Most of us are swiping our credit cards every single day, multiple times a day to make our purchases. When you swipe your credit card there is no transaction of handing over your physical, hard-earned money that takes place, and this tends to lead to overspending.

There is a way to take control of your spending and that is by using the cash envelope system. Using cash to pay for your purchases might seem like a blast from the past, however, this classic budgeting method has stood the test of time and continues to empower individuals and families to take control of their finances and achieve their financial goals.

Examples of a few of my cash envelopes

In this blog post, we will dive into the cash envelope system, understand its benefits, and learn how to implement it effectively for greater financial success and to help you curb your overspending.

Understanding the Cash Envelope System:

The cash envelope system is a simple yet powerful budgeting technique that involves using physical envelopes to allocate cash for specific spending categories. You can buy gorgeous and fun envelopes on sites like Etsy or Amazon, you can make your own, or you can use regular envelopes from places like Walmart or Target. You can also get cash envelope binders as well. But, the idea is to spend as little as possible on the actual envelopes, at least in the beginning. I first used basic white mailing envelopes in my beginning cash stuffing days. I then saved some money and bought some prettier, heavy-duty envelopes from Amazon.

My cash envelopes that I bought from Amazon. They are super cute and affordable

Each envelope represents a different expense, such as groceries, entertainment, dining out, and more. By physically separating and limiting cash for each category, you gain greater awareness of your spending habits and can make informed decisions about your financial choices. When you run out of cash in a specific envelope/category, you don’t get to spend any more money until the next cash stuffing day- usually payday or at the beginning of the month. This will help curb your overspending.

Benefits of Using the Cash Envelope System:

1. Increased Financial Awareness: With cash envelopes, you can visually see how much you have left to spend in each category, preventing overspending and promoting financial mindfulness.

2. Enhanced Budget Accountability: The system keeps you accountable to your budget, preventing impulse purchases and ensuring that you stay on track with your financial goals.

3. Debt Reduction: By following your budget, you can free up funds to pay off debts faster. Using the debt snowball or debt avalanche payoff methods you can pay down your debt fast, saving you lots of money.

4. Build Savings: Build up your savings for emergencies, short-term and long-term financial goals, and future investments.

By using cash, you will spend less money, especially on your day-to-day purchases

Creating Your Cash Envelope System:

Identify Spending Categories: Start by listing your regular expenses and create specific categories, such as groceries, transportation, entertainment, vacations, and more.

