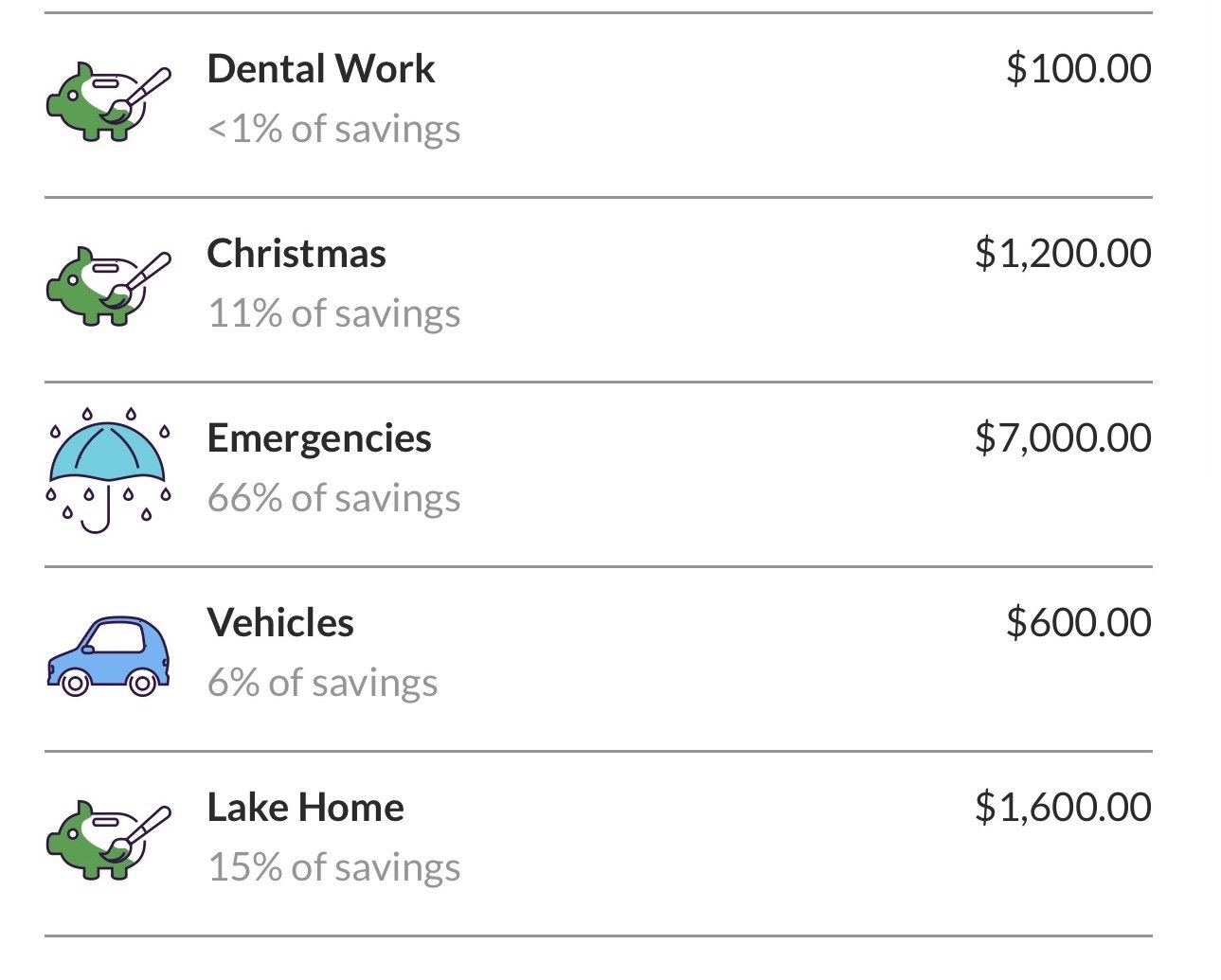

I suggest having a savings account with savings “buckets” at an online bank. I personally use Ally.com where I have a High Yield Savings Account (HYSA). These accounts have a higher interest rate on your money than a typical local bank or credit union. Make sure the online bank is FDIC insured and that you know what types of fees and the minimum amount is needed in each account.

Typically, at these types of banks, you can set up as many savings accounts as you would like and there is no minimum amount of money you need to have in each account, or the minimum amount is quite low, around $5-$10.

I personally use Ally.com for my Emergency Savings Fund

Just know that it will take a little bit longer for you to have access to the money in your savings account from an online bank. So, if an expense arises and you need the money right away, you might need to use a credit card and then transfer the money to pay off your credit card right away. Or if you have a little bit of time to wait, usually you can have your money in 24-72 hours.

If you have an emergency fund I would keep that money in a savings account at an online bank.

It is important to be saving not only for emergencies but also for your future goals. Say you want to take a family vacation in a year. You can save per month into a savings account at the online bank. Say you want $5000 for your vacation in 12 months. You would take $5000 divided by 12, to be around $416 per month to save per month for the next year to meet your family vacation savings goal.

Family vacation we took and paid for in cash!

You can have savings accounts also called sinking funds or savings buckets for MANY things. Pets, vacations, home repairs, car repairs, clothing, new appliances, a new car, a house down payment, kids sports, back-to-school shopping, etc. You can really create a savings account and come up with a savings plan and goal for literally anything.

If you are having a hard time deciding which of the 3 buckets an expense goes into, that is okay. You can just add it to any of the 3 buckets as long as you know which bucket you put your money into for that specific thing and then spend out of that bucket for that thing.

It is really about saving money and planning ahead for future expenses than being perfect on which money goes into which bucket.

If you want help setting up this type of budget be sure to reach out to me at Jesswaynecoaching.com

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts

Head home | Read Jess's story | Personal Finances | Business Finances | Courses & Resources | Browse the blog | Get in touch