Have you ever had an overdraft fee from your bank? Are you often scared that you will go into the negative–into the red with your checking account?

It is important for you to have a cash buffer, this is where you keep a little extra money in your checking account as a safety net or “buffer” to prevent you from going into the negative so you don’t get an overdraft and get nailed with a hefty fee.

Overdraft fees are like burning your money. Having a cash buffer in your account will prevent overdraft fees

I always keep at least $200 in my checking account as my cash buffer. This is in addition to what I keep in my checking account to cover my bills, expenses, and day-to-day spending.

Your cash buffer is not emergency savings money, it does not have a “job” other than to keep you from sinking below zero in your account. It is just in case your expenses/bills come out of your account a day early due to the holidays or your utility bill is slightly higher than normal. The cash buffer money is to cover those things.

The average overdraft fee is $35. I don’t know about you, but I sure don’t want to spend $35 on a fee just because I miscalculated my utility bill this month. I want to have some padding of cash in my checking account to keep me fee-free!

Now, I know you are thinking, “I don’t have an extra $200 to have just hanging out in my bank account.” Trust me, I hear you, I see you, I was you!

There was a time, not too long ago, when I was drowning in debt, $100,000 of debt, not including my house. I didn’t have “extra” money to save for a rainy day or for a buffer. But guess what? This is a MUST HAVE! It doesn’t have to be $200 exactly, it could be $20, $50, or whatever amount you are able to keep in there to prevent you from getting that big fee.

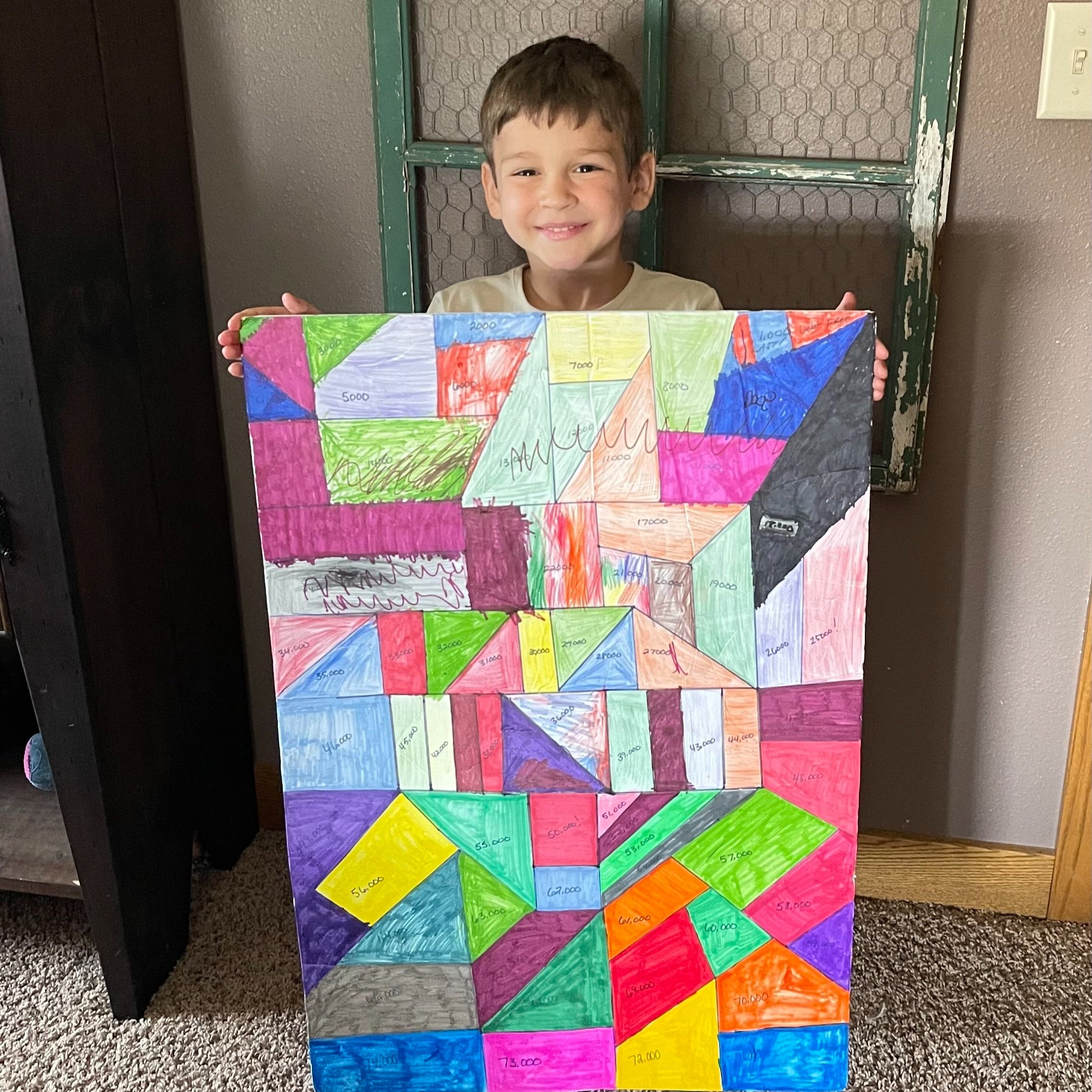

My son, Colton, holding our debt payoff tracker board. This helped keep us motivated in paying off our mountain of debt.

You can pick up an extra couple hours of work to save up this cash buffer, you could dog walk, babysit, clean someone’s house, or meal prep for your neighbor or friend. There are SO many ways in which you can make some quick cash to use as your buffer. Heck, you can sell a pair of shoes and there it is. It really is that easy.

Now, let’s say you are really great at keeping a budget and your numbers look good on paper, an app, or a spreadsheet, you can still end up slipping into the red in your checking account. Even if you’ve never had an overdraft fee, it could happen, so keeping some extra cash in your account will make sure that this doesn’t happen. There is a first time for everything, am I right?

I often have expenses “pop up” out of nowhere and I would have overdrafted my checking account and been not so nicely given a fee of $40, however, my cash buffer saved me!

This is as important as having an emergency savings account. Did you know you need to have a savings account with money in it, that is to be used ONLY for emergencies?

Emergencies happen, it is not a matter of “if” but a matter of “when”. I want you to be ready to tackle that emergency and pay the bill without worrying about going further into debt for it.

What if you picked up a nail in your tire? Or your child ends up in Urgent Care for a sprained ankle? What if your pet gets sick and needs to see the vet, how are you going to pay for these expenses?

My son, Bryson with his broken arm. We had 3 emergencies happen in 1 month. We were so very grateful we had our emergency fund to cover those expenses.

Having an emergency fund will allow you to have peace of mind, a sense of safety, and security with your money and mind. Even when I was paying off our debt, I had an emergency fund of around $2,000. This prevented us, many times during our debt-payoff journey from going further into debt.

I suggest doing everything and anything, keep it legal of course, that you can do to build up your savings account to at least $1,500, while in debt. Then focus on paying off your high-interest rate debt, debt with an interest rate of more than 8%. You can also continue to save in your savings account while you are paying off debt. Once your debt is gone, besides your mortgage, then you should focus on saving 3-6 months of monthly living expenses into your savings.

So, say you spend $5,000 per month on all your needs and a little bit of spending money. Your fully funded emergency fund, (your savings account) when it is complete, should have between $15,000-$30,000 in it! That likely sounds like a lot of money and it is, but that money will save your butt one day. What happens if you or your husband get laid off or fired from your job? Or you get hurt and can’t work for 3 months? This money you’ve saved up will be a HUGE benefit to have.

This is likely to take you a while to save. I automatically save each month into my emergency fund to keep building it. When an emergency pops up, like a flat tire—that just happened the other day, I am able to pay for the bill with my savings and then I prioritize replacing that money ASAP.

Creating a monthly budget is also crucial to the health of your personal finances. Most people think a budget is restrictive and that is not true, it can be if that is what you need or want, but a budget is simply a plan for your money. Don’t let your money get up and sneak off, run away, like the socks in your dryer…create a plan (ahem- a budget) for your money. Tell your money where to go.

I have a monthly Financial Mission Membership where you can get all the tips and tricks to creating a budget, paying off debt, and saving more money, you can find it here, https://linktr.ee/jesswaynecoaching

Join me in Financial Mission!

I also set up much of my savings to be automatic, so the money leaves my checking account each month and goes into the savings accounts automatically each and every single month. This way I set it and forget it. I don’t have to think about it again and I am saving way more money doing it this way than I was when I would have to manually go in and make the transfers and think to do it. It also takes something off my shoulders, because lets face it, us moms do and have to think so much. We carry such a heavy mental load each and every day. So by not having to worry about transferring the money and thinking about it all, I relax knowing I am saving automatically.

Remember, the amount of the cash buffer doesn’t need to be a lot but you want it to cover any additional possible overdraft amounts so you don’t get nailed with an pesky overdraft fee. Keep this money in your checking account all the time and don’t count it as part of your budget or expenses. Pretend it isn’t in your account and don’t spend it!

For more of my money resources head on over to Jesswaynecoaching for access to my blog, podcast, courses, and my exclusive 1:1 coaching program.

XOXO

Jess Wayne

My websitewas designed using 100% solar power

back to top

Follow along

Listen to the podcasts