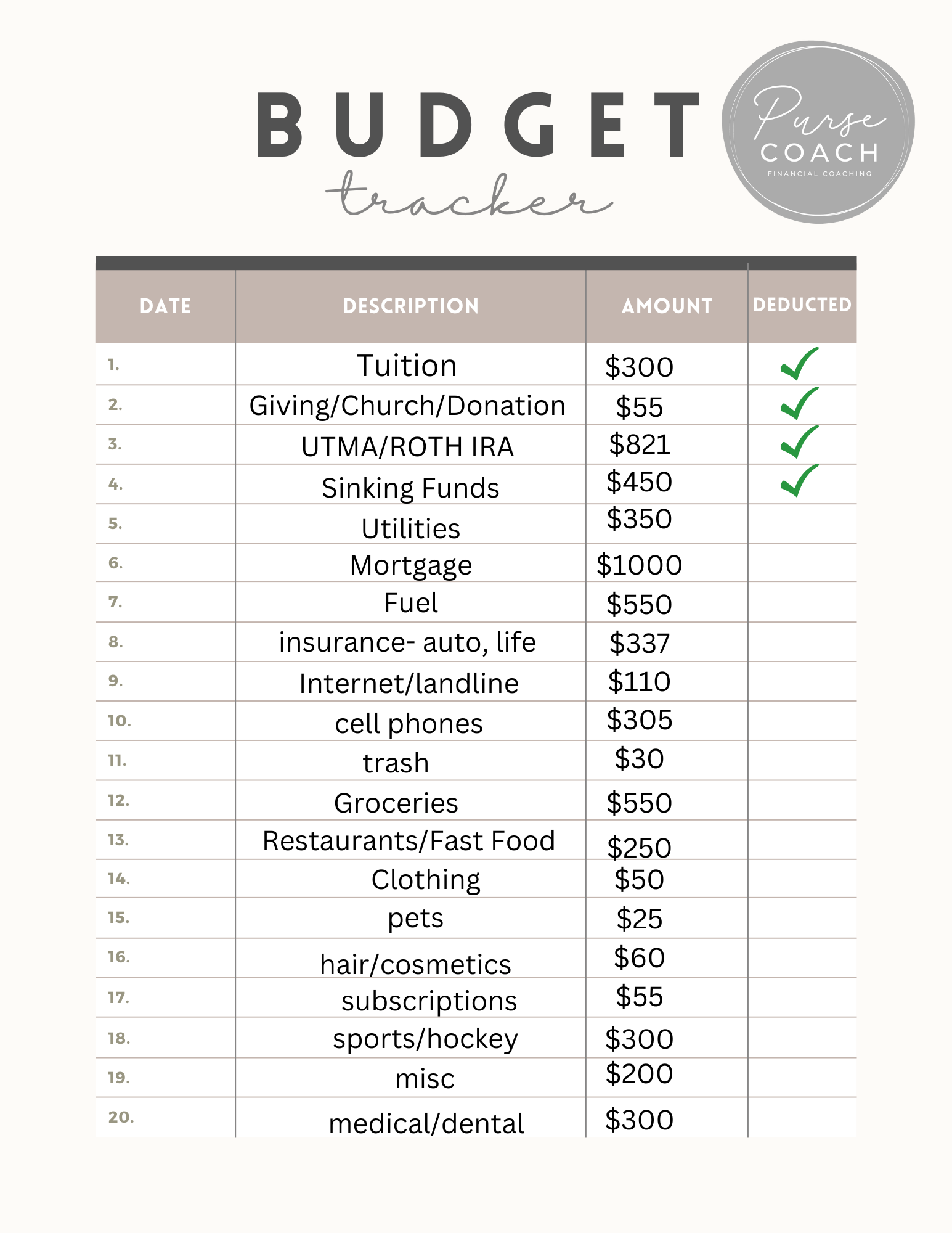

Determine Budget Amounts: Figure out a reasonable amount for each category/envelope based on your income and financial goals. Be realistic and ensure that your budget aligns with your overall financial plan.

Label and Organize Envelopes: Label each envelope with the name of the spending category and allocate the predetermined cash amount for each.

1. Implementing the System:

Use Cash for Budgeted Categories: Use cash from the designated envelopes for corresponding expenses. Once the cash in an envelope is gone, do not spend any more money in that category until the next budgeting period.

Regularly Review and Adjust: You are going to need to occasionally review your budget and cash envelope system to assess progress and make any necessary adjustments to better meet your financial needs. A budget is fluid, it changes from month to month.

2. Tips for Success:

Start Small: If you’re new to budgeting or the cash envelope system, begin with a few categories, maybe 5 and gradually add more as you become more comfortable.

Stay Disciplined: Avoid the temptation to dip into other envelopes or borrow from one category to fund another. Don’t rob Peter to pay Paul. Staying disciplined is essential for the system’s effectiveness. Make sure you allow enough money in your envelopes so you don’t feel too restricted, but be realistic on what you can allocate into each category. Budgeting can be tricky when first starting out, but I know you can do it! If you need help, ask me, I LOVE budgeting!!

Combine with Digital Tracking: While using cash for certain expenses, consider digital budgeting tools to track larger, recurring bills and payments. I pay most of my bills, utilities, subscriptions, internet, etc automatically with my credit card and then I pay off my credit card in FULL every single month.

Types of cash envelope categories:

-

Dining Out / Restaurants

-

Groceries

-

Transportation / Gas

-

Entertainment / Leisure

-

Personal Care / Beauty

-

Clothing / Fashion

-

Household Supplies

-

Gifts / Special Occasions

-

Health / Medical Expenses

-

Travel / Vacation

-

Kids’ Expenses (e.g., school supplies, extracurricular activities, youth sports!)

-

Home Maintenance / Repairs

-

Savings / Emergency Fund

-

Debt Repayment

-

Miscellaneous / Other

-

Utilities (e.g., electricity, water, gas)

-

Phone / Internet / Cable

-

Insurance (e.g., health, car, home)

-

Pet Expenses (e.g., pet food, grooming, vet visits)

-

Education / Learning (e.g., courses, workshops, books)

-

Charitable Giving / Donations

-

Subscriptions (e.g., streaming services, gym memberships)

-

Home Décor / Furnishing

-

Electronics / Gadgets

-

Vehicle Maintenance

-

Travel Savings (for future trips and vacations)

-

Hobbies / Crafts

-

Business / Work Expenses (e.g., supplies, networking events)

-

Savings Goals (e.g., down payment for a house, a new car)

-

Fun Money (for guilt-free splurges or treats)

Electronic Savings Buckets: You can use electronic/online savings buckets or sub-savings accounts instead of physical cash envelopes. I also have some of these for my larger savings goals including a different vehicle, my emergency fund, saving for a house downpayment, etc.

You can use these savings buckets the same as your cash envelopes, it will just take some getting used to in regard to transferring money from the savings bucket into your checking account to pay for items. Again, I suggest using these types of savings accounts for categories that you are not going to be spending out of monthly. Save these for your long-term financial savings goals.

An Example of what an online savings bucket system looks like. I use Ally.com for mine

The cash envelope system is a time-tested and proven method for taking charge of your finances and achieving financial success. By implementing this budgeting method, you’ll gain greater awareness of your spending habits, hold yourself accountable to your financial goals, and create a pathway to a more secure and robust future. There is no reason to wait, start your cash envelope journey today and witness the transformative impact it can have on your financial well-being.

To learn more about this type of budgeting method or other budgeting methods, be sure to check out my self-paced, online money courses at https://jessica-s-site-d45b.thinkific.com/collections

Remember, the key to mastering your finances is consistency and commitment to your budgeting plan. You will also want to grab an accountability and support person to help keep you motivated and on track. Find a budgeting buddy to cash stuff with today! With the cash envelope system as your guide, you’re on the path to financial empowerment and greater control over your money. Happy budgeting!

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